The crypto market skilled a pointy downturn on Monday, with current top-performing property akin to XRP (XRP), Tron (TRX), and Cardano (ADA) taking substantial hits.

This follows weeks of explosive rallies that had surprised market observers, propelling these “dino cash” to surprising highs.

These altcoins noticed steep declines as Bitcoin’s retreat from $100K triggered widespread liquidations and a market-wide selloff. On the time of writing, Bitcoin is buying and selling simply above $97,000 and a pair of% decrease than it was this time yesterday, based on CoinGecko knowledge.

Whereas XRP, which led the surge with a 450% improve final month, dropped 12% up to now 24 hours, falling to $2.17 from its current excessive of $2.82, based on CoinGecko knowledge.

TRX took a big hit as nicely, plunging 16.6%, whereas ADA noticed a 13.5% decline. In the meantime, the world’s largest crypto Bitcoin (BTC) slid under $97,000 after briefly reclaiming the $100,000 mark.

The selloff intensified throughout U.S. night hours on Monday, with over $1.5 billion in liquidations recorded, based on Coinglass knowledge.

XRP alone accounted for $57.44 million in wiped-out derivatives positions, pointing to a pattern of bullish sentiment being harshly corrected.

Bitcoin’s decline triggered $189.18 million in liquidations, whereas Ethereum (ETH) and different main altcoins like Solana (SOL) and Dogecoin (DOGE) additionally confronted vital losses.

“This selloff rivals the sharp crash of August 5, underscoring the volatility that continues to dominate crypto markets,” a CoinSwitch official advised Decrypt. “Nevertheless, seasoned buyers perceive that such pullbacks are sometimes par for the course in a bull market.

“Traditionally, these dips have been adopted by swift recoveries as contemporary capital flows again into oversold property,” the official added.

ADA’s drop under the $1 degree marked a crucial level for buyers, whereas Litecoin (LTC) noticed $18 million in liquidations, struggling to carry above $112 earlier than a modest restoration.

The decline follows Bitcoin’s failed try to carry above $100,000 degree, which triggered a wave of revenue reserving, based on Edul Patel, CEO & Co-founder of Mudrex.

“When Bitcoin rises, it sometimes creates a wave of optimistic sentiment throughout the market, usually lifting altcoins as nicely,” Patel advised Decrypt. “Nevertheless, after Bitcoin hit its psychological resistance at $100K, revenue reserving set in, resulting in a consolidation at $96K accompanied by vital liquidations.

“Even the slightest indication of Bitcoin promoting can set off a ripple impact, inflicting altcoins to dip,” he added.

Regardless of the current volatility, the Mudrex CEO stays optimistic concerning the long-term outlook:

“That is positively a short lived pit cease and a part of accumulation earlier than any additional highs. Market cycles in crypto are sometimes characterised by durations of consolidation after vital rallies.

Patel famous how such phases permit buyers to reassess their methods, accumulate property, and put together for the following market motion.

Whereas short-term volatility is predicted, the broader pattern stays upward as adoption and curiosity in crypto develop alongside the regular evolution of rules.

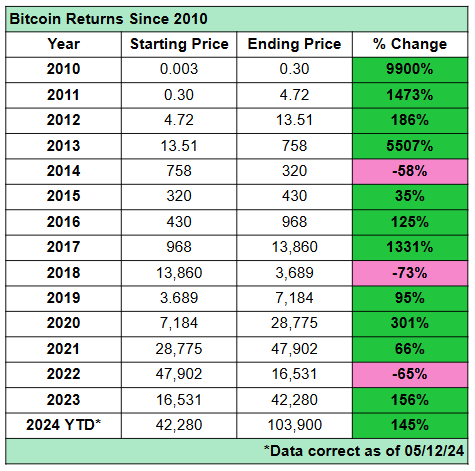

Because the market strikes ahead, historic traits recommend potential restoration as buyers reassess their positions and put together for the following part of the rally.

Edited by Stacy Elliott.

Day by day Debrief E-newsletter

Begin every single day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.