Sensible and Revolut have been leaders within the fintech cross-border transactions house, disrupting conventional banking methods. With Revolut’s IPO probably coming in 2025, it’s attention-grabbing to match each firms to find out whether or not Sensible is positioned to problem Revolut’s dominance or if the 2 serve totally different functions for buyers.

Key Highlights

Sensible trades at a fraction of Revolut’s non-public valuation.

Sensible Nearing All-Time Highs, however nonetheless not costly.

Banks are positioning within the battle to come back: Sensible offers.

Seeing Revolut All over the place

Throughout a latest journey to Spain, I couldn’t escape Revolut’s advertisements. Aggressive advertising and IPO rumors acquired me considering: How will a publicly traded Revolut have an effect on Sensible? Whereas each are fintech firms, and disruptors to conventional banking, their methods and enterprise fashions differ considerably.

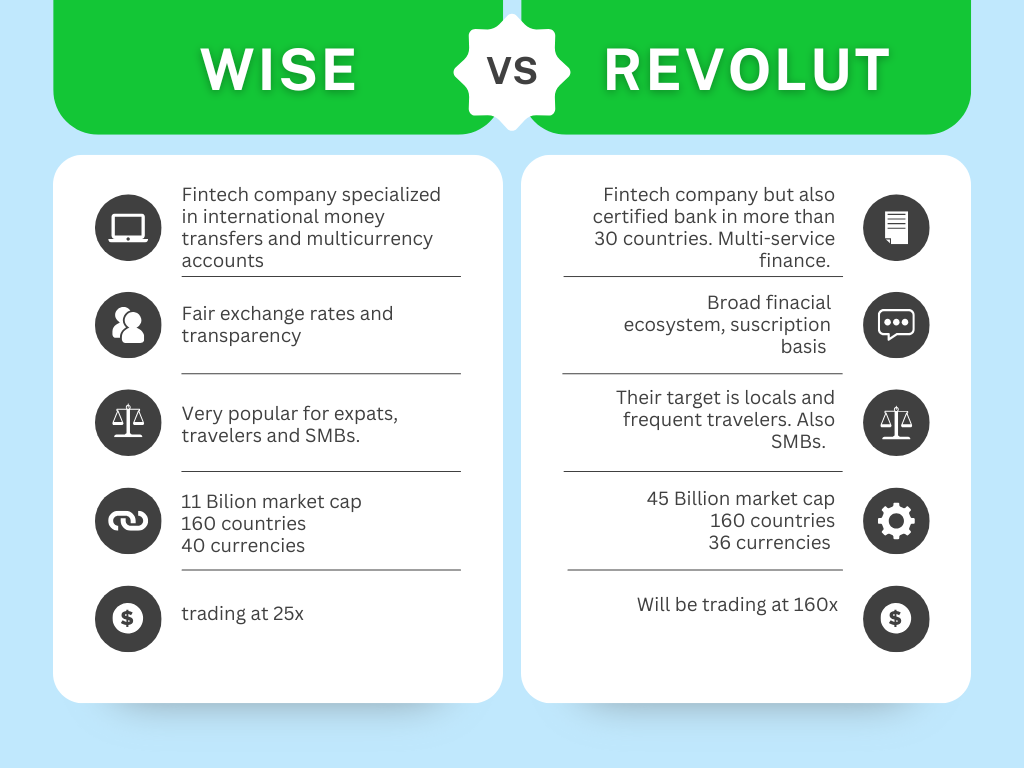

Sensible’s mission is obvious: low-cost, clear, and environment friendly cross-border transfers. Revolut, then again, goals to turn out to be a worldwide monetary super-app, providing every thing from banking to crypto. Given these distinct targets, ought to buyers actually be evaluating the 2?

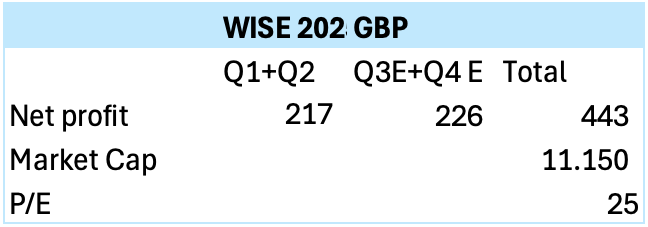

Revolut’s IPO particulars are nonetheless scarce, however a secondary share sale occurred in August 2024, factors towards a $45 billion valuation. That’s a large valuation, particularly for a corporation that, whereas rising quick, hasn’t persistently been worthwhile. In the meantime, Sensible is buying and selling at 25x P/E with regular profitability and a powerful return on capital. Let’s take a more in-depth take a look at their enterprise fashions.

Companies Mannequin Breakdown: Sensible vs. Revolut

Sensible is likely one of the world’s quickest rising fintech, whereas being very worthwhile. Launched in 2011, the enterprise is listed on the London Inventory Alternate beneath the ticker, WISE. In fiscal 12 months 2024, Sensible supported round 12.8 million individuals and companies, processing roughly £118.5 billion in cross-border transactions, and saving clients over £1.8 billion, in keeping with the knowledge offered by the corporate.

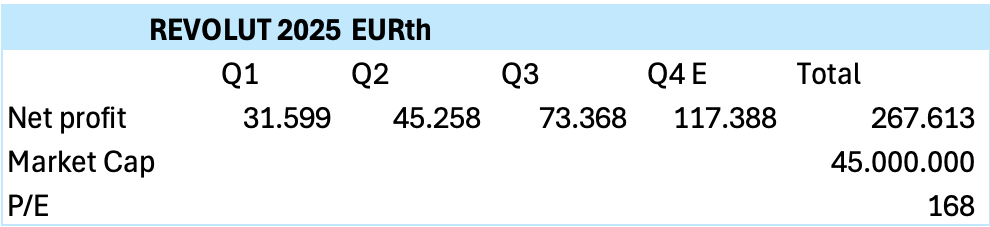

The actual valuation of Revolut’s IPO remains to be unsure, though the obtainable info factors to a $45Bn worth, given latest transactions. For the reason that final annual assertion obtainable for Revolut on their web site is dated for 2023 and the newest monetary report was with date 30 of September 2024, I needed to make some common predictions to match each firms:

1 GBP in thousands and thousands

2 EUR, in 1000’s

As a reference, Revolut’s valuation could be nearly 7 instances Sensible’s present valuation. This implies two issues, probably: Sensible is undervalued and Revolut is overvalued. For my part, each are appropriate, and I wouldn’t put money into Revolut given the newest identified valuation.

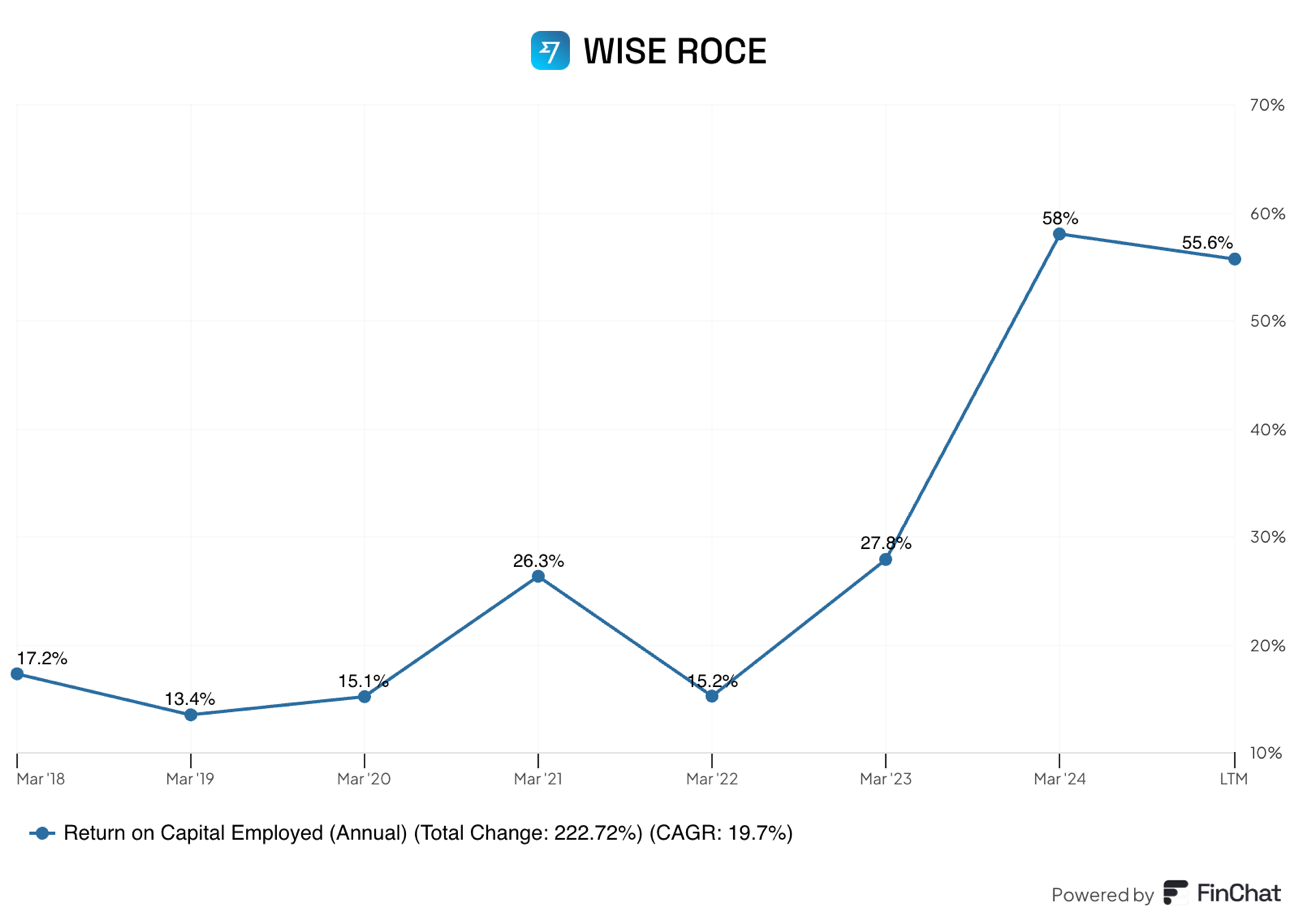

Sensible, buying and selling at 25x P/E, is an attention-grabbing alternative, rising 15-20% yearly. With stable returns on capital employed since 2018, proving the administration dedication in value discount and enhance the shareholder’s revenue.

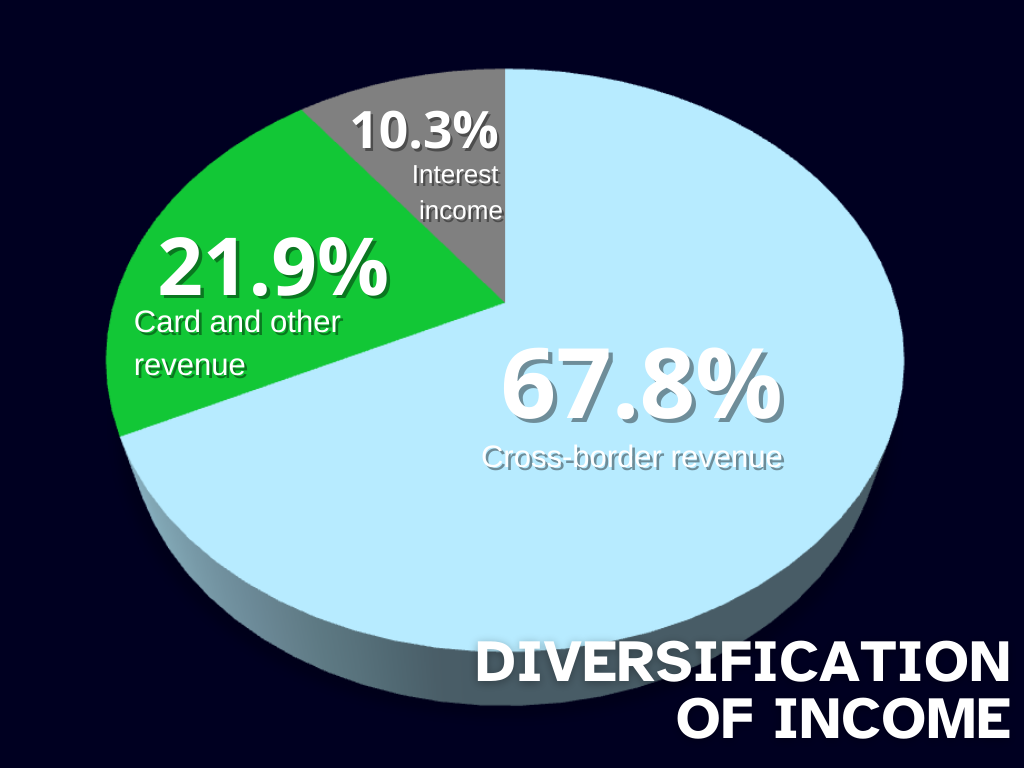

Sensible is a Fintech (used to explain new know-how that seeks to enhance and automate the supply and use of economic companies). Utilizing Sensible’s platform, clients can transfer their cash overseas to 40 totally different currencies in just one account. The corporate primarily generates income from cash transfers, conversion companies and debit card companies. Sensible additionally generates income from its multi-currency funding function. This function permits clients to buy models in funding funds, offered by fund managers, utilizing their Sensible account stability.

The client development charge has been of 29% in 2024 in contrast with 2023, even thought, they needed to pause clever enterprise new accounts as a result of they’re rising too quick for his or her capability! This 12 months they’re targeted on put money into infrastructure to get the flexibility to provide the large current demand.

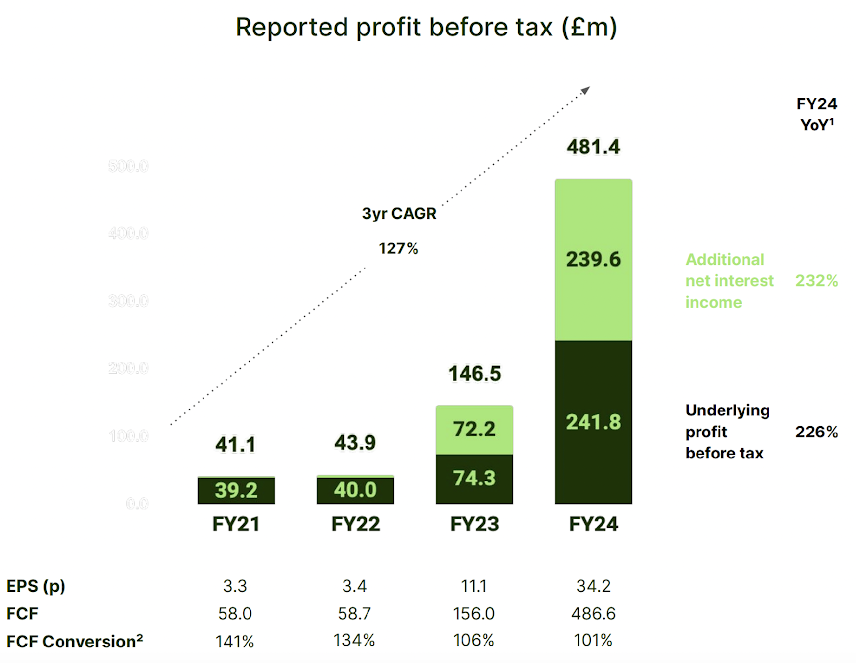

The final a part of the income that’s necessary to spotlight is the curiosity earnings with a ten.3% of the income with a price of 120.7m (this income solely considers the curiosity earnings of the primary 1% yield. If we take into account all of the curiosity earnings, beneath and over 1%, it might be 485m). That is constructed from investments in cash market funds, listed bonds, and curiosity from money at banks.

To create a clear and sensible option to transfer your cash overseas, they take into account the mid-market alternate charges which is the worth the banks are prepared to pay for getting or promoting the currencies, and the mid-point between each is the mid-market alternate charge (the honest charge as properly). That is thought-about the “actual” conversion charge, and that’s the principle distinction with banks, they don’t often share the actual conversion charge with you, as a result of they put the margin on prime of the actual charge.

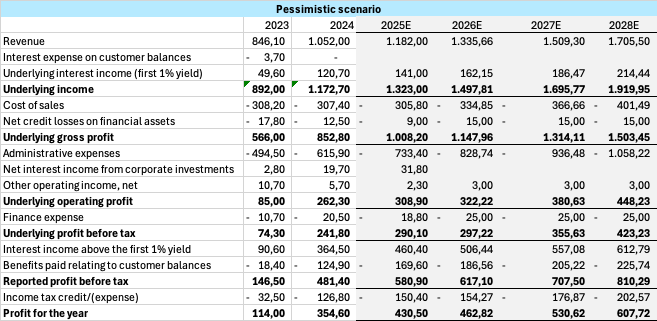

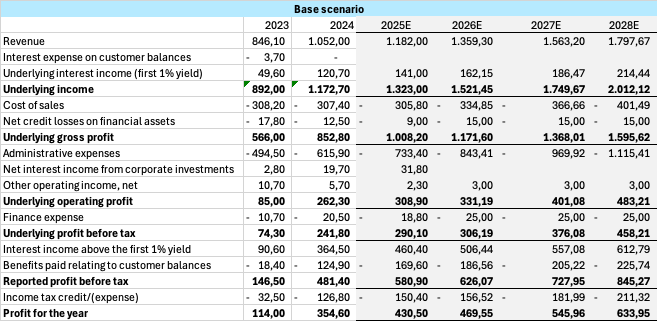

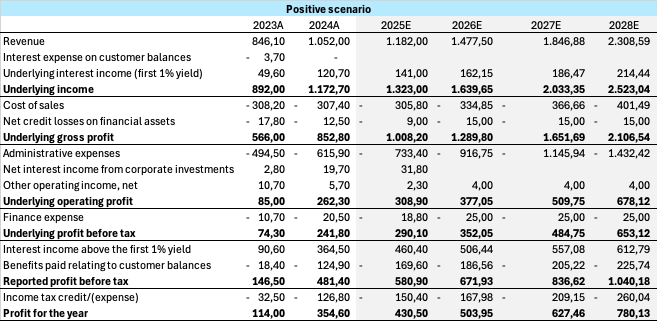

Funding thesis

As we’re near the top of their finish of economic 12 months, anticipated in March 2025, I made some estimations of what might be the way forward for the income of the corporate, (after I first purchased a Sensible share, my estimations, even the optimistic one had been so low in contrast with right this moment outcomes) I needed to renew my situations thus far, making new estimations for the interval (2025-2028) for the pessimistic situation I estimated a development of 13% yearly, which is decrease than their very own expectations of a 15-20% development CAGR. For the bottom situation I thought-about 15% development of income, good within the low vary of their expectations , and for the optimistic situation a really optimistic development of 25%.

Utilizing the mid-point development estimate of the corporate (15%), and being conservative on the curiosity earnings that Sensible could have sooner or later, we may see a rise of over 44% internet earnings. Thus, utilizing the identical a number of that the corporate trades right this moment (25x) we’d have a return of over 44% in three years (As a result of the 2025 outcomes are nearly right here and are in base of the final semester outcomes).

If we take into account the online money place of the corporate, which stays at 800m, (excluding the client’s held stability), the corporate trades even decrease, which may give us much more upside. Adjusting the online money place, the corporate’s PE ratio is round 24 instances earnings. We might all the time depart room for multiple-expansion, which given the corporate’s development, return on capital employed, and profitability, is a really seemingly chance.

Nevertheless, with the inventory close to all-time highs, is it nonetheless a purchase? With buyer development at 29% YoY and cross-border volumes up 24% to £37.8B, Sensible’s fundamentals look robust, with a mean ROCE of 30% within the final 5 years, with clear aggressive benefit by way of their pink of partnerships worldwide, rising the variety of clients +20% quarterly.

However may they maintain the tempo in development in the long run? The TAM (Complete Addressable Market) of the cross-border funds has proven an annual development of three%, Sensible’s estimation from their annual report in 2024 are that in 2027 it is going to obtain a complete quantity of £28.5 TRILLION between retail, SMBs (Small and medium enterprise), and enterprises. In 2024 the TAM just for retail was £2 trillion moved yearly. All this info means, that there’s round £28.5 trillion in alternatives for the infrastructure of clever which is presently having lower than the 1% of the market share. However this doesn’t imply that there’s no danger related to the enterprise, right here we’ll discover a number of the primary dangers for Sensible.

WISE’s RISKS.

Nevertheless, Sensible’s plan to beat this, is working along with banks worldwide, providing their prepared to attach infrastructure, and complying with each nation’s totally different rules. Being associate with a considerable quantity of greater than 90 firms from numerous sectors, together with banks, which is a vital community to assist the enhancing of lowering SWIFT prices, and time. We additionally should take into account the size of the corporate, working in over 160 international locations.

The most recent information was when Morgan Stanley introduced the settlement with Sensible to facilitate the overseas alternate worldwide capabilities for company clients, it is a nice milestone as a result of that is the primary funding financial institution to allow these on clever, that is the start of many different banks selecting observe this path, as is the case with Normal Chartereds a financial institution in Asia, Africa and the Center East. All of those new relationships imply international presence for Sensible.

Fines and compliance that compromise WISE’s mission. Final January the Client Monetary Safety Bureau ordered Sensible to pay practically $2.5 million for a collection of unlawful actions, essentially the most regarding act was the disclosure of the 6 digit conversion charge, the CFPB stated the rule of thumb is between 2 and 4 digit, what make us query if this “Unfair competitors” may probably have an effect on the shoppers within the US, that’s greater than three million of individuals between the 48 states, the District of Columbia, Guam, the U.S. Virgin Islands, and Puerto Rico, within the matter of their mission to make clear transactions. I haven’t discovered any communication from Sensible to search out how they’re anticipating to repair this. Nevertheless a $2.5 milion isn’t a significative quantity contemplating the free money circulate of the corporate.

Forex Volatility. Fluctuations in alternate charges may have an effect on profitability, however many of the income come from charges in conversion and switch.

The stagnation of the corporate’s development is a sound concern. If the expansion that we expect doesn’t materialize, the valuation and the a number of that the corporate trades at might be harmed. Nevertheless, the loyal base of consumers (“evangelical clients” as they name them) creates an unbelievable development in clients, the TAM confirmed us the probabilities are nonetheless with house to development, as the instance of the doorway of WISE on January to the Mexican market, and the brand new partnership with international banks, makes unlikely the stagnation within the coming three years not less than.

Digital currencies and cryptocurrencies, with globalization of this sort of foreign money, and each time extra international locations acknowledging the makes use of of it, we may see a digital globably accepted, as is the case of the Inthanon-LionRock between Thailand and Hong kong or undertaking Aber between Saudi Arabia and the UAE. So finally you might cease needing to alternate your cash to totally different currencies, with only one asset you might pay in China, US and in Venezuela. I consider this might be the longer term however in a super world. It will want an excessive amount of cooperation between nations, and that is hardly seemingly within the coming 20 years not less than.

Credit score danger. To evaluate this difficulty, the corporate has a really conservative strategy to speculate their buyer’s stability. As of their newest report, solely 36% of their money place is invested in market funds (3.776m out of 10.479m), whereas the remainder is in present accounts. Relating to their short-term investments, nearly 100% of the cash is invested in Aa and A devices, creating a strong and stable stability sheet for the corporate.

Conclusion

Sensible was my finest funding in 2024, however in 2025, it’s time to reassess. At 25x earnings and close to all-time highs, is it nonetheless deal? Initially, Revolut’s IPO appeared like an alternate alternative, however after reviewing the restricted information obtainable, its rumored valuation might be seven instances increased than Sensible’s present a number of.

For now, my focus stays on Sensible, buying and selling at 25x however rising quickly in each buyer base and international enlargement. With no debt, a worldwide infrastructure benefit, and a management crew aligned with shareholders’ pursuits (CEO and co-founder Kristo Käärmann nonetheless owns 18% of the corporate) Sensible stays a compelling long-term funding.

What do you suppose? Will Revolut’s IPO be a game-changer, or is Sensible nonetheless the smarter wager?

Sources

Sensible annual assertion 2024

Analyst presentation 2024

Revolut annual assertion

https://clever.com/imaginary-v2/photos/2bbbb368c98fe4aa7b2aa3e133341520-FY24_Analyst_Presentation_.pdf

https://www.revolut.com/information/revolut_announces_secondary_share_sale_to_provide_employee_liquidity/

https://www.investopedia.com/softbank-backed-revolut-secures-usd45b-valuation-ahead-of-possible-ipo-8696459#:~:textual content=Revolutpercent20haspercent20securedpercent20apercent20$45,intopercent20thepercent20companypercent20inpercent202021.

https://www.theguardian.com/enterprise/article/2024/aug/16/fintech-firm-revolut-valued-employee-share-sale

https://www.statista.com/subjects/11647/cross-border-payments/#topicOverview

https://www.consumerfinance.gov/about-us/newsroom/cfpb-orders-wise-to-pay-25-million-for-illegal-remittance-practices/#:~:textual content=Thepercent20CFPBpercent20ispercent20orderingpercent20Wise,saidpercent20CFPBpercent20Directorpercent20Rohitpercent20Chopra.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding targets or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.