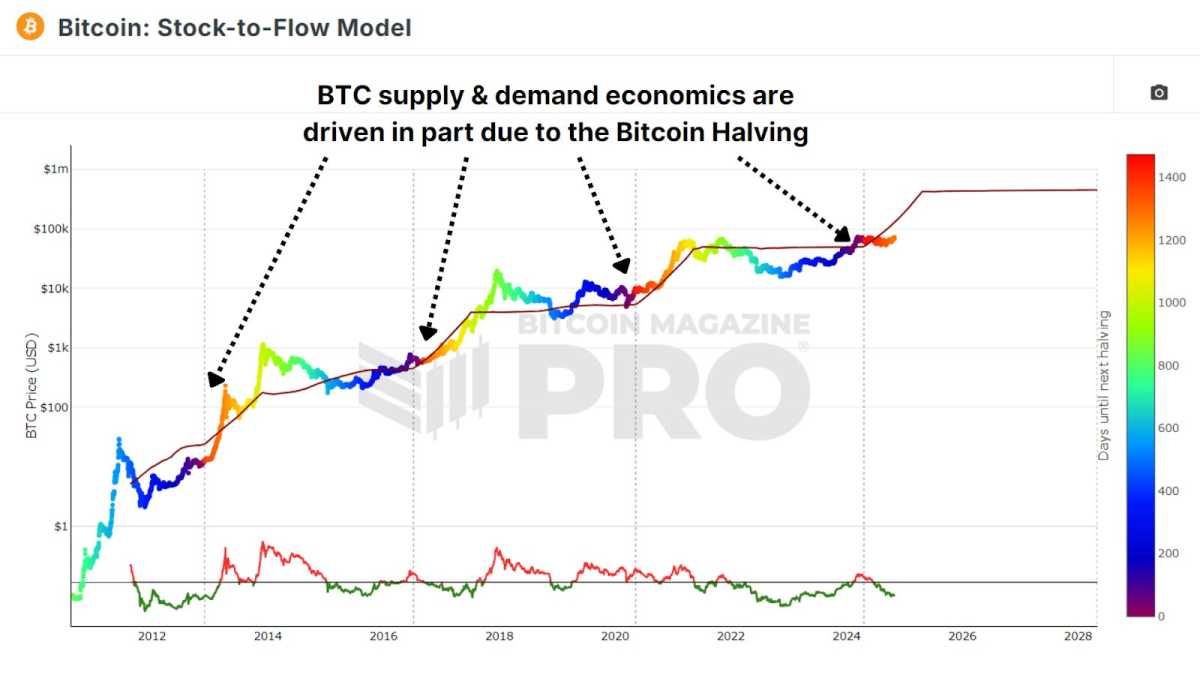

Knowledge exhibits the Bitcoin premium on Coinbase has shot up alongside the newest rally. Right here’s what this means in regards to the supply of the surge.

Bitcoin Coinbase Premium Hole Has Develop into Extremely Optimistic

As CryptoQuant Netherlands neighborhood supervisor Maartunn identified in a brand new put up on X, the cryptocurrency’s value noticed its newest break after the Coinbase Premium Hole began rising.

The “Coinbase Premium Hole” is an indicator that retains monitor of the distinction between the Bitcoin costs listed on cryptocurrency exchanges Coinbase and Binance.

When the worth of this metric is optimistic, it implies that the worth listed on Coinbase is at present increased than on Binance. Such a pattern implies that the shopping for stress from the previous customers is larger than that of the latter (or the promoting stress is much less).

Then again, a detrimental worth means that Binance is observing a better shopping for stress than Coinbase as the worth listed there may be better.

Now, here’s a chart that exhibits the pattern within the Bitcoin Coinbase Premium Hole over the previous couple of days:

The worth of the metric seems to have been fairly optimistic in latest days | Supply: @JA_Maartun on X

Because the above graph exhibits, the Bitcoin Coinbase Premium Hole began taking notable optimistic values yesterday, implying that purchasing stress on the platform was hovering. Since then, the indicator has solely continued to shoot additional up.

Coinbase is understood for use by US-based institutional entities, so the metric’s worth can present hints about how the shopping for or promoting stress from these massive American buyers compares in opposition to that of Binance’s world consumer base.

Because the Coinbase Premium Hole has been optimistic in the course of the previous day, it might seem potential that US institutional buyers have been taking part in accumulation.

The chart exhibits that alongside the rise within the indicator’s worth, the Bitcoin value has additionally shot up and damaged previous the $45,000 barrier for the primary time since April 2022.

Given the timing, it might be doubtless that the shopping for stress from the American whales has been a driver (if not the primary one) for the cryptocurrency’s newest rise.

The surge has come because the sector has stored its eyes peeled for the approval of the asset’s spot exchange-traded funds (ETFs), which many count on to occur quickly. These US institutional holders is also shopping for into the identical hype.

Maartunn defined earlier {that a} correlation had emerged between the BTC spot value and Coinbase Premium Hole. This newest occasion exhibits that this correlation, held over the past month of 2023, may also proceed to carry in the course of the begin of 2024.

BTC Value

Bitcoin had gone as excessive as $45,900 earlier in the course of the day however has since seen a pullback in direction of $45,500.

The value of the coin appears to have sharply gone up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, CryptoQuant.com