Bitcoin (BTC) and Ethereum (ETH) have been hit with huge promoting strain as worry grips not simply the crypto market but additionally U.S. shares. Your complete crypto sector has struggled amid adverse macroeconomic situations, with traders unsure concerning the market’s subsequent main transfer.

World commerce battle fears and erratic coverage shifts from U.S. President Trump’s administration have fueled volatility and uncertainty, making a hostile setting for traders. Consequently, the U.S. inventory market has plunged to its lowest ranges since September 2024, dragging crypto costs down alongside conventional property. With no clear aid in sight, merchants stay on edge as each shares and crypto struggle to carry key assist ranges.

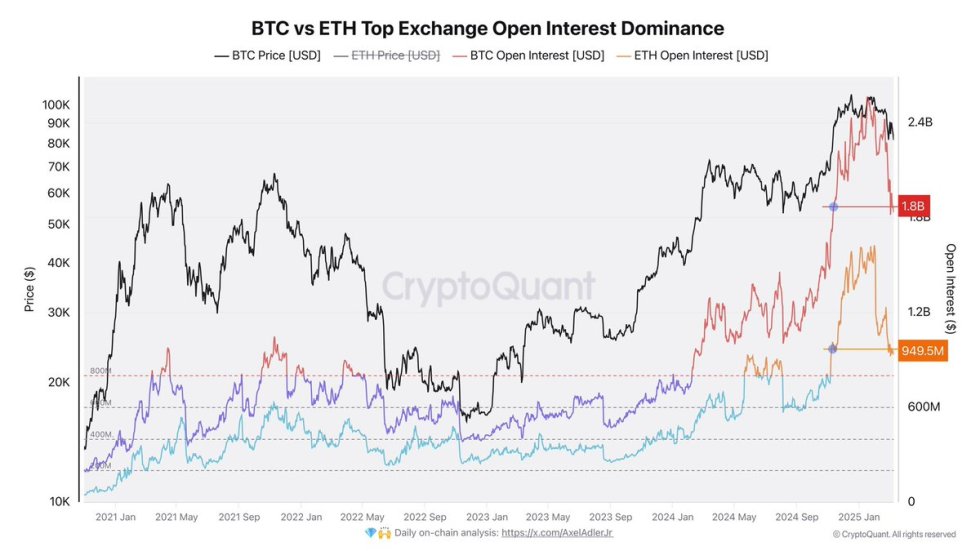

Key on-chain metrics from CryptoQuant reveal that open curiosity in Bitcoin and Ethereum futures has dropped considerably, reflecting a transparent shift in investor sentiment and speculative exercise. The decline in open positions means that merchants are exiting the market because of liquidations or threat aversion, including to the uncertainty surrounding Bitcoin’s and Ethereum’s worth motion.

With markets underneath strain, the approaching days might be essential in figuring out whether or not BTC and ETH can get well or if additional draw back is forward.

Bitcoin Drops 19% As Worry Grows

Bitcoin has fallen over 19% because the begin of March, with worry and uncertainty dominating market sentiment. Many traders now consider the bull cycle is over as BTC struggles to reclaim key ranges and bearish sentiment units new draw back targets. With promoting strain rising, merchants are carefully watching whether or not Bitcoin can stabilize or if additional losses are forward.

For the reason that U.S. elections in November 2024, macroeconomic volatility and uncertainty have pushed the market. Rising commerce battle fears, unpredictable coverage adjustments, and international financial instability have all contributed to continued weak spot throughout threat property, together with each crypto and U.S. shares. With these situations anticipated to persist, Bitcoin stays weak to extra worth swings.

Prime analyst Axel Adler shared insights on X, revealing the numerous drop in open curiosity in Bitcoin and Ethereum futures signifies a serious shift in investor sentiment and speculative exercise. Merchants exit their positions amid heightened uncertainty. In response to Adler, open curiosity in BTC futures has dropped by $668 million, whereas ETH futures have seen a decline of $700 million. In complete, positions price $1.368 billion have been closed throughout each devices.

Adler notes that this liquidation wave represents a partial market reset, as leveraged merchants exit the market. Whereas this might sign diminished speculative strain, Bitcoin nonetheless must reclaim key ranges earlier than a restoration can happen.

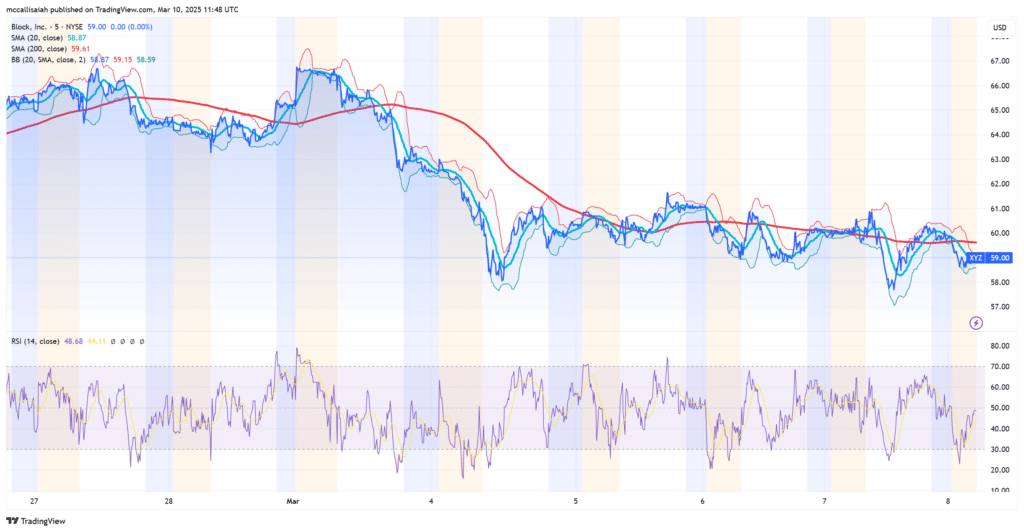

BTC Struggles Under Key Transferring Averages

Bitcoin is presently buying and selling at $81,500, having misplaced the 200-day Transferring Common (MA) and Exponential Transferring Common (EMA) across the $85,000–$82,000 vary. This breakdown has positioned BTC in a weaker place, rising the chance of additional declines until bulls can reclaim key resistance ranges.

For a restoration to achieve momentum, bulls should maintain agency above the $80,000 assist stage and push again above $85,000. A robust transfer previous this zone might sign the beginning of a rebound, however market situations stay unsure, making the tempo of any restoration extremely unpredictable. And not using a decisive push greater, BTC might stay trapped in a consolidation part, struggling to seek out course.

Nevertheless, dropping the $80,000–$78,000 vary would put Bitcoin liable to additional draw back, with the following key assist ranges sitting at $75,000 and probably even $69,000. If bears keep management, BTC might expertise one other wave of promoting strain, delaying any hopes of a restoration. The approaching days might be crucial in figuring out whether or not Bitcoin can stabilize or if additional declines are on the horizon.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.