Bitcoin ($BTC) has step by step established itself as a standalone asset throughout the framework of asset allocation.

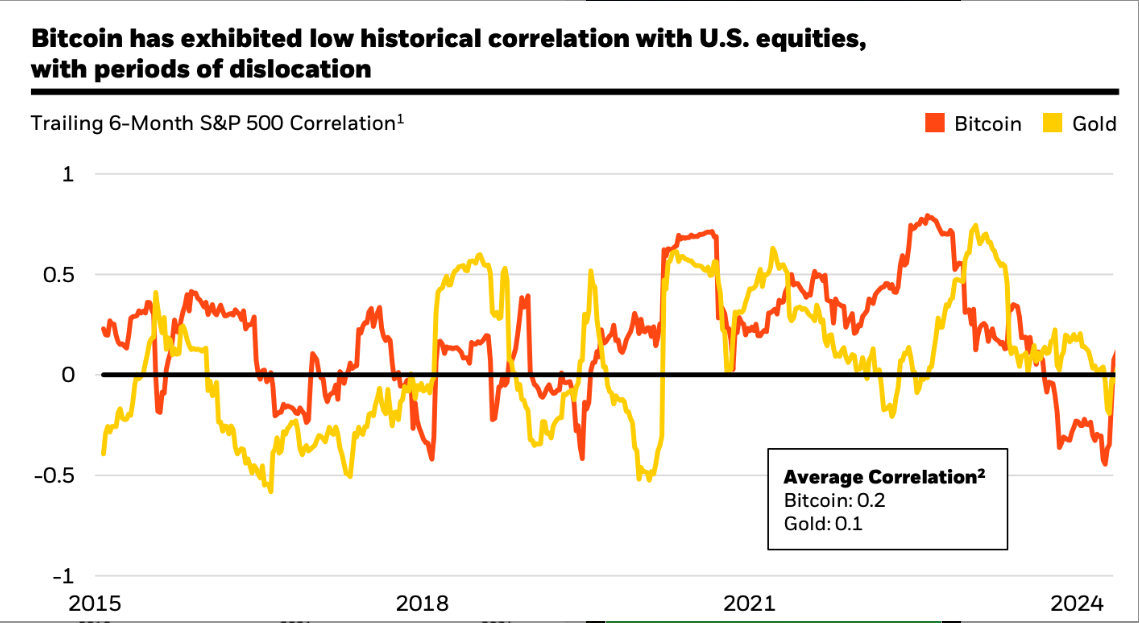

Thought of by establishments equivalent to BlackRock as a wonderful diversification software as a result of its low correlation with conventional asset courses (shares, bonds), Bitcoin is attracting an rising variety of traders.

Under, we are able to see how Bitcoin has behaved throughout totally different crises in comparison with different property.

Nonetheless, investing instantly in cryptocurrencies entails vital challenges: excessive volatility, managing digital wallets, and the executive complexity of tax reporting for features or losses. An attention-grabbing answer to profit from the benefits of this market whereas bypassing these obstacles is to spend money on cryptocurrency-related shares. These shares supply an oblique different to Bitcoin whereas enjoying a diversifying position in an funding technique.

Why Are Cryptocurrency-Associated Shares Diversification Instruments?

Shares of cryptocurrency-related firms occupy a novel place within the funding panorama. They permit traders to profit from the expansion tendencies of the crypto market with out instantly investing in digital property. Like Bitcoin, they exhibit traits that make them engaging in a diversified asset allocation:

Average Correlation with Conventional Property: Though a few of these shares are traded on exchanges, they don’t at all times observe the actions of conventional indices (S&P 500, Nasdaq). Their efficiency relies upon extra on crypto market fluctuations and blockchain know-how adoption.

Excessive Progress Potential: Corporations working within the crypto ecosystem (mining, buying and selling platforms, blockchain applied sciences) are positioned in quickly increasing markets. This progress is unbiased of conventional financial cycles.

Oblique Publicity to Crypto Volatility: Not like instantly buying Bitcoin, these shares can supply lowered threat by the diversification of firms’ income streams (e.g., NVIDIA or PayPal derive vital earnings from different sectors).

Primary Classes of Cryptocurrency-Associated Shares

Cryptocurrency-Specialised Corporations These firms are instantly uncovered to cryptocurrency efficiency. They embrace buying and selling platforms like Coinbase World (COIN), whose revenues improve with transaction volumes, or mining firms equivalent to Marathon Digital Holdings (MARA), Riot Platforms ($RIOT), and Hut 8 Mining ($HUT).These shares are perfect for traders in search of a excessive correlation with Bitcoin whereas diversifying their portfolios.

{Hardware} Producers Corporations like NVIDIA ($NVDA) and $AMD profit from the rising demand for mining gear. Whereas their actions are influenced by the crypto market, additionally they revenue from different progress drivers, equivalent to synthetic intelligence, video video games, and cloud computing. These firms present partial publicity to the crypto market with a extra diversified threat profile.

Blockchain-Pushed Corporations Tech giants equivalent to Block, Inc. (SQ) or MicroStrategy ($MSTR) use blockchain to develop progressive monetary options. PayPal (PYPL) and Visa (V) additionally combine blockchain to facilitate digital funds. These firms supply oblique publicity to the crypto sector whereas capitalizing on broader blockchain alternatives.

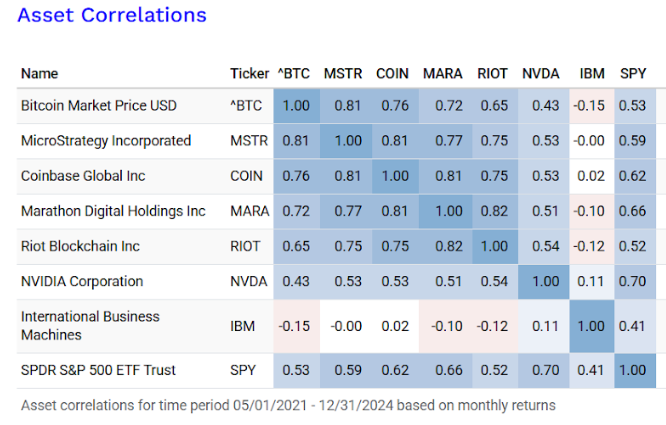

Which Shares Are Most Correlated with Bitcoin?

Sure shares have a stronger correlation with Bitcoin as a result of their direct dependence on its efficiency. For instance:

MicroStrategy (MSTR): This firm holds vital Bitcoin reserves, making its valuation extremely linked to BTC value actions.

Marathon Digital Holdings (MARA) and Riot Platforms (RIOT): These mining firms rely instantly on the profitability of operations, which is influenced by Bitcoin costs.

Coinbase (COIN): The buying and selling volumes on its platform range in keeping with general curiosity in cryptocurrencies.

Conversely, firms like NVIDIA or IBM have a decrease correlation with Bitcoin as they diversify their actions past the crypto market.

It’s even attainable to intently mimic Bitcoin’s efficiency by combining a number of shares. As an illustration, a portfolio comprising (MSTR0.3 + MARA0.3 + COIN*0.7)/1.3 intently tracks Bitcoin’s actions.

Methods to Combine These Shares into Asset Allocation

Outline Your Funding Targets Earlier than investing, it’s important to set your goals. Do you wish to maximize portfolio diversification, scale back volatility, or capitalize on crypto progress? These targets will decide which forms of shares to prioritize.

Diversify Inside the Crypto Sector Mix firms instantly correlated with Bitcoin (like MicroStrategy or Riot) with diversified firms (like NVIDIA or PayPal).Think about ETFs such because the Grayscale Bitcoin Belief (GBTC) or Amplify Transformational Information Sharing ETF (BLOK) to unfold investments throughout a number of sector gamers.

Undertake a Gradual Strategy Given the volatility of crypto-related shares, it might be smart to take a position step by step. A technique like Greenback-Value Averaging (DCA) can assist mitigate the consequences of market fluctuations.

Recurrently Reevaluate Your Allocation Crypto-related shares are delicate to technological improvements and regulatory adjustments. Recurrently reviewing your allocation ensures alignment along with your goals.

Crypto Shares as a Complement to Bitcoin in a Diversified Portfolio

Incorporating cryptocurrency-related shares into an asset allocation can improve portfolio diversification. Whereas Bitcoin serves as an uncorrelated asset relative to conventional markets, these shares supply hybrid publicity. They mix the potential progress of the crypto market with extra secure fundamentals, thereby lowering a few of the dangers related to direct crypto funding.

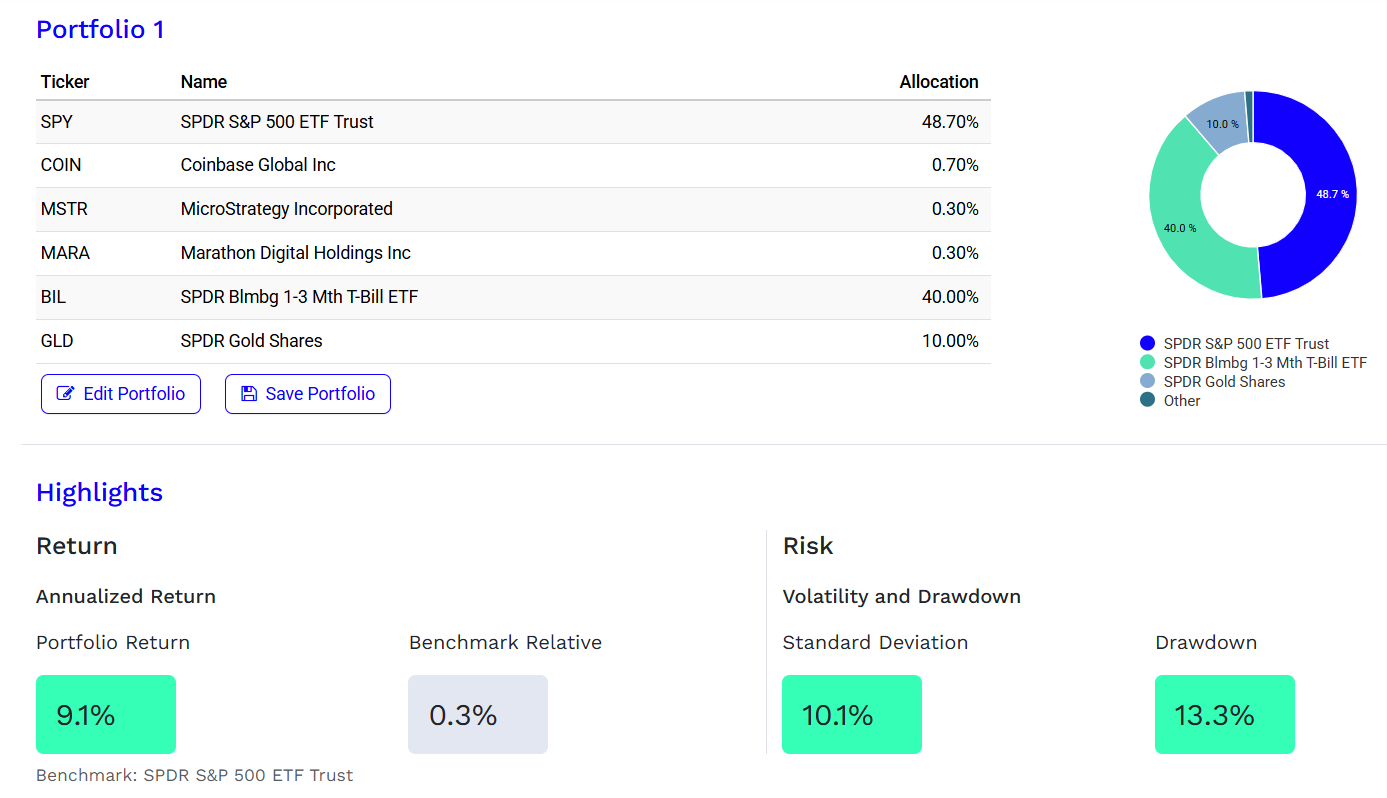

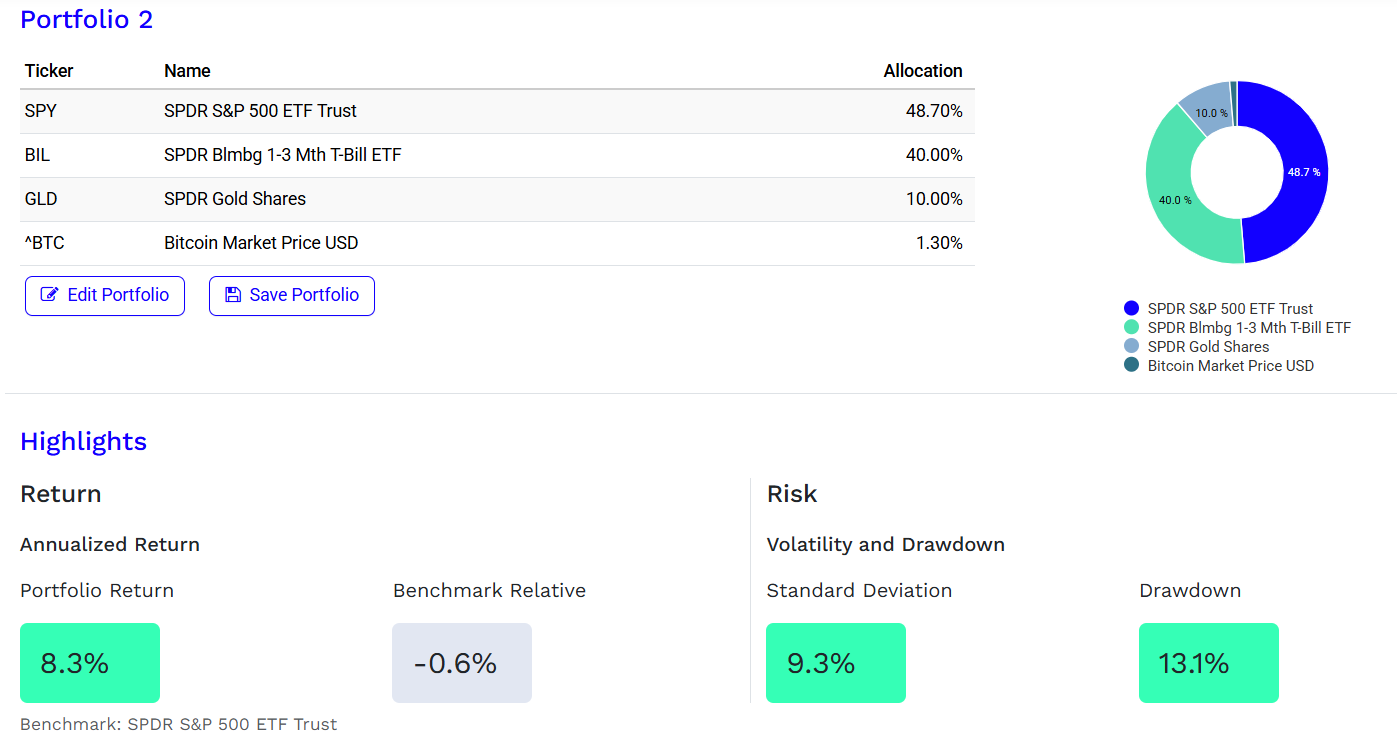

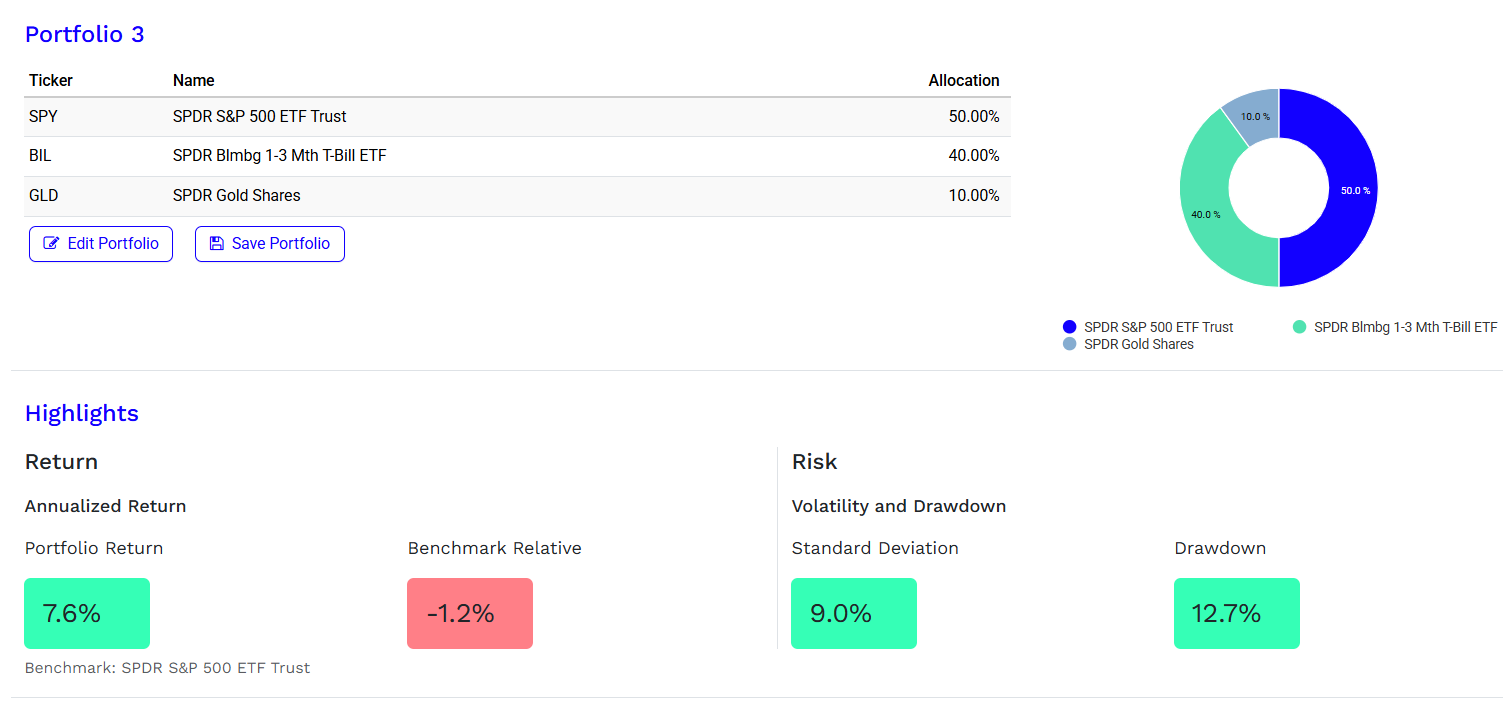

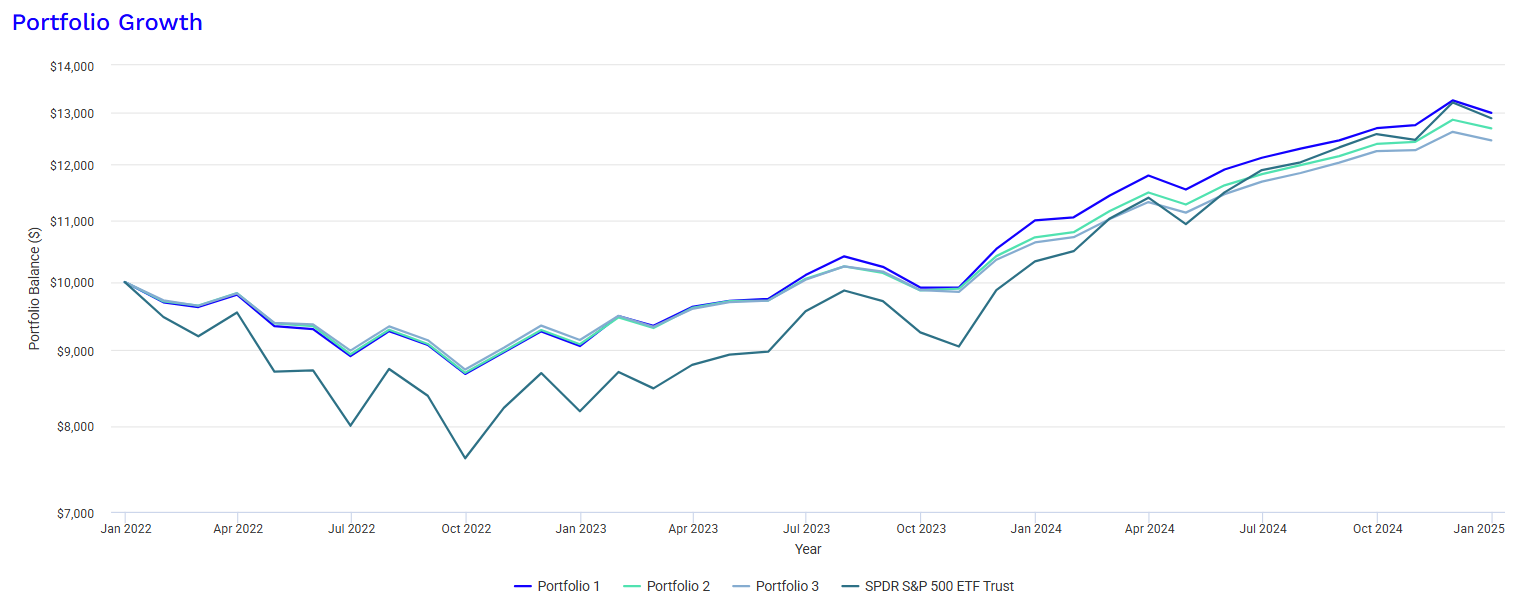

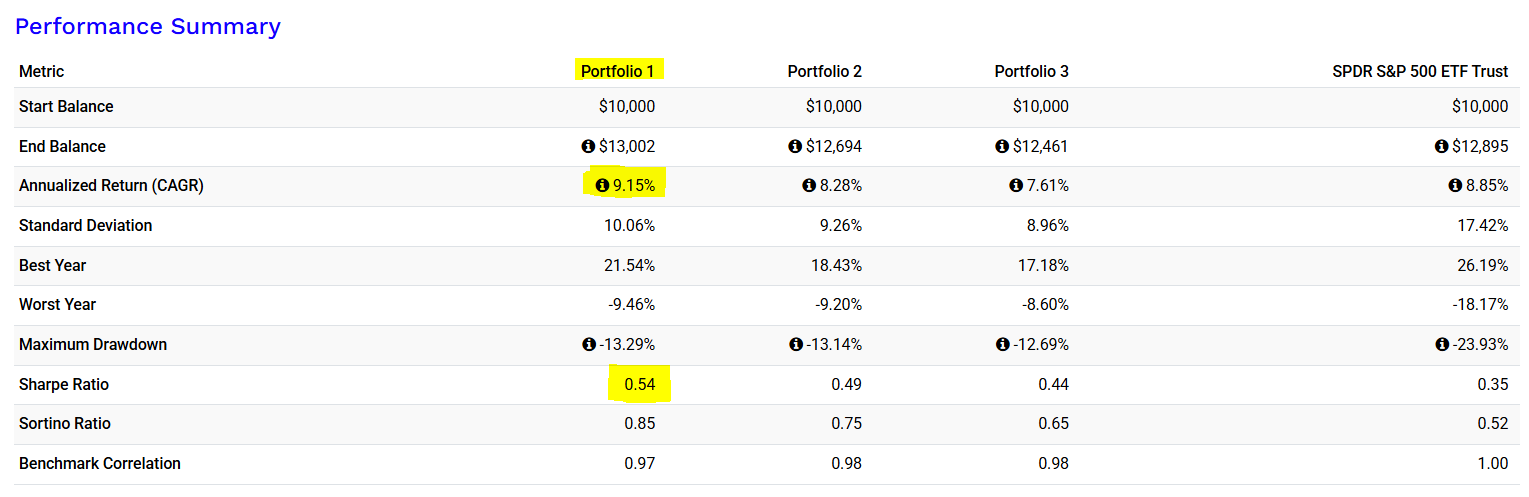

Our three-year evaluation of a balanced portfolio reveals that including 1.3% Bitcoin had a optimistic impression on risk-adjusted efficiency. Nonetheless, changing Bitcoin with a basket of three cryptocurrency-related shares yielded even higher outcomes. However, utterly excluding cryptocurrencies led to a big decline in efficiency.

Portfolio 1: With cryptocurrency-related shares

Portfolio 2: With Bitcoin

Portfolio 3: With out Bitcoin or cryptocurrency-related shares

Dangers of Investing in Cryptocurrency-Associated Shares

Investing in cryptocurrency-related shares, equivalent to these in mining, exchanges, and blockchain applied sciences, provides potential rewards but additionally vital dangers:

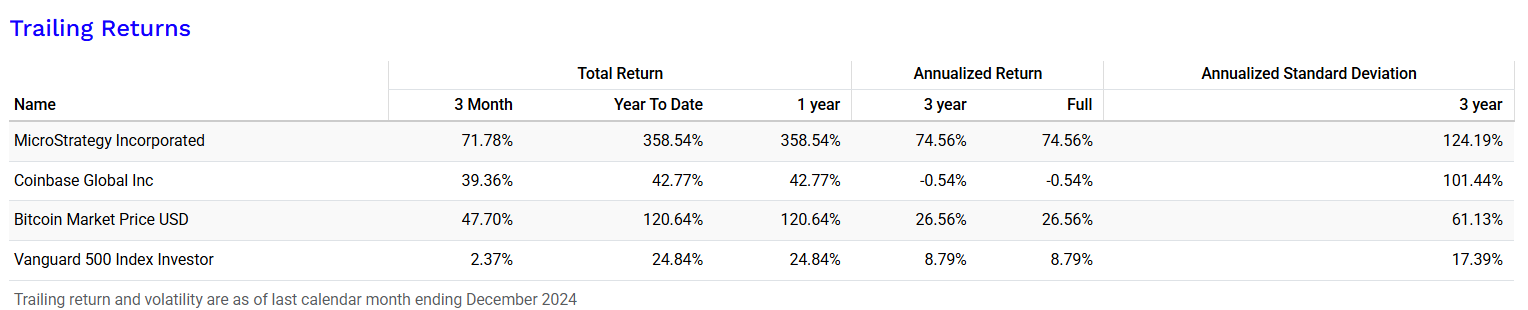

Excessive Volatility: Cryptocurrency costs fluctuate wildly, impacting the worth of associated shares.We will see beneath that the property associated to crypto are far more unstable than Bitcoin itself and even the S&P 500. In truth, for MSTR, the usual deviation over the past three years is 124.19%, in comparison with 17.39% for the S&P 500 and 61.13% for the Bitcoin.

Regulatory Dangers: Altering authorities laws may hurt the profitability of firms on this sector.

Safety Dangers: Cyberattacks and technical failures can result in vital losses for firms and traders.

Liquidity Dangers: Low buying and selling volumes in some shares could make shopping for or promoting troublesome, with greater transaction prices.

Adoption and Expertise Dangers: Sluggish adoption or disruptive applied sciences may scale back the worth of cryptocurrency-related firms.

Market Manipulation: The unregulated nature of the market will increase the chance of value manipulation.

Whereas providing robust progress potential, these dangers require cautious consideration and diversification for efficient threat administration.

Conclusion

Investing in cryptocurrency-related shares is a brilliant technique to profit from the rise of this sector whereas diversifying your portfolio. These shares present publicity to the alternatives supplied by crypto with out the complexities of direct administration. As a complement to Bitcoin, they strengthen the diversification position of a portfolio and supply engaging progress potential in a quickly evolving monetary atmosphere. Nonetheless, you will need to think about the dangers related to these investments. Value fluctuations in cryptocurrencies, unsure regulation, and market volatility can result in vital losses. Traders ought to due to this fact concentrate on these dangers and proceed with warning when including these shares to their portfolio.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.