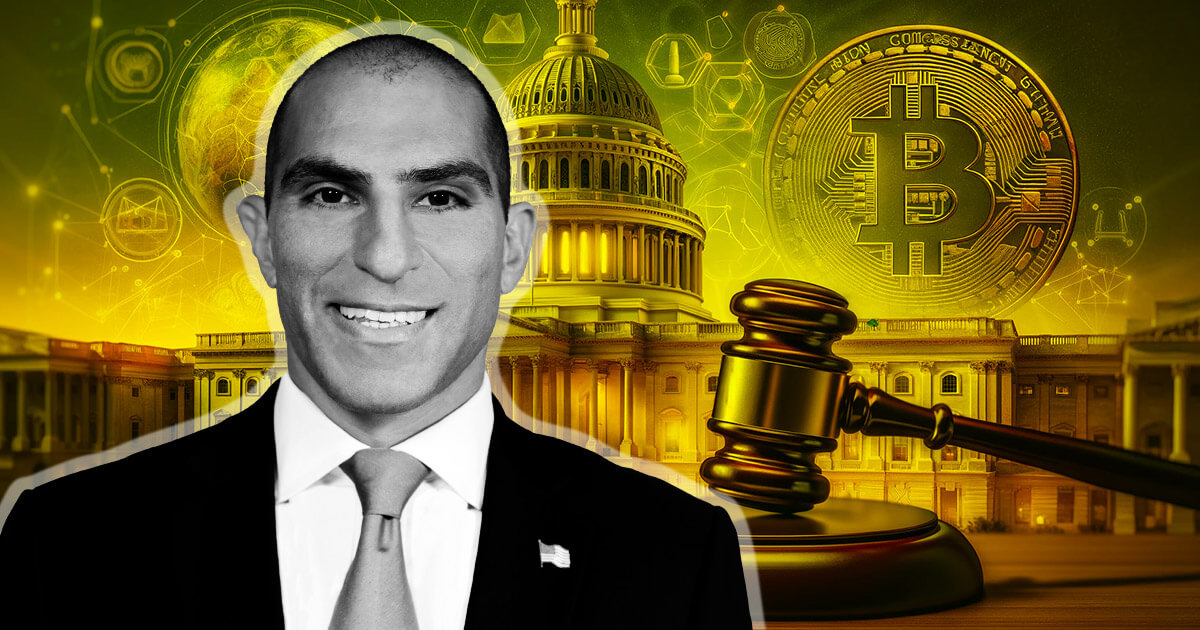

CFTC chair Rostin Behnam instructed Congress there may be an pressing want for laws that may present regulatory readability for the crypto trade to make sure traders are appropriately protected.

Behnam made the assertion throughout his testimony earlier than the Home Agriculture Committee on March 6 that primarily targeted on the C FTC’s fiscal yr 2025 finances request.

Behnam stated:

“The notion that crypto goes away is a false narrative.”

He added that greater than 49% of the CFTC actions filed through the 12 months ending October 2023 concerned conduct associated to digital belongings even if “no federal company retains direct regulatory authority” over the crypto trade.

Framework in 12 months

Through the listening to, Behnam spoke in regards to the challenges and alternatives offered by digital belongings, like Bitcoin (BTC) and Ethereum (ETH), which signify a good portion of the crypto market’s complete capitalization.

He stated there’s a false notion amongst regulators and lawmakers that the digital belongings market would possibly diminish in relevance. Nonetheless, the earlier decade has proven that to be removed from the case, as demand for these belongings has grown exponentially throughout that point.

Behnam pressured the necessity for proactive legislative measures to make sure a steady and clear regulatory atmosphere. He added that defending traders must be the federal government’s foremost precedence, contemplating the surging curiosity in digital belongings because the begin of the yr.

Behnam stated it will take the CFTC roughly 12 months to develop a complete regulatory framework for digital belongings if Congress passes the Monetary Innovation and Expertise Act for the twenty first Century (FIT Act).

The FIT Act, which has superior via the Home Agriculture and Monetary Providers Committees with out reaching a ground vote, goals to make clear the regulatory obligations relating to digital belongings.

BTC, ETH are commodities

Behnam’s testimony additionally addressed inquiries from committee members relating to the classification of digital currencies as commodities or securities, a distinction that impacts regulatory jurisdiction.

In response to a query from Rep. John Duarte, Behnam defined that digital belongings are typically thought of commodities if they don’t meet the standards for being categorised as securities, indicating the nuanced strategy required to manage these belongings successfully.

Behnam added that Bitcoin and Ethereum didn’t meet the standards wanted to be categorised as securities, which mechanically means they fall underneath the commodities umbrella regardless of being extremely totally different from bodily commodities like gold or corn.

The CFTC chair instructed Duarte that there’s an immense urge for food for Bitcoin amongst retail and institutional traders, no matter whether or not the federal government needs to legitimize it or not.

Behnam admitted that regulators have been attempting to “shoehorn” crypto into different frameworks, and the trade must be thought of individually.