By Lale Akoner

Jan 27, 2025

Regardless of the concentrate on crypto’s volatility, its long-term lack of correlation with main asset courses like equities, fastened revenue, and commodities, is usually neglected.

Understanding how completely different property work together is crucial to constructing resilient portfolios, as their relationships can considerably influence general danger and return. The position of correlation in portfolio diversification is obvious: decrease correlation means much less danger and diminished general portfolio volatility. If cryptocurrencies present little to no multi-year correlation—and even detrimental correlation—with different property in a portfolio, they may assist decrease portfolio danger via diversification. However, in the event that they’re strongly correlated, including crypto would possibly work in opposition to diversification targets.

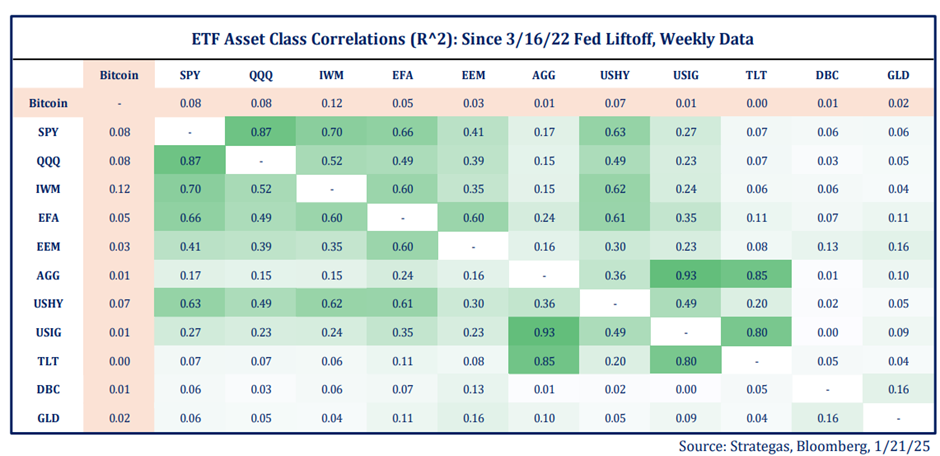

For the reason that Fed began rising charges in March 2022, bitcoin has had very weak, virtually zero, correlation with main asset class ETFs, as proven beneath. As anticipated, bitcoin is uncorrelated with fastened revenue and commodity ETFs, and mildly correlated with small caps and the Nasdaq ETFs. However, correlations inside the ETFs themselves had been a lot increased.

As focus danger in broader indices grows, crypto property might present significant long-term diversification advantages, if appropriately allotted. That is particularly probably underneath the present US administration’s pro-crypto insurance policies, as crypto property are more and more pushed by impartial fundamentals — costs could reply extra to regulatory approvals and adoption catalysts like ETF approvals than to tech-sector-specific tendencies.

Information from Strategas and Bloomberg as of Jan. 21, 2025. Abbreviations for ETFs: SPY: SPDR S&P 500 ETF Belief; QQQ: Invesco Nasdaq ETF; IWM: iShares Russell 2000 ETF; EFA: iShares MSCI EAFE ETF; EEM: iShares MSCI Rising Markets ETF; AGG: iShares Core US Mixture Bond ETF; US HY: iShares Core US Mixture Bond ETF; US IG: iShares Broad USD Funding Grade Company Bond; TLT: iShares 20+ Yr Treasury Bond ETF; DBC: Invesco DB Commodity Index Monitoring Fund; GLD: SPDR Gold Belief