ARGAN SA ($ARG.PA) is a French REIT that provides a 5.5% dividend yield at this time, but in addition presents a possibility to continue to grow revenues sooner or later. The principle prospects of the corporate consist on nice well-known firms like Carrefour, L’Oreal, DHL, Aldi, Decathlon, Amazon, or BMW.

Key Highlights:

ARGAN combines a excessive dividend yield with long-term income progress

Pores and skin within the recreation: the administration owns over 37% of the enterprise

Making use of a good valuation method, ARGAN trades at a reduction

The enterprise mannequin:

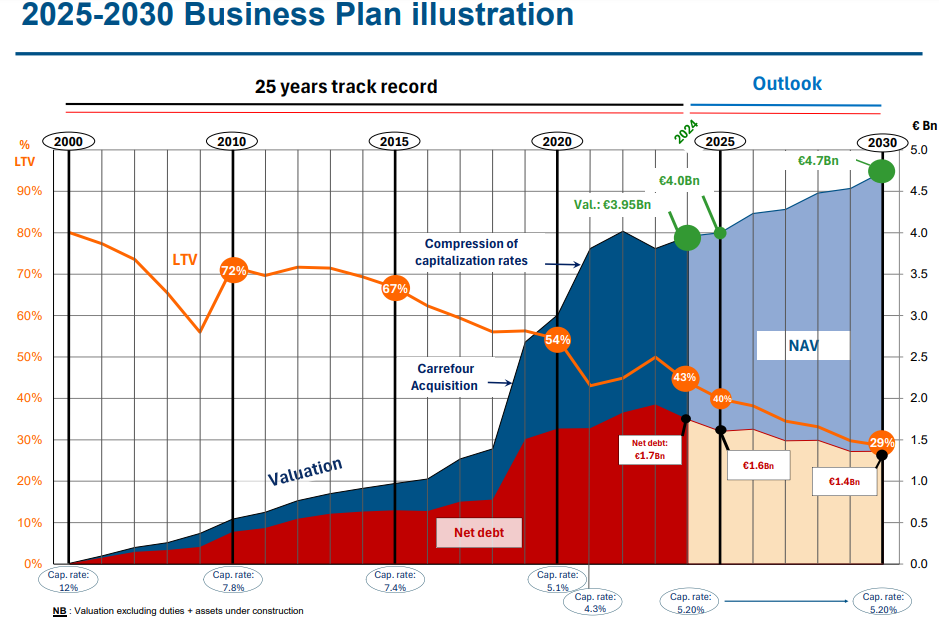

ARGAN’s enterprise consists on renting premium logistics amenities. They will construct, develop or purchase warehouses, after which lease it, taking good care of the property administration throughout the entire lease. The corporate was created in 2000 by Jean-Claude LE LAN, who continues to be the Chairman of the corporate. Listed in 2007, proper earlier than the Nice Monetary Disaster, the corporate has returned over 321% plus dividends.

Pores and skin within the recreation:

ARGAN is an organization with a market capitalization of 1.6 billion Euros. As we’ve stated earlier than, the founder continues to be within the firm, however not simply as an worker; his household nonetheless owns 37% of the shares excellent. This offers him and his household a long-term imaginative and prescient, since their wealth is tied to the efficiency of the enterprise. Predica, a subsidiary of Crédit Agricole Assurances, has owned 15% of the corporate for a very long time, serving as a superb counterweight for the household’s affect throughout the enterprise.

The present valuation:

ARGAN has generated 137 million Euros in Recurring Web Revenue in 2024, up 9% from the earlier 12 months. Which means the corporate is at present buying and selling at 11.6 instances recurring earnings. For comparability, the present earnings ratio of the SP500 is 28 instances.

The EPRA NAV NTA of the corporate, which is the Web Tangible Worth of the property, stays at 85.5 Euros per share. With a present worth per share of 63.30 Euros, we’re buying the corporate’s property at a 35% low cost to truthful worth. This worth has grown by 8% in 2024, and is predicted to continue to grow in 2025.

For 2025, the corporate expects to extend its income by 6%, given new initiatives and the listed will increase in worth of the present tenants; and its web recurring revenue by 11%, to 151 million Euros.

However is that this low-cost?

A good valuation:

ARGAN has a skillful administration that has overcome tough instances just like the Nice Monetary Disaster whereas delivering distinctive returns to shareholders. Additionally, their wealth is tied to the enterprise, so they’re incentivized to make ARGAN a profitable enterprise.

I take into account two methods to securely method the valuation of ARGAN.

First, a a number of on the web recurring income. However there’s a trick right here. In 2021, the corporate managed to safe 500 million euros by a bond with a 1% rate of interest, which is due in November 2026. That is principally free cash that the corporate is and has been utilizing. Nevertheless, as soon as the due date arrives, they’ll should refinance this cash. Most likely not the complete quantity, but when they did, refinancing at a 3.5% rate of interest would cut back web earnings by about 12.5 million euros.

Thus, I take into account that the corporate’s earnings energy stays at 140 million Euros in 2025, being very conservative, which at a a number of of 15 instances (according to worldwide friends), offers us a margin of security of over 30%.

Second, it’s additionally truthful to worth the corporate at guide worth. It could most likely be clever to use a premium to it, given the higher than the typical high quality of the corporate’s property. However being conservative, and pondering of guide worth as a superb valuation technique, the corporate additionally trades at a 30% low cost at this time.

If the corporate traded at a premium, which I believe is probably going, the low cost might go as much as 57% utilizing a multiplier of earnings of 18 instances, or to 48% if we utilized a ten% premium on the guide worth of the corporate.

Not every thing is ideal:

Alternatives exist for a motive within the inventory market. And I discover 4 causes for ARGAN to be low-cost:

1. Debt

Though the corporate has been deleveraging its stability sheet these days, the debt to property ratio is comparatively excessive. The present Mortgage to Worth ratio of the corporate is 43.1%, which implies that debt funds 43% of the property; and the Debt to EBITDA ratio stays at 9.2 instances. In 2023, these ratios had been 49.7% and 11 instances, respectively, which reveals the trouble of the corporate to deleverage the stability sheet whereas nonetheless paying over 3 euros per share in dividends.

The present value of debt is 2.25%, in contrast with 2.30% in 2023, and is predicted to go all the way down to 2.10% in 2025. 22.13% of the rental revenue is destined to curiosity on loans, whereas 22.54% was destined in 2023.

Sooner or later, the plan of the corporate is to maintain lowering the debt whereas investing to develop extra. They plan to finance new investments promoting their present property. The factors they may observe is: seniority (older amenities will likely be bought, ideally); profitability (amenities with decrease profitability will likely be bought, ideally); and ESG causes (amenities with increased CO2 emissions, that are usually older, will ideally be bought first).

2. Capital improve

To struggle the excessive affect of debt on the corporate, coupled with the upper rates of interest situation that we’ve lived in the course of the previous two years, the administration determined to extend the capital in 2024. With a worth of 74 euros per share, the corporate created 2 million new shares, valuing the corporate at 1.7 billion euros.

Though the corporate disclosed that this capital improve was focusing on new investments, it is usually a measure to adjust to their debt covenants and to keep up their BBB- score by S&P. Capital will increase are hardly ever favored by traders, because it usually indicators overleverage and a possible mismanagement.

3. Writedowns

The French REIT trade has been impacted in the course of the previous years of huge writedowns. REITS are required to worth their property at truthful worth, and in 2022 and 2023 ARGAN needed to writedown its property, reducing its guide worth. In 2024 this pattern has reverted, though some rivals are nonetheless going by it.

The overvaluation of the guide worth is at all times a danger concerning REITs, and the current writedowns have scared traders. Nevertheless, ARGAN shouldn’t be too affected by this, for the reason that amenities they personal are comparatively new (11.6 years as a median), and warehouses are much less affected by overvaluations than housing.

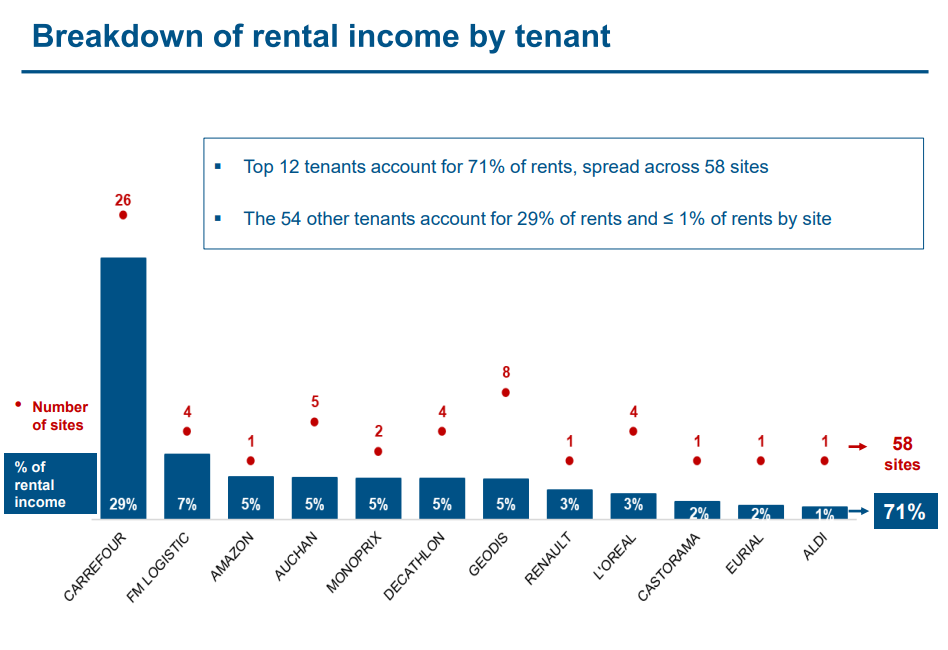

4. Focus of purchasers

Carrefour, ARGAN’s major tenant, accounts for 29% of the rental revenue of the corporate. This will pose a danger to the corporate in the long run. Nevertheless, the typical mounted size of the leases is over 5 years, with 43% of the leases with a time period of over 6 years from 2024. Apart from, the corporate has been managing completely the occupancy ratio, which has been 100% up to now two years, and hasn’t been decrease than 99% since 2016.

Conclusion:

ARGAN is a enterprise that’s buying and selling beneath its truthful worth. With a reduction ranging between 30% to 50%, I believe that dangers are being overweighted by the market. The corporate has a stable historical past of income and dividend progress, even by tough instances (Nice Monetary Disaster, pandemic). Moreover, the administration has pores and skin within the recreation and a confirmed trajectory of being too conservative when releasing estimates. Though the primary focus at this time is lowering debt, I don’t discard (nor do they, in keeping with their newest earnings name) that they change into extra aggressive with leverage and progress if a superb alternative comes.

Catalysts:

Decrease rates of interest

Enchancment of European financial views

Enchancment of S&P score (2026)

Time

If no catalysts happen, I’m nonetheless comfortable to be ready for the market to acknowledge the worth of an organization whereas receiving a 5.5% dividend yield and a web recurring revenue progress of excessive single digit.

Dangers:

Portfolio focus: Carrefour is a giant a part of the income.

Debt: Though the corporate has traditionally had an occupancy fee near 100%, reducing it to market requirements (about 95%, though it relies upon extensively on the regio) might imply difficulties in paying down the debt.

Problem discovering new developments.

How do you see ARGAN? Do you discover the dividend and the potential progress compelling?

I personal a place in ARGAN on the time of writing.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding targets or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.