Let’s be trustworthy, all of us love music. Our tastes could differ, however for Spotify, that doesn’t matter. It’s the undisputed chief in music streaming, with 675 million customers and counting. However, Spotify is now not nearly music, it’s an audio empire, increasing into podcasts with wonderful exhibits similar to Digest and Make investments by eToro (you should test it out).

Now, after years of losses, Spotify is lastly making severe cash, with speedy subscriber development, rising margins, and a renewed give attention to profitability. Shares hit a document excessive initially of this yr, topping out at USD$648, however current market volatility has seen shares fall 21%. But, Spotify’s fundamentals haven’t modified. So, ought to it have a spot in your portfolio, or has the music stopped? Let’s discover out.

Spotify reinvented music streaming and is now increasing into podcasts, audiobooks, and AI-powered playlists, turning it right into a full-scale audio empire with rising income and a rising person base.

It’s not alone within the house although. Competitors stays excessive from cashed-up tech giants similar to Apple, Amazon and YouTube.

Spotify has 27 purchase scores, 11 holds, and a pair of sells, with a mean value goal of USD$659.88 signalling a possible upside of 23% from its final closing value.

The Fundamentals

Should you solid your thoughts again to the early 2000s, the music business was in flux. Bodily discs have been quickly declining, and the rise of digital music gamers alongside the iPod that launched in 2001 was altering the sport. However on the identical time, music piracy was booming. Platforms like Napster and LimeWire have been costing the music business billions in unlawful downloads. Then, in 2006, 23-year-old Swedish entrepreneur Daniel Ek had a revolutionary thought: make music so accessible and reasonably priced that stealing it could really feel like extra hassle than it was value. And with that, Spotify was born.

At the moment, Spotify permits customers to stream totally free with advertisements or subscribe to Spotify Premium for an ad-free expertise. With greater than 675 million month-to-month energetic customers, the platform provides nearly each tune on the earth, together with thousands and thousands of podcasts and audiobooks. It additionally offers content material creators with instruments and analytics to develop their viewers. Over time, Spotify has developed from a music streaming service right into a complete audio ecosystem, with 263 million paying subscribers producing most of its income.

Spotify’s mannequin is brilliantly easy:

Free tier: Pay attention with occasional advertisements. A gateway for customers to the premium tier.

Premium tier: Pay a month-to-month charge for no advertisements, higher high quality, and offline listening.

Spotify pays round half of its income again to artists and labels, however cultural phenomena like Spotify Wrapped have turned it into greater than only a music app—it’s a each day companion for tons of of thousands and thousands of individuals worldwide. After years of prioritising person development over income, Spotify is now specializing in its backside line. Current value hikes, cost-cutting measures, and growth into higher-margin choices like podcasts and audiobooks are a part of a method to spice up profitability—and it’s working.

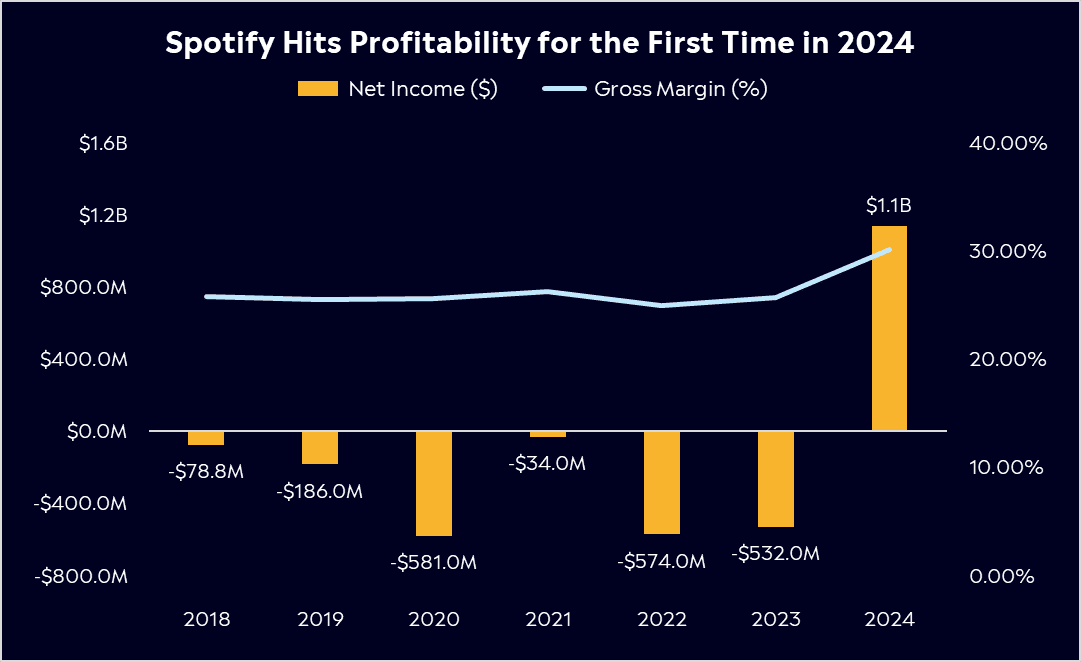

After going public in 2018, Spotify loved the tech rally of 2020, with a lockdown-driven increase that noticed month-to-month energetic customers develop 27%. Nevertheless, that rapidly light and shares went into reverse in early 2021 amid rising rates of interest, a broader tech sell-off, persistent working losses and slowing subscriber development. However because the enterprise went from power to power and turned worthwhile for the primary time ever in 2024, shares have now rallied greater than 550% because the begin of 2023.

Enjoyable Truth: Probably the most-streamed tune of all time is “Blinding Lights” by The Weeknd, with over 4.7 billion streams and counting. Australian singer-songwriter, Tones and I has the thirteenth most-streamed tune with “Dance Monkey” racking up 3.2 billion streams.

*Previous efficiency shouldn’t be a sign of future outcomes.

Competitor Analysis

Spotify stays the undisputed king in music streaming, commanding roughly 31% of the worldwide market share. However the competitors is fierce and rising throughout a number of fronts.

Apple Music is Spotify’s most formidable competitor with roughly 15% market share. Its benefits embody deep {hardware} integration throughout iPhones and AirPods, higher-quality audio choices, and the monetary muscle to develop. Apple dominates in podcasts, boasting the most important podcast listing, an space Spotify is actively rising. The Apple One bundle, which packages Apple Music with different providers like TV+, Arcade, and iCloud storage, creates a compelling worth proposition that Spotify can’t instantly match. With Apple’s huge ecosystem and monetary power, it stays a serious risk.

Amazon Music advantages from Prime bundling, providing thousands and thousands of songs at no additional value for subscribers. Its integration with Alexa and Echo gadgets makes it the default alternative for a lot of good house customers. Nevertheless, it lacks Spotify’s highly effective discovery algorithms and social engagement options. Amazon’s audiobook service, Audible is Spotify’s largest competitor in that class particularly with its Kindle product.

YouTube Music holds a singular edge by its seamless integration with YouTube’s huge video library, claiming round 12% of the streaming market. Many informal listeners already use YouTube for music, and its ad-supported tier instantly competes with Spotify’s free plan. As video and short-form content material grows in recognition, YouTube Music’s place strengthens, significantly amongst youthful demographics who uncover music by video content material. Its rising podcast base additional encroaches on Spotify’s growth plans.

Different streaming gamers, like TIDAL, Deezer, and Pandora, have carved out area of interest audiences, however none have matched Spotify’s scale. In the meantime, Tencent Music dominates in China, the place Spotify doesn’t function, however Spotify owns a stake in Tencent by a share swap. Regardless of the competitors, Spotify’s capacity to innovate, by AI-powered playlists, unique content material, and social-driven options like Spotify Wrapped, means challengers are discovering it onerous to achieve market share. Podcasts, audiobooks, and new integrations guarantee it stays the go-to platform for audio content material throughout gadgets.

Monetary Well being Examine

After years of losses, Spotify turned the nook in 2024, posting a constructive internet revenue for the primary time ever of €1.1 billion. Free money stream surged to €2.3 billion, almost 4 instances 2023’s stage and a dramatic enchancment from simply €21 million in 2022. This turnaround was pushed by robust person development, enhancing gross margins, and disciplined cost-cutting.

In its newest outcomes full-year outcomes reported in February, Spotify reported:

675 million month-to-month energetic customers (+12% YoY)

263 million premium subscribers (+11% YoY)

€15.6 billion in whole income (+18% YoY)

File gross margin of 30.1%, with expectations for this to maintain rising regardless of video-podcast investments.

Spotify’s freemium mannequin stays a key driver of its scale. The ad-supported tier attracts new customers and serves as a pipeline for premium subscribers, reinforcing its world growth technique, a key benefit over video-streaming opponents whose prices rise sharply with content material growth. The corporate has improved margins quickly by value will increase, increasing promoting income, and cost-cutting measures, pushing its profitability outlook increased. Spotify can be discovering extra methods to monetise its platform, with new pricing tiers for ‘superfans’ that goal to spice up income per person by unique content material and early entry to live performance tickets (a wrestle everyone knows) to assist drive engagement. With new premium subscriber additions surpassing expectations at 27 million for the yr and churn staying low, Spotify’s monetary power is enhancing. The corporate is well-positioned to increase its profitability streak within the years forward with value hikes. Its technique to personal podcast content material and new video podcasts will probably be a key development driver.

* Previous efficiency shouldn’t be a sign of future outcomes.

Purchase, Maintain or Promote?

Spotify stays a horny long-term development story, with robust fundamentals and increasing profitability. Nevertheless, a lot of its success is determined by executing value will increase with out deterring customers. With music streaming penetration nonetheless low in lots of markets, particularly in comparison with video streaming, there’s substantial room for growth.

After years of maintaining subscription costs largely unchanged, Spotify has begun elevating them whereas nonetheless gaining customers, and that might want to proceed. However on the flip aspect, competitors from Apple, Amazon, and YouTube is there, and value hikes may drive churn. With excessive expectations baked into its valuation, any slowdown may hit shares onerous. Spotify is presently buying and selling at 44x ahead earnings, with shares buying and selling close to all-time highs regardless of the current sell-off. In keeping with Bloomberg’s Analyst Suggestions, Spotify has 27 purchase scores, 11 holds, and a pair of sells, with a mean value goal of USD$659.88 signalling a possible upside of 23% from its final closing value. With a powerful runway of development in lots of markets and enhancing financials—increased margins, advert income, and value management—supporting long-term profitability, Spotify is the identify to observe within the music business.

*Information Correct as of 11/03/2025

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.