Please see this week’s market overview from eToro’s international analyst workforce, which incorporates the most recent market knowledge and the home funding view.

Robust jobs report, oil, China, and an eventful week forward

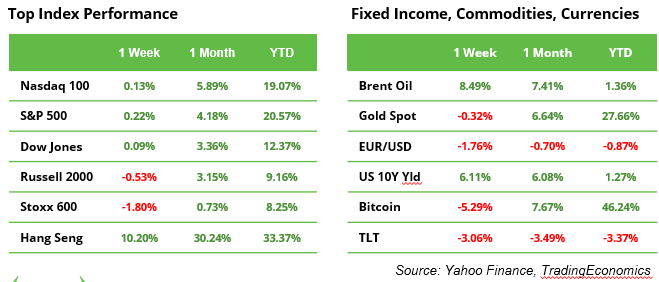

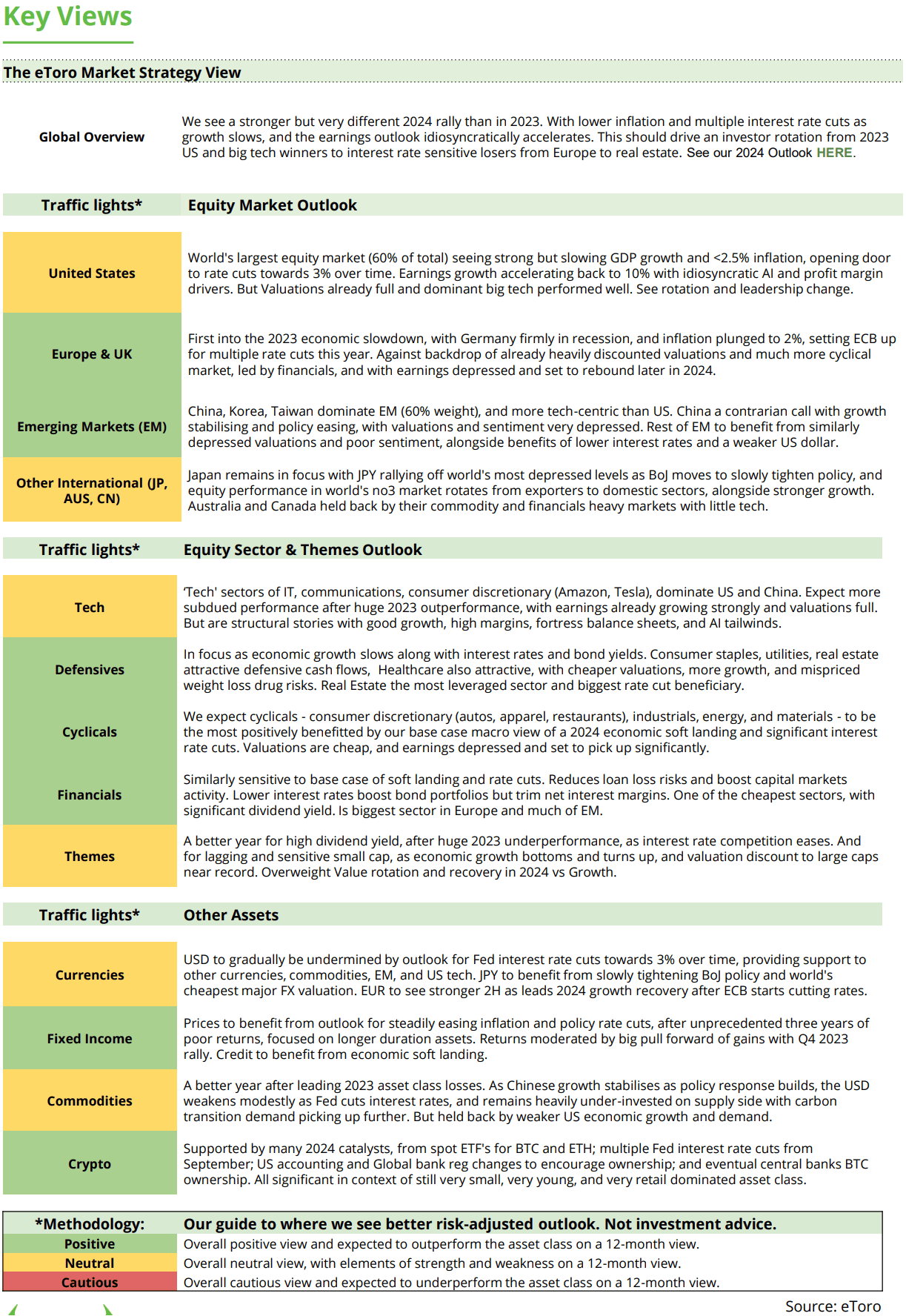

Final week ended with a bang as a brand new jobs report confirmed that US firms and the federal government collectively added 254K payrolls in September, considerably larger than the 150K anticipated, holding unemployment down at 4.1%. This helps the Fed’s “goldilocks” situation and retains the prospect of a smooth touchdown for the financial system firmly on the desk. Following the information, the US greenback strengthened to its highest stage since mid-August, and the US 10-year rate of interest rose by 13 foundation factors to three.98%, moderating future price reduce expectations.

Probably the most mentioned subject, nevertheless, was the oil value, which rose 8.5% over the week on account of fears that oil manufacturing websites could also be drawn into the increasing battle within the Center East.

The most important gainer final week was the Cling Seng Index, marking its second consecutive week on the high. The China-focused fairness index added one other 10%, bringing the full to +30% over the past thirty days. Traders are anticipating additional will increase within the Chinese language authorities’s help package deal aimed toward reviving the native financial system.

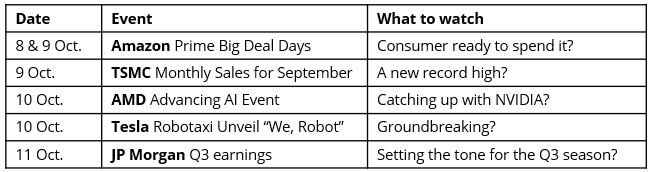

This week is especially eventful, with “Champions League” firms Amazon, TSMC, AMD, Tesla, and JP Morgan making headlines. JP Morgan will unofficially kick off the Q3 earnings season on Friday.

Oil costs rise most in a single week since January 2023

The oil value has firmly reversed course. The value of a barrel of Brent rose to $78 from a latest low of $70 on Tuesday, whereas North American crude (WTI) climbed from $66 to $74 (see chart).

Total, oil costs have been trending downward on hypothesis that Saudi Arabia, the world’s largest oil producer, might abandon its $100 per barrel value goal to be able to seize a higher market share—a transfer anticipated to materialise with an official improve in manufacturing ranges on the upcoming OPEC+ assembly on 1 December. Moreover, lacklustre demand for oil was highlighted in an replace from ExxonMobil, which said that stress on refining margins would considerably influence its Q3 earnings, on account of be revealed on 1 November. Nonetheless, higher-than-anticipated financial development in key markets might reverse this development.

Q3 earnings, what to anticipate?

Pepsico, Delta Airways, JP Morgan, Wells Fargo, and Blackrock are amongst the primary firms to report their monetary outcomes for the third quarter. As a median for the S&P 500, the market expects 4.7% income development and 4.2% earnings development, making Q3 stand out because the weakest quarter of the 12 months. With earnings development projected to bounce again to 14.6% in This autumn and furthermore 14.9% for 2025, buyers might be particularly targeted on ahead steerage to guage whether or not these excessive expectations might be maintained. Ought to the numbers fall quick, the present P/E ratio of 21.4 might become too demanding. Danger is clearly on the draw back. One other focus within the coming weeks is on rate-sensitive shares in actual property, utilities, and healthcare, which have carried out effectively not too long ago.

Upcoming IPOs

Sentiment for brand spanking new inventory change listings seems to be cautiously enhancing. Cerebras, a competitor to NVIDIA, is aiming for a valuation of $7 to $8 billion by a Nasdaq itemizing. On-line vogue retailer Shein is focusing on a $60 billion valuation through a London itemizing. In the meantime, Hyundai plans to boost $19 billion by itemizing shares of Hyundai Motor India in what could be the primary automobile IPO in India since Maruti Suzuki’s in 2003. All three have filed their regulatory paperwork and should begin buying and selling in October.

Earnings and occasions

Main macro launch embrace Germany’s commerce stability and US CPI and PPI.

This week is especially eventful, with Amazon, TSMC, AMD, Tesla, and JP Morgan in focus.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

| by Jessy quiee | The Capital | Mar, 2025

| by Jessy quiee | The Capital | Mar, 2025