In simply over a month since their approval by the US Securities and Change Fee (SEC), Bitcoin ETFs have swiftly gained traction out there, posing a formidable problem to the long-standing dominance of gold ETFs.

Bitcoin ETFs Achieve Floor on Gold ETFs

The speedy rise of Bitcoin ETFs has led to a convergence in asset values, with BTC ETFs closing the hole with gold ETFs. Bitcoin ETFs maintain roughly $37 billion in belongings after solely 25 buying and selling days, whereas gold ETFs have gathered $93 billion in over 20 years of buying and selling.

On this regard, Bloomberg’s Senior Commodity Strategist, Mike McGlone, emphasizes the shifting panorama, stating, “Tangible Gold is Shedding Luster to Intangible Bitcoin.”

In accordance to McGlone, the US inventory market’s continued resilience, the US foreign money’s power, and 5% rates of interest have offered headwinds for gold. Furthermore, because the world more and more embraces digitalization, the emergence of Bitcoin ETFs in america provides additional competitors to the dear metallic.

McGlone additional states that whereas the bias for gold costs stays upward, buyers who solely deal with gold might threat falling behind potential paradigm-shifting digitalization developments.

In the end, McGlone means that buyers ought to take into account diversifying their portfolios by incorporating Bitcoin or different digital belongings to remain forward within the evolving funding panorama.

Bitcoin Rally Pushed By Institutional Demand

The success of Bitcoin ETFs is additional demonstrated by latest information suggesting that the upward pattern in Bitcoin costs is pushed primarily by institutional demand. On the identical time, retail participation seems to be declining.

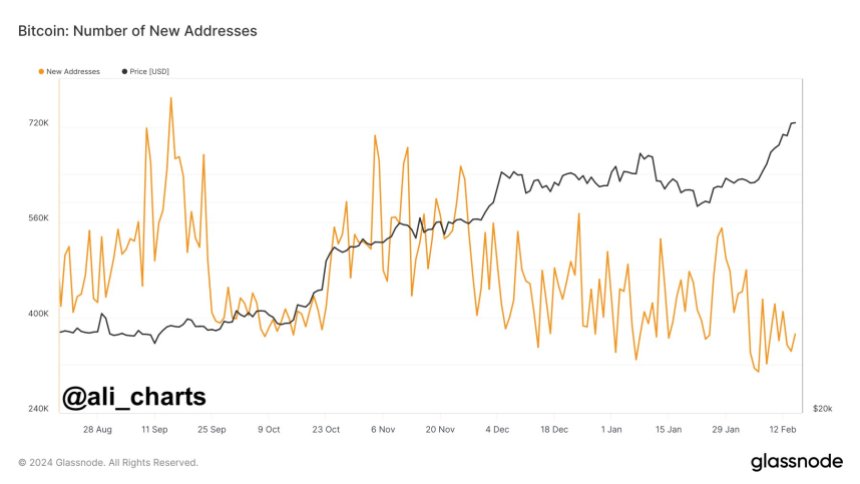

In accordance to analyst Ali Martinez, as the value of Bitcoin continues to hover between $51,800 and $52,100, there was a noticeable lower within the creation of latest Bitcoin addresses every day, indicating a scarcity of retail participation within the present bull rally and highlighting the rising affect of institutional buyers within the cryptocurrency market.

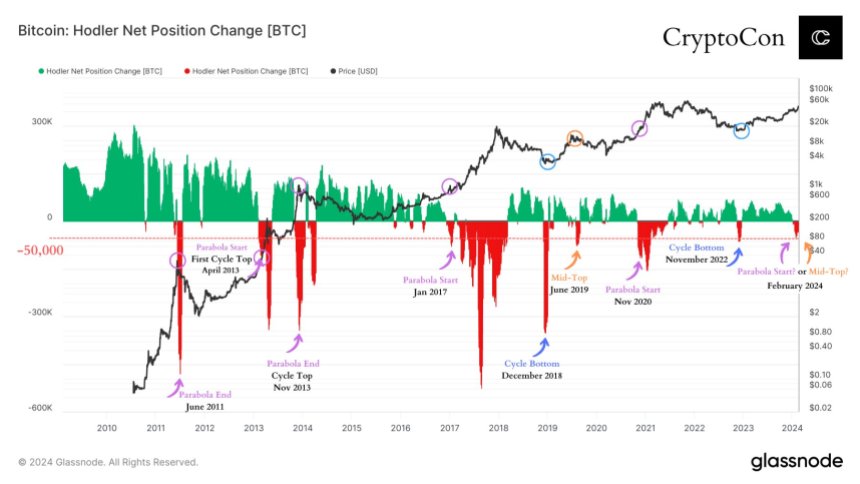

Nevertheless, market knowledgeable Crypto Con factors out a major shift in Lengthy-Time period Bitcoin holder positions, signaling a possible draw back motion.

As seen within the chart beneath shared by Crypto Con, the place change line crossed beneath -50.00 for the primary time in over a 12 months, a sample that has traditionally occurred at important moments in Bitcoin’s market cycles. These moments embody the cycle backside, mid-top (which occurred solely as soon as), and the beginning/finish of a cycle high parabola (which occurred most ceaselessly).

In accordance with Crypto Con, this latest shift in long-term holder positions raises two potential eventualities: a mid-top or an imminent parabolic motion. Such a motion at this stage within the cycle is taken into account uncommon.

Primarily, it signifies that long-term Bitcoin holders are exiting their positions in vital numbers, probably anticipating a market correction or a change within the total pattern.

Total, the shift in Bitcoin holder positions and the decline in retail participation current contrasting dynamics within the present market panorama. Whereas institutional demand continues to drive the value of Bitcoin larger, long-term holders look like taking revenue or adjusting their positions.

Whereas BTC is at present buying and selling at $51,800, it stays to be seen what the course of the subsequent transfer shall be and the way establishments will proceed to affect the value motion of the biggest cryptocurrency as spot Bitcoin ETFs acquire traction.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal threat.