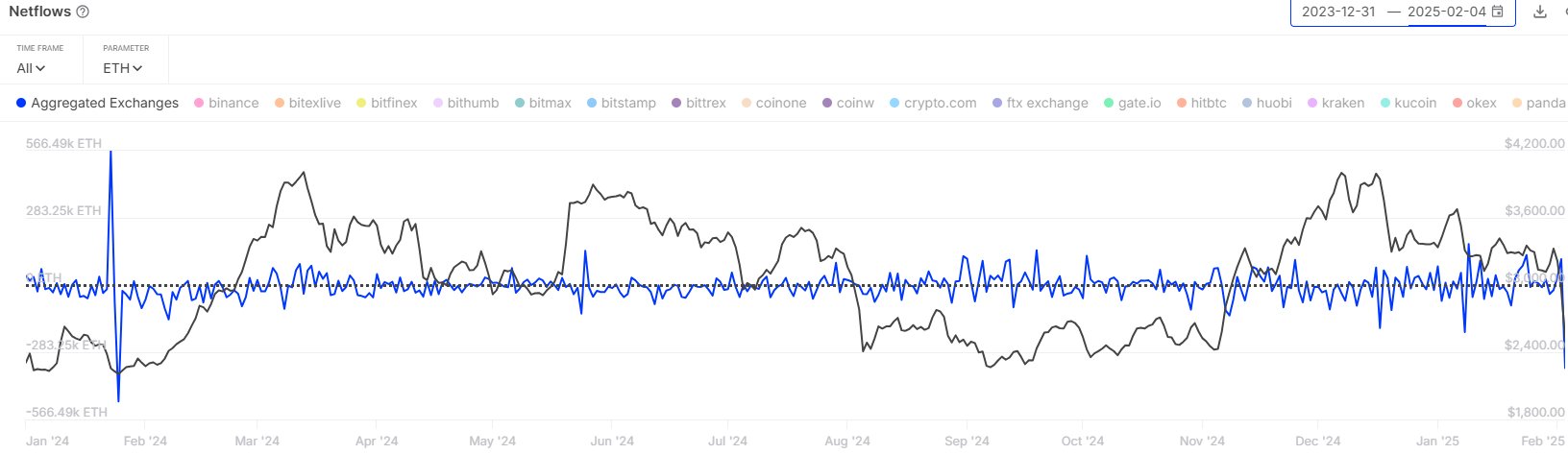

Bitcoin (BTC) is displaying strikingly bullish patterns as its worth hovers across the $97,000 mark. Technical evaluation factors to a uncommon symmetry in Bitcoin’s worth motion, evaluating the pioneer cryptocurrency to previous tendencies and predicting a pointy transfer to new all-time highs.

Bitcoin Worth Motion Mirrors Bullish Symmetry Patterns

An in depth Bitcoin worth evaluation by TradingView crypto analyst, ‘TradingShot,’ reveals that Bitcoin just lately bounced off its 100-day Transferring Common (MA). This vital help degree beforehand triggered a large worth rally in January 2024. Presently, the asset’s worth motion is mirroring its pattern conduct from the earlier 12 months, the place the same bounce from the MA100 and the emergence of a bullish symmetry sparked the start of a rally that propelled BTC to a brand new all-time excessive.

The analyst shared a chart indicating that Bitcoin is now shifting inside a “Channel Up sample”—an upward-sloping parallel channel indicating a possible long-term bullish pattern. Inside this sample, TradingShot reveals two accumulation channels, highlighting a interval the place the Bitcoin worth consolidates earlier than persevering with its upward transfer.

From 2023 to 2024, Bitcoin skilled its first accumulation channel. Proper now, the pioneer cryptocurrency is in its second accumulation channel, making ready to interrupt above it because it goals for a robust, bullish restoration.

After totally analyzing Bitcoin’s worth actions, TradingShot recognized “a tremendous RSI-based symmetry of two fractals.” The analyst revealed that the Channel Up sample is a dominant long-term indicator that might possible information the BTC worth to the prime of the cycle. He additionally disclosed that BTC began its means of breaking above this sample and probably replicating previous bullish strikes that might propel it to the height of the long-term Channel Up sample.

The analyst’s bullish Relative Power Index (RSI) sits close to the $97,000 Bitcoin worth degree between its two accumulation channels. Within the present accumulation channel, the intervals between the RSI decrease highs carefully mirror these from the earlier channel between 2023 and 2024.

The analyst factors out that in each the previous and current accumulation channels, there have been 25 days between the 2nd RSI decrease excessive and the third. Moreover, the hole between the third and 4th RSI decrease highs is 32 days within the present channel and 34 days within the earlier one.

This near-perfect bullish symmetry exhibits that the present worth motion might comply with the identical previous tendencies, suggesting a potential bullish continuation to a brand new all-time excessive.

Fibonacci Projections Level To $145,000 By March

Primarily based on bullish symmetry patterns, TradingShot has set a new all-time excessive goal for Bitcoin. The analyst marked the two.618 Fibonacci extension degree in each cycles on the chart. Within the first cycle, BTC skilled a large rally that pushed it to a brand new ATH across the $73,000 degree.

The projected peak for the cryptocurrency’s present market cycle is $145,000 primarily based on the identical Fibonacci ratio, highlighted within the inexperienced space on the chart. TradingShot forecasts that the Bitcoin worth might attain this bullish goal between March and April 2025, assuming the bullish symmetry sample follows historic tendencies.

Featured picture from iStock, chart from Tradingview.com