Aedifica ($AED.BR) is a lesser recognized Belgian healthcare REIT. It operates throughout Europe and boasts engaging fundamentals reminiscent of an 100% occupancy, ~19 12 months WAULT and even a excessive EPRA yield at 8%. But the inventory has been below strain since 2021, is that this deserved given the adjustments in rates of interest or does Aedifica at the moment current traders with a horny funding case?

Enterprise Profile

Aedifica is a Belgian regulated actual property firm (REIT) specializing within the funding and growth of healthcare actual property throughout Europe. The corporate focuses on senior housing and care services, addressing the growing demand pushed by demographic shifts.

Aedifica’s has long-term lease agreements, usually with established operators from a mixture of for revenue and non income. The corporate’s portfolio spans Belgium, Germany, the Netherlands, the UK, Finland, Eire and Spain.

Funding case

The funding case is kind of easy for Aedifica, long run tailwinds from an more and more ageing inhabitants throughout Europe supported by a horny valuation. Let’s break these down:

Demand drivers

The inhabitants in Europe is ageing, the share of these aged 80 years or above within the EU’s inhabitants is projected to have a 2.5 fold enhance between 2024 and 2100, from 6.1% to fifteen.3%. This can require extra enough housing and care services which already aren’t maintaining in lots of nations.

Determine 1: twenty first century growth of inhabitants throughout the EU

Tenants

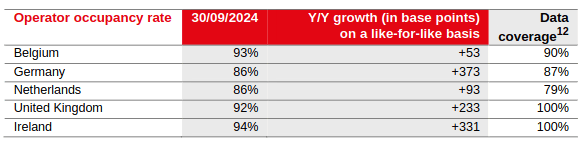

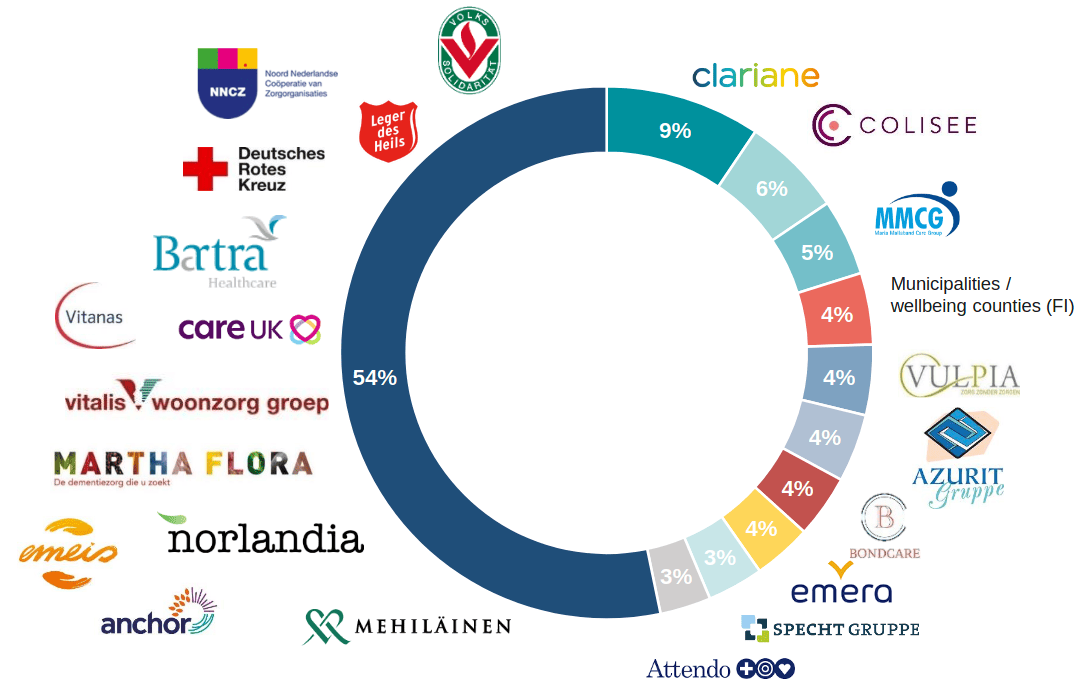

Those immediately taking advantage of the aforementioned developments are the operators of those care services. Consider firms reminiscent of Korian or non income reminiscent of Leger des Heils. They’ve had some after results from covid by decrease occupancy, elevated labor prices and better charges. The scenario for Aedifica´s tennants is bettering although.

Determine 2: Tenant occupancy charges

Yields

As a REIT Aedifica in fact could be very depending on rate of interest adjustments, these have an effect on their rate of interest prices and property values and probably the unfold between borrowing and rental yields. In decrease yield environments Aedifica traded at greater than €120 a share nevertheless as charges elevated the share acquired minimize in half.

Valuation

As I should not have a crystal ball which incorporates the ECBs charges on the finish of the last decade I valued Aedifica from a situation primarily based strategy.

Excessive RFR

Base case (present yield)

Low RFR

LTM EPRA yield

10%

7.98%

4%

Present share value

61.90

61.90

61.90

Ending share value

57.43

71.98

143.58

Accrued EPRA per share

24.39

27.10

29.81

Whole

81.83

99.08

173.40

ARR

6.44%

12.01%

36.03%

Desk 1: Quite simple valuation primarily based on 5 years of forecasting, RFR = threat free price

The 4% EPRA yield noticed through the put up covid low yield setting may very well be repeated once more which in my view will not be unlikely given the present political scenario in Europe. Even when charges keep the identical to now a really engaging double digit annual return might be noticed. That is primarily based in Aedifica adjusting to greater charges, 2025 and 2026 can be transitional years on this case. If charges had been to start out growing once more (I’ve doubts the ECB would enhance it rather more from current highs) a optimistic return stays as a result of excessive EPRA technology potential of Aedifica.

Dangers

Charges

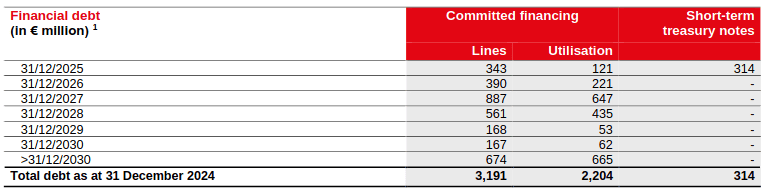

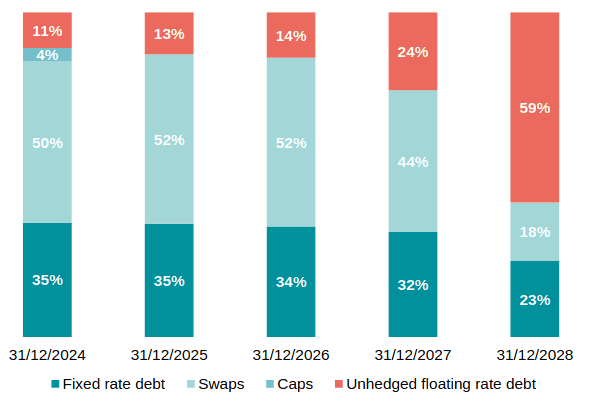

Aedifica ($AED.BR) is rated BBB however considerably greater charges may put strain on them from three sides: decrease asset values, elevated monetary bills and tenant credit score deterioration. Refinancing is unfold out comparatively evenly as debt will get rolled over, brief time period most debt is fastened anyhow so most rate of interest adjustments would go into refinanced debt price and hamper development.

Determine 4: Debt sorts

Demand adjustments

If Europeans handle to reside longer at dwelling at a price which compensates for absolutely the quantity development in aged this might have an affect on the occupancy ranges of Aedifica´s tenants.

Massive tenants

Aedifica does have some tenant focus with Clariane which is publicly traded and has not carried out effectively, nevertheless their portfolio expansions are additionally diversifying away from massive single tenants and enhance geographical diversification as effectively decreasing regulatory threat from sure nations.

Conclusion

Aedifica presents a compelling funding case with sturdy fundamentals, together with 100% occupancy (tenant occupancy ~90%), long-term leases (~19-year WAULT), and an 8% EPRA yield. Pushed by Europe’s ageing inhabitants, demand for healthcare actual property is anticipated to develop. Regardless of this, the inventory has been below strain on account of rising rates of interest put up covid, impacting valuation. A easy scenario-based valuation implies engaging potential returns even when charges stay regular, with vital upside if charges decline and restricted draw back in a barely greater price setting. Dangers embody refinancing challenges, tenant focus, and potential demand shifts. Total, Aedifica seems undervalued, providing a stable long-term alternative for traders prepared to make a directional guess on rates of interest with a top quality firm.

The creator of this evaluation does maintain shares in Aedifica on the time of writing, which can affect the attitude offered.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

Sources:https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Population_structure_and_ageingAedifica annual outcomes 2021, 2022, 2023 & 2024