Tons of of thousands and thousands of Africans face two issues holding them again from progress: 600 million lack electrical energy, whereas just about all 1.4 billion individuals on the continent lack high-quality forex. Evaluate this to the US, Northern Europe, or Japan, the place almost everybody has entry to constant, reasonably priced energy and a widely-accepted reserve forex just like the greenback, euro, or yen.

The longer that Africans endure from energy blackouts and excessive inflation, the more durable it’s for them to get a leg up, regardless of their finest efforts. Worse nonetheless, legacy vitality and monetary suppliers don’t have any incentive to alleviate this subject, that means forex debasement, debt traps, and grid shutdowns persist.

Most would possibly have a look at this situation and conclude that the following African century will probably be very troublesome. Regardless of being blessed by ample vitality sources like mighty rivers, blazing solar, sturdy winds, and geothermal warmth, Africa stays largely unable to harness these pure assets for its financial progress. A river would possibly run by way of it, however human growth within the area has been painfully reliant on charity or costly overseas borrowing. Till now.

Within the eyes of a number of the continent’s entrepreneurs, educators, and activists, one thing has emerged that has the potential to revolutionize entry to dependable electrical energy and high-quality forex — the constructing blocks of progress — for Africa’s swiftly rising inhabitants. Imagine it or not, that factor is Bitcoin.

I. Mining within the Shadow of Mt. Mulanje

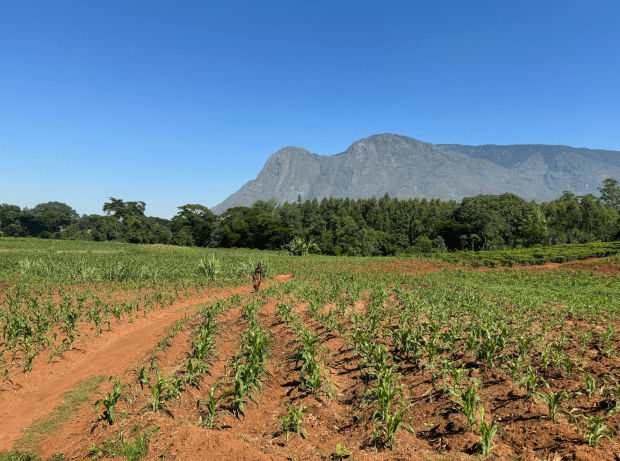

Just a little over an hour southeast of town of Blantyre, in southern Malawi, alongside scenic dust roads, towers Mount Mulanje. A shocking 3,000-meter massif — one of many highest peaks in southern Africa — its advanced of cliffs and valleys straddles the border with Mozambique. The jaw-dropping surroundings rivals Yosemite, however given its distant location, there are a lot of days of the yr the place native guides say there aren’t any hikers in any respect. In some other nation, Mulanje may be the positioning of a top-5 nationwide park — with world-class, hovering granite faces and the most important vertical climbs in Africa — however most days, the realm sits quiet.

Within the 18th and nineteenth centuries, the area was hit laborious by European and Arab slavery. Portugal, Oman, Britain, and different empires extracted tons of of 1000’s of slaves from Mozambique, Malawi, and the encompassing areas to ship off to pressured labor within the Americas and the Center East by way of regional ports like Zanzibar. At finest, 1 in 5 survived the journey. Slave routes handed proper by way of Mt. Mulanje, which was an easily-identifiable marker alongside the way in which. As we speak, the mountain’s foothills are peppered with lush forests, encroaching tea plantations, and farmers rising pineapple, banana, and maize. The ecosystem is a world treasure, with endemic crops and animals together with prehistoric cycads, the endangered nationwide tree of Malawi, the Mulanje cedar, and a number of the rarest bugs and reptiles on earth.

Sadly, the exploitation from way back continues, simply in numerous kinds. Logging and mining threaten the native surroundings, and with out industrial infrastructure, residents are remoted and left to fend for themselves.

The inhabitants right here could also be gifted with many pure assets, however the mom of recent progress has eluded them. Solely about 15% of Malawians — and solely about 5% of individuals dwelling within the nation’s rural areas — have entry to electrical energy. In Bondo, a small village within the foothills of Mt. Mulanje, some residents acquired their very first entry to lights at evening in 2016. “Earlier than then,” based on the city’s senior chief, “there was solely darkness.”

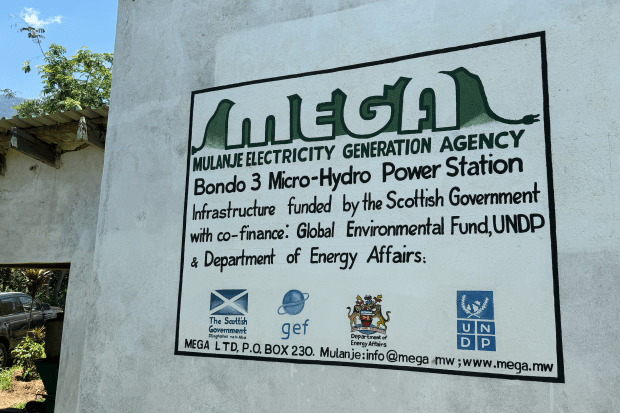

This lack of energy creates a number of issues for a rising inhabitants. As an alternative of flipping on a range, residents log the realm across the mountain, slicing down timber and brush to make fires or to create charcoal for cooking. At evening, kids examine below the sunshine of harmful paraffin lamps, or don’t examine in any respect. The logging devastates the forest and the fires and lamps create noxious indoor air air pollution. International donors — together with the Scottish Authorities — paid for a small hydroelectric plant for Bondo in 2008, and after eight lengthy years of development, it started to supply energy for a number of the native inhabitants.

Throughout that point, Carl Bruessow — an avid hiker and the pinnacle of the Mt. Mulanje Conservation Belief — helped begin the Mulanje Electrical energy Era Company (Mega), Malawi’s first privately-owned micro-hydro vitality supplier. Mega can also be a social enterprise with the mission of offering the residents of Bondo with electrical energy. The uncooked value of energy from a small hydro scheme just like the one financed by the Scots on the banks of a river on Mulanje is extraordinarily excessive, nearing 90 cents per kilowatt-hour. For context, residential energy within the US or Europe ranges from 10 cents to twenty cents per KwH. Grid energy in Africa usually ranges from 20 cents to 40 cents per KwH. For instance, in Kenya, it’s 27 cents. Carl, in his efforts to provide again to the local people, closely sponsored this value for the residents of Bondo. Resulting from his generosity, they paid lower than 20 cents per KwH to Mega for electrical energy.

Carl lined the distinction, however such an operation was not sustainable. Over 2,000 households had to this point been linked to the Mega grid, however one other 3,000 have been nonetheless ready for hookups to their properties, and Carl was operating out of cash. The ability stations have been producing greater than sufficient energy for five,000 properties, however a lot of the electrical energy was orphaned and unable to be offered, as Mega didn’t have capital to have the ability to buy the tools to attach new households. There was no capital, both, to contemplate enlargement in order that the hydropower wouldn’t dwindle within the late summer time through the dry season.

In some locations, industrial operations would possibly purchase orphaned rural energy. However in a spot like Bondo, there merely aren’t very many power-hungry companies. The surplus electrical energy couldn’t be offered, so the facility stations constructed machines that existed solely to suck up the unused energy. This was particularly tragic when there was a variety of rain, or at occasions of low demand like at evening, when the stations have been pressured to dissipate the overwhelming majority of their valuable electrical energy: a complete waste.

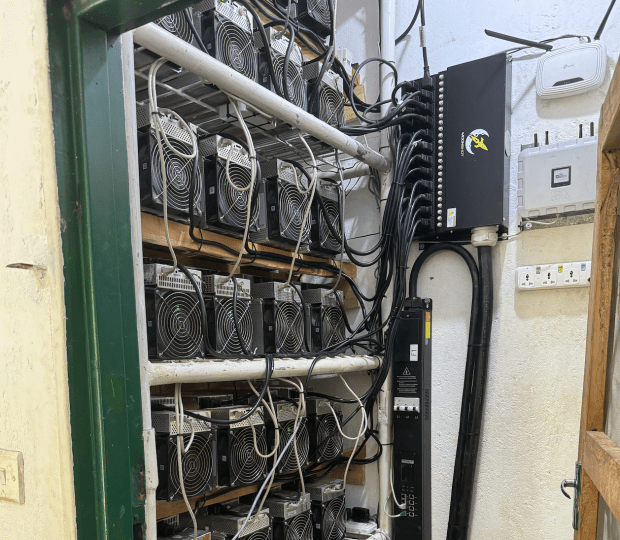

Two years in the past, entrepreneurs Erik Hersman, Janet Maingi, and Philip Walton launched Gridless, a brand new firm specializing in off-grid Bitcoin mining in Africa. The trio had backgrounds with firms like Ushahidi, BRCK, and iHub, with experience in constructing {hardware}, writing software program, in addition to scaling communications and web infrastructure, giving them a becoming resume for the duty. One among their first website visits was in Bondo, the place they visited with Carl and inspected Bondo’s energy stations. In early 2023, a Gridless Bitcoin datacenter was put in and launched, and now, Carl and Mega have a brand new supply of capital. In December, I used to be in a position to journey to Bondo to determine the way it all works.

As we speak, any and all extra energy generated by Bondo’s energy stations will get offered in real-time to the Bitcoin community by Gridless’s miners, and Carl earns 30% of that income. It arrives on to Mega’s pockets, in BTC. The brand new capital is enabling Mega to attach extra prospects to energy, drive prices down, and broaden their operations, to ultimately join everybody within the Bondo area to electrical energy. Mega, the group, and Gridless all profit. And probably the most profound half? No support or authorities subsidy is required.

Bitcoin is usually framed by critics as a waste of vitality. However in Bondo, like in so many different locations all over the world, it turns into blazingly clear that should you aren’t mining Bitcoin, you’re losing vitality. What was as soon as a pitfall is now a chance. Bitcoin miners could be regarded as dung beetles, scraping up the waste vitality that nobody else desires and reworking it into one thing precious.

As Mega hooks up increasingly more prospects, Gridless might unplug a few of their mining machines, and transfer elsewhere, or maybe transfer to harness the output of recent energy technology stations in the identical space which can be ready to hook up with their purchasers. If the Bitcoin community pays X, prospects might want to pay X+1, so ultimately miners will begin to get priced out. However even in a scenario the place at 5:00pm the native demand from Bondo eats near full capability of what’s out there, mining can nonetheless be profitable, as a result of there’s so little demand in a single day, and the river by no means sleeps.

Elsewhere in Malawi, the nationwide grid is damaged. As of December 2023, individuals who obtain grid energy endure from 6-8 hours of “load shedding” per day, the place enormous swaths of the nation’s inhabitants are minimize off from energy by the electrical energy firm. However in Bondo, there is no such thing as a load shedding. The mini-grid is correctly balanced by the Bitcoin miners. If there’s not sufficient water energy, Gridless’s automated software program turns the ASICs off. If there’s an excessive amount of water energy from, for instance, one of many tropical cyclones that periodically hammers the area, Gridless’s ASIC operation eats it up. It’s a small surprise that in little Bondo, the electrical energy works extra constantly than within the massive cities.

One evening throughout my go to to Bondo, Carl requested me to pause because the sundown was fading, to take a look at the hills round us: the lights have been all turning on, all throughout the foothills of Mt. Mulanje. It was a robust sight to see, and staggering to suppose that Bitcoin helps to make it occur because it converts wasted vitality into human progress.

The potential for this mannequin to scale is mind-boggling. Contemplate: energy technology in Africa is usually deliberate wanting ahead, for instance, on a 30-year window. So websites are constructed to supply future capability, not the capability of right this moment. So when a website just like the one in Bondo boots up, it takes some time earlier than it will probably get from 0% to even 20% capability. At that time, earlier than Bitcoin, the facility firm might need needed to cost 5 occasions the worth for the electrical energy it offered, simply to make itself complete.

That is catastrophic for purchasers, particularly these like those in Bondo who’ve a number of the smallest disposable incomes on the continent. However with Bitcoin, the community now buys 100% of the all out there extra electrical energy, bringing prices down even when solely a small proportion of the facility station’s capability is being bought by residential or industrial shoppers.

We’re advised to imagine that progress is at all times taking place and that pure human innovation goes to make issues higher and cheaper. However in Malawi, given the collapse of the native kwacha forex, and the shortage of incentives for infrastructure funding, the enlargement of the electrical energy grid has not simply been stalled, it has been made prohibitive.

Bitcoin fixes this in two methods: by straight delivering a high-quality, peer-to-peer forex to the facility mills, and by permitting them to make use of all of their capability, the entire time, reducing costs for his or her prospects and elevating their income.

Roughly 95% of all small energy technology in rural Africa, based on Erik, is funded with concessional financing, whereas it may take 5 to seven years to boost funds from charity. The method relies on altruism and the subsidy is another person “doing the best factor.”

The micro-hydro stations in Bondo, for instance, have been paid for by overseas donors, who could be very useful for getting a undertaking off the bottom however who usually don’t choose up the invoice for ongoing operation prices or enlargement. In addition they don’t have very a lot pores and skin within the sport, and are OK with an eight-year timeframe for getting individuals on-line. With Bitcoin, the incentives are totally different. Out with the donors, in with co-investors, who’re very eager about getting the facility up and operating as quickly as potential.

Transferring ahead, there’s a lot work to do in Bondo. Carl and Mega are at the moment figuring out methods to leverage their new revenue stream from the Bitcoin community to attach up tons of of recent properties to electrical energy. They’re additionally contemplating an enlargement to a brand new, bigger energy station to deal with the difficulty of decrease energy output within the two driest months of the yr.

It will, in fact, be inbuilt partnership with Gridless, in order that it may begin producing income instantly, on day one, even when it takes time to attach new properties and companies.

The essential significance of electrical energy was underlined once we met Bondo’s group leaders and members of the residents’ electrical energy committee. They listed the entire new advantages that the city now receives: they used to need to stroll 20 kilometers for issues like corn mills, or televisions, or refrigeration, or to cost telephones, or for his or her youngsters to check at evening, or for healthcare, and now they don’t.

The women in our assembly even identified a humorous factor: earlier than, the boys of the village would go to city to observe soccer at evening, leaving their households behind. However right this moment, they don’t go away, they simply watch it at house and are there for his or her wives and youngsters. LEDs exchange kerosene lamps, lowering hearth danger and lethal indoor air air pollution. The proportion of youngsters that go on to larger ranges of education has elevated, dramatically. The checklist of life upgrades goes on and on.

By this level you may be saying, high-quality, this sounds good, however why not do one thing else with the electrical energy generated by Bondo’s rivers? Philip explains that no different enterprise would run higher in a spot like this, blessed by low-cost vitality however remoted from infrastructure.

The price of AI farming, for instance, is barely in a small manner dictated by electrical energy: a chip may cost $30,000 and use 1200 watts. Distinction this to Bitcoin mining, the place electrical energy makes up an enormous portion of value, and a chip may cost $1,200 and use 3500 watts. So it makes no financial sense to construct an AI knowledge middle in Bondo, to not point out the connectivity, bandwidth, and latency points.

Furthermore, AI processes can’t be merely turned on and off like Bitcoin mining with out inflicting some form of hurt to the service itself, so AI compute, in its present type, can’t be a grid balancer. However Bitcoin can: when the microgrid must deploy electrical energy elsewhere, miners can flip off simply. Lastly, even when Mega tried to service AI firms in Bondo, how would they receives a commission? It will be the identical entice of overseas change issues, charges, and coping with the collapsing native forex. With Bitcoin, they receives a commission in globally-accepted, 24/7 saleable satoshis.

Another space of potential is the externality of Bitcoin mining: warmth. After we put our fingers over the air exhaust popping out of the again of the Gridless facility in Bondo, we felt a searing blast. The extra miners, the extra warmth. A miner is in essence an area heater, and a surprisingly environment friendly one at that.

A brand new Purpose documentary helps clarify this, specializing in a bathhouse in Brooklyn, the place the proprietor is now paying much less each month in electrical energy payments to warmth his spa water with ASICs than he did utilizing extra conventional heating tools. Any heating operation that isn’t mining Bitcoin might be losing vitality.

1,000 miles to the north of Bondo, within the D.R. Congo’s spectacular Virunga Nationwide Park, rangers have been mining Bitcoin with stranded hydropower for the previous three years, producing essential revenue for the bioreserve and the 5 million individuals who stay close by.

This coming March, the warmth from Virunga’s miners will probably be harnessed to dry cocoa beans. Historically, that is performed by laying out the beans to roast below the solar, the place they’re weak to the climate, and to being eaten or stolen by animals. Drying the beans with the recent blast from the miners will dramatically expedite the method, and for minimal extra value.

As an alternative of spending $200,000 on an industrial drying operation, the park rangers merely purchased $200,000 value of ASICs that may course of cocoa and earn Bitcoin. Transferring ahead, if any of their opponents course of cocoa and don’t mine Bitcoin, they are going to be losing vitality, and they are going to be much less aggressive.

In line with environmentalist and Bitcoin advocate Troy Cross, within the final Bitcoin value cycle that crescendoed in late 2021, mining was pushed by entry to low-cost capital, not low-cost energy. For instance: Wall Road borrowing cheaply to purchase shares in Bitcoin mining firms.

However within the subsequent cycle, he says, it will likely be pushed by entry to low-cost energy. And this might tilt in Africa’s favor. There would possibly even be locations, he says, the place the price to mine, let’s say in Blantyre, exceeds the mining profit, however the enterprise financial savings from the surplus warmth (promoting chocolate) makes the entire thing worthwhile. Actually, he says, one ought to suppose by way of: revenue from mining plus revenue from warmth minus the price of mining. Wherever the place one finds low grade electrical warmth, there are unrealized Bitcoin income.

In Bondo, Mega’s authentic concept was to make dried pineapple snacks utilizing the surplus warmth. However on our go to, a brand new concept was hatched: the mine itself is on a tea plantation. Tea, as soon as picked, must be dried inside a matter of hours, and it’s performed so with heaters, which suck up electrical energy. Why not use ASICs to dry the tea? The operators at the moment are occupied with it.

In a spot the place electrical energy is usually exceedingly scarce, it’s a luxurious to consider and take into account what to do with additional energy, but it surely’s taking place in Bondo now that there’s a know-how that enables individuals to harness worth that was as soon as simply blown out the window.

II. The Collapse of the Kwacha

One Wednesday morning in November 2023, the 20 million residents of Malawi woke as much as discover their forex devalued by 44%. The federal government and IMF argued that the transfer would increase exports and stabilize the financial system, however for the common particular person, all they felt was a right away lower in buying energy. Many retailers merely closed for the day, as workers wanted time to recreate the worth labels used in all places from gasoline stations to grocery shops.

This was not, like in Argentina, one thing that most individuals may escape. In Argentina, there’s a extensively accessible and complex black marketplace for {dollars}. In Malawi, this doesn’t exist. Individuals are caught within the kwacha. In line with the nation’s Reserve Financial institution, 85% of Malawians are unbanked, that means almost everybody makes use of paper kwacha notes issued by the federal government as their important retailer of worth and medium of change. Devaluation right here stays an efficient approach to steal from the inhabitants.

If one have been to design the right weapon, one thing that might damage everybody in a rustic on the similar time, it’s laborious to consider a greater one than forex devaluation. In contrast to a nuclear blast or bioweapon, it will probably damage each single particular person concurrently. On this case, the harm was a right away 44% discount within the buying energy and lifestyle for thousands and thousands of individuals in Malawi, particularly the poorer and center courses who can not simply entry {dollars}.

It isn’t as if the federal government held a referendum, asking the general public to vote on whether or not they wished their buying energy to break down the next week: in fact, nobody would agree. Devaluation needs to be deliberate and orchestrated largely in secret, and it tends to be in a single day phenomena. So regardless of the standing of Malawi as a partly free nation, with comparatively free and honest elections, the devaluation was completely undemocratic. That is half of a bigger world subject the place monetary repression is ignored, although political repression is mentioned and highlighted.

Devaluations, for instance, are typically relegated to the again web page of the newspaper, forged as a procedural matter. However they inflict grievous hurt. It’s a surprise why devaluation shouldn’t be thought-about a criminal offense, or perhaps a crime in opposition to humanity. The individuals of Malawi did resist, in a sequence of protests. These small uprisings have been put down, typically brutally, by police. And in the end, the marchers have been pressured to surrender and settle for the theft. This wasn’t the primary time that the general public was robbed of its labor and wages at scale, both: over the previous 20 years, the kwacha has misplaced 95% of its worth in opposition to the greenback, a lot of it in deliberate devaluations like this one.

As we drove by way of the markets and farms close to Blantyre, it was clear that the hard-working individuals round us didn’t want such a devaluation. They have been already a number of the poorest on this planet. Malawi’s per capita revenue, based on the United Nations, hovers round $650 per yr. That’s 33 cents per hour, assuming a nine-to-five, five-day work week. And that’s, in fact, the median fee. For individuals dwelling in distant areas, it’s in all probability a lot nearer to $100 per yr or 5 cents per hour. And now, every hour of their effort solely will get them 56% as a lot grain, fruit, meat, airtime, electrical energy, medication, personal education, or petrol because it did two months in the past.

This explicit devaluation, like so many others, was a results of overseas stress from the IMF and World Financial institution, who need consumer nations to move by way of austerity earlier than receiving any contemporary new funds. Austerity is a euphemism for weakening the forex, ending subsidies on primary items, shrinking welfare, elevating taxes, crushing unions, harming small native companies, and creating extra favorable situations for giant multinational firms and patrons of any regionally harvested, excavated, or produced items.

After finishing the late 2023 devaluation and pleasing its collectors, Malawi acquired the inexperienced mild for a $137 million World Financial institution mortgage, in addition to a brand new mortgage of $175 million from the IMF. $115 million of those loans have already been paid out as of early December: a Christmas bailout for the nation’s corrupt bureaucrats. The IMF initiatives that Malawi will want $1 billion in debt reduction over the following three years, guaranteeing that much more forex devaluation is on the horizon.

Phrase on the road is that one other devaluation, maybe one other 25%, is coming.

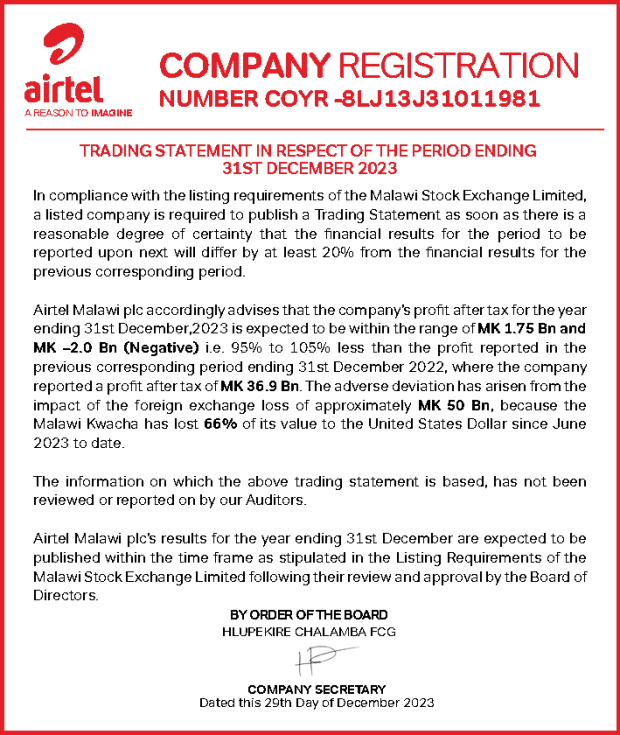

The macro influence on the nation’s financial system has already been enormous: Airtel, one of many nation’s largest cell operators, posted a press release on the finish of 2023 that the corporate’s revenue is predicted to be 100% lower than the revenue posted in 2022. “The antagonistic deviation,” they write, “has arisen from the influence of the overseas change loss… as a result of the Malawi Kwacha has misplaced 66% of its worth to the USA Greenback since June 2023 so far.” Residents might need stopped protesting within the streets in opposition to this catastrophe, however some are discovering different, extra quiet methods to wage a revolution.

Grant Gombwa is a pupil dwelling within the Blantyre area, and is likely one of the nation’s first Bitcoin meetup organizers. He loves the thought of a forex that no authorities can devalue. Malawi’s first official Bitcoin meetup will happen in February within the capital, Lilongwe. Grant will make the 5-hour drive to unite with maybe two dozen different Bitcoiners. It’s a modest begin, however given the financial situations, it’s doubtless a trickle in what’s going to ultimately grow to be a flood of recent Bitcoin customers. Grant mentioned that, personally, what evokes him is that earlier than he was caught, unable to pay for something overseas together with his native forex. However right this moment he has an improve, and may converse the identical financial language as somebody in New York, Cairo, or Beijing.

Grant estimated that amongst younger individuals in Malawi, between 18 and 30 years previous, that just about all of them owned a telephone, and that round two-thirds owned smartphones. Not all smartphone customers can afford constant knowledge, in fact, however that doesn’t forestall them from utilizing Bitcoin.

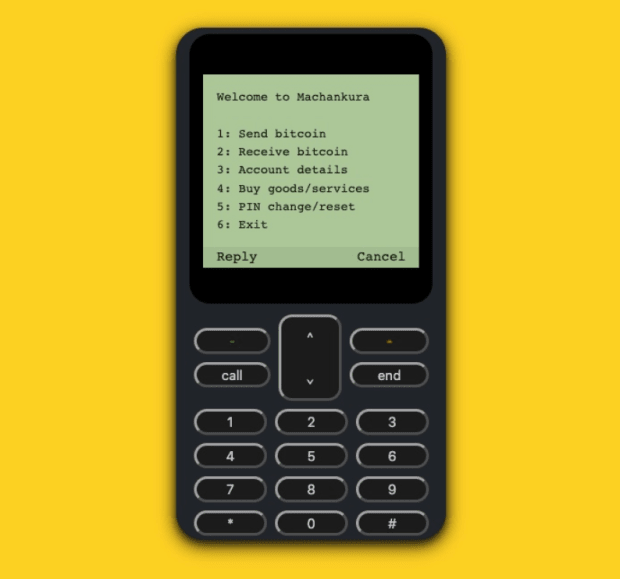

As we’ll study extra about later on this story, Africans in nations like Malawi can use a service referred to as Machankura to ship or obtain Bitcoin from any function telephone, or any smartphone with no knowledge: no web required. Which means an financial escape route is right here – it simply will take Grant and different native educators a while to point out individuals the way in which.

In certainly one of our conversations, Grant defined a doubtlessly promising concept. The Malawian authorities, he mentioned, with incentives from overseas lenders, is putting in electrical automobile charging stations throughout the nation. He guesses that only a few locals will really be capable of afford these kind of automobiles, particularly within the first few years. So these solar-powered electrical mills will probably be for probably the most half sitting, unused, losing the solar’s vitality. Enter Bitcoin.

Grant’s concept is to convey just a few ASICs to those likely-idle charge-points, hook them up, earn some satoshis, and pay a proportion to the proprietor of the property to verify he doesn’t get kicked out. We’ll see if Grant’s concept will get traction. However what’s sure is that there will probably be many extra concepts prefer it, springing out of locations like Blantyre and Bondo now that wasted vitality could be was capital.

III. Turning Fireplace into Digital Gold

The Nice Rift Valley is likely one of the largest areas of seismic and volcanic exercise on earth. The geothermal vitality potential on this a part of Africa, stretching 7,000 kilometers south from the Purple Sea to Mozambique, is huge and almost completely untapped.

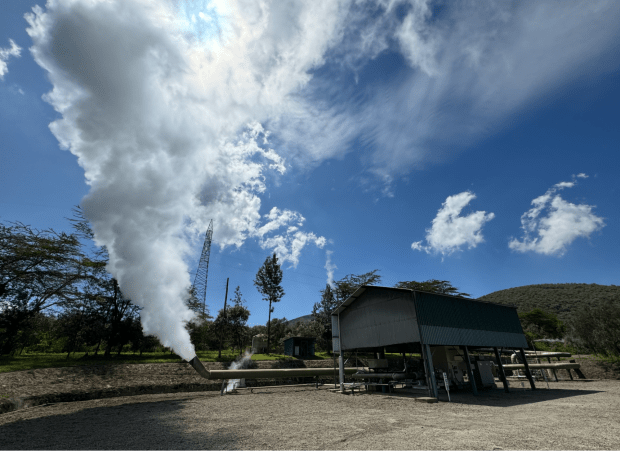

To get a way of the potential that Bitcoin mining may have on the area, I visited a website just a few hours exterior of Nairobi, Kenya, on the shores of Lake Naivasha. The scenario is consultant of any variety of industrial operations in rural Africa, or for that matter, in rural locations wherever on this planet. A 1.4 megawatt geothermal plant (which funnels scorching steam rising out of a 2,000 meter-deep gap by way of a turbine to generate electrical energy) powers a water pump maybe a kilometer away on the shores of the lake.

The pump pushes the lakewater as much as a close-by advanced of fields, the place flowers are grown and exported to supermarkets in Europe. This is only one such flower farm in a rustic stuffed with them: Kenya is the world’s largest flower exporter, and all of these fields want irrigation, and all of that irrigation wants energy.

Right here’s the factor: these water pumps don’t eat energy in a constant manner. However geothermal energy is at all times on, hinting at an amazing quantity of electrical energy waste simply ready for somebody (or one thing) to return and purchase it up. Geothermal might be the only finest present energy supply on this planet for Bitcoin mining. Hydro is nice, however throughout dry months, it will probably decelerate. Nuclear may be higher in a vacuum, but it surely’s impractical in the meanwhile for small websites, and a minimum of a decade away from a rollout throughout Africa.

Geothermal is 100% clear and 100% constant. A plant just like the one right here in Naivasha may run for 40 years, with no interruptions, and no change in energy output. It’s certainly one of many who make up a complete of 1 gigawatts (i.e. one thousand megawatts) of energy technology simply on this area alone. The foreman in command of the positioning tells us that the encompassing hills and valleys may really help as much as 10GW of geothermal electrical energy, however the remainder stays untapped.

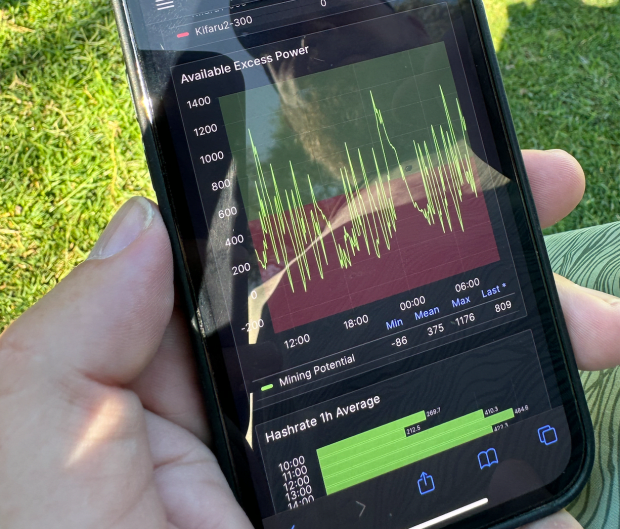

Down on the pump, we see one thing that might quickly be current at any industrial operation within the African countryside: a small shack, with a Starlink on high emitting a robust hum. Inside are 144 Whatsminer ASICs, arrange, neatly corded, and run by Gridless. Every thing from the hut itself to the software program is custom-made in Africa by Africans. It’s a 500-kilowatt operation, which is about excellent, based on Erik, for a scenario like this. He reveals me the precise electrical energy utilized by the ASICs on his cellphone: about 375KW on common, day-after-day. That is projectable into the longer term. Gridless has performed a 5-year backstudy on Bitcoin mining income, and may predict being paid between 7 and 9 cents per kilowatt hour by the Bitcoin community. If the BTC value goes up, the earnings get crushed again down by the brand new mining competitors. If the BTC value goes down, it turns into simpler to mine: the issue adjustment in motion.

The upfront value for a set-up just like the one on Lake Naivasha runs within the low six-figures together with the ASICs and different infrastructure. Every day income for the Bitcoin mine will probably be just a few hundred {dollars}. Gridless pays out 30% of the income to the facility firm as a flat charge for the best to make use of the stranded electrical energy. Relying on the consistency of the surplus vitality, Gridless usually recovers their funding inside just a few years.

One can shortly see how Bitcoin mining goes to be enormously worthwhile throughout Africa. “If you recognize you’re constructing a variable-demand energy station sooner or later, you’ll incorporate Bitcoin mining from the beginning,” says Erik. “In any other case, you’re losing vitality.”

Storing the vitality in batteries and utilizing it later seems like a pleasant concept, however doesn’t make financial or technological sense proper now, he says. Think about a barely bigger 2-megawatt operation much like the one at Lake Naivasha, that might be $1,000,000 in gross income per yr, and never in kwacha or shillings, however in chilly laborious satoshis, payable on to the positioning, no accounting workplace or overseas change prices required.

The scene by the lake is completely solarpunk: the earth’s warmth is powering agriculture, and the Bitcoin mine is eliminating any electrical energy waste, and changing it as an alternative into digital gold. It’s sitting right here in a spot like this that you simply notice that not Bitcoin mining is such a staggering waste of vitality.

Later, as I discuss with the Gridless group concerning the implications of the Lake Naivasha website at a restaurant in Nairobi, the facility goes out throughout our meal. Janet tells me that that is typical in Kenya however that Bitcoin may help repair this, as a requirement response know-how.

“In the course of the day, there’s a variety of demand, and we flip off our machines,” she says, “At evening, when individuals fall asleep, we activate our machines. Usually, if there’s an excessive amount of unplugging too quick, it will probably trigger blackouts. However we will steadiness the grid with extra Bitcoin mining. We are able to take in sudden incoming energy, and we will sluggish sudden collapses of energy by turning off.”

ASICs could be turned on and off at a second’s discover with out hurt to the operator, not like manufacturing or different compute processes, making Bitcoin mining among the finest applied sciences on this planet for stabilizing grids.

What Gridless is doing at small scale with offgrid vitality may additionally assist the nationwide grids struggling all throughout the continent.

Micro-hydro and geothermal aren’t the one energy sources that Gridless is monitoring. Photo voltaic, they are saying, solely offers vitality throughout one third of the day, and requires costly battery know-how to be viable. Such batteries may triple the price of working an influence website, making it far much less interesting.

Gridless does have its eye on just a few wind websites, however an alternative choice is biomass vitality. Previously weeks, the corporate has introduced two new East African Bitcoin mining websites on-line, powered by biomass.

One new mine adorns a sugar processing facility, and one enhances a plant that refines sisal, a troublesome fiber used for rugs, rope, and different textiles. In each circumstances, the leftover plant materials is burned and the warmth boils water to energy a turbine, producing electrical energy. In each circumstances, as is the case for many African industrial operations, the positioning is simply too removed from any residential communities to straight energy properties or different companies. Typically, the electrical energy is just simply run straight again into the bottom.

Biomass is usually thought-about clear and renewable: sisal and sugar crops suck carbon dioxide from the air into their constituent elements, after which when they’re burned, that carbon is launched again into the sky. Sisal and sugar manufacturing is widespread in East and South Africa, and but the surplus energy usually goes to waste.

Phillip explains that even within the case the place an influence technology piece is added to a sisal or sugar refinery, the operators can’t often produce electrical energy except about 70% of the capability is used: in any other case the boiler malfunctions. Within the case of the sugar refinery, there was nobody shut sufficient to purchase the facility. Within the case of the sisal farm, the facility technology function was merely by no means turned on. Once more: enter Bitcoin. With Gridless know-how, these energy stations at the moment are operating at near full capability, and saving the beforehand orphaned electrical energy, turning it into capital.

“ASICs will grow to be an built-in element of any vitality website,” says Philip. “A turbine, a transformer, and a mining container. That is simply what you’ll do. When you don’t, you gained’t be aggressive. You’ll be losing vitality.”

IV. Bitcoin With out Web

As of 2023, some 600 million Africans lacked web entry. Greater than half the continent continues to be offline. Starlink makes what Gridless does potential, and progressive firms like BRCK proceed to broaden web entry in rural locations. However what good can Bitcoin do for the common citizen of a rustic like Malawi, the place solely a fraction of the inhabitants is on-line?

Ten years in the past, Bitcoin educator Andreas Antonopolous questioned: what if Africa may leapfrog banks, similar to it had leapfrogged landline telephones? What if individuals simply used their telephones to entry Bitcoin-powered monetary companies? He even questioned: may this be potential with out web entry?

As destiny would have it, an entrepreneur named Kgothatso Ngako born in Mamelodi, a township exterior of Pretoria initially constructed by the apartheid authorities of South Africa, would give you an answer.

Ngako — or “KG” as he’s generally identified — was working as a pc scientist on the Council for Science and Industrial Analysis in Pretoria about 8 years in the past when his boss gave him a brand new task: analysis Bitcoin.

KG was as soon as supplied a $1,000 cost in Bitcoin in 2016 for a distant gig (1.3 BTC then, value greater than $50,000 right this moment), however took the cost in PayPal as an alternative. Why? He couldn’t use Bitcoin for something. The CSIR examine he labored on rekindled his curiosity, however in the end the researchers concluded that blockchain know-how was the factor that had benefit, not Bitcoin.

In 2017, Bitcoin’s value shot up and KG, like many others, lastly took a more durable look. However what initially attracted his curiosity was the galaxy of crypto tokens that sprouted up round Bitcoin. By early 2018, when the following bear market started to hit, he was buying and selling a dizzying array of tokens on Binance. He had a bunch of altcoins that had misplaced a lot worth they couldn’t even be traded on the engine, so KG visited a “mud web page” to transform them into Binance’s native BNB token and from there he transformed to BTC.

He ultimately did sufficient studying and analysis and had seen sufficient: he wished to start out saving in and dealing in Bitcoin, not different digital currencies. Warren Buffet specifically had impressed him: what’s going to acquire worth over 30 years, thought KG? Bitcoin, he thought, and possibly not a lot the opposite tokens.

The primary Bitcoin undertaking KG created was Exonumia, named after an previous phrase for the examine of currencies and numismatics. In 2018, he wasn’t able to contribute to Bitcoin with code, however a minimum of, he thought, he may introduce the thought to extra individuals. Exonumia is an African-wide translation platform, nonetheless in operation right this moment, that places Bitcoin instructional supplies into dozens of African languages from Berber to Malagasy to Shona. The important thing, KG mentioned, was the structure of the interpretation itself.

Most individuals would attempt to automate translations utilizing software program. However that wasn’t the total level of the mission. Constructing a human community was the true aim. So KG did it the “sluggish manner” and would recruit individuals from numerous nations in Africa and pay them to do the work. Over time, he acquired to know Bitcoiners in dozens of locations throughout the continent. In 2019, he expanded this community by internet hosting common areas on Twitter and welcoming anybody in Africa with an curiosity in Bitcoin. Folks would message him out of the blue on the Exonumia account, with new concepts, from new nations, and new initiatives have been born.

After his CSIR job, KG took a task at AWS. However in the end, the work there felt prefer it was taking him additional away from the issues he discovered attention-grabbing. It was, as he says, fully disconnected from the realities of life again within the South African townships the place he grew up.

Exomunia appeared a lot extra essential. On the finish of 2020, he determined to give up the company world and work full-time on freedom know-how. The primary software program undertaking that he spun up was a VPN, referred to as ContentConnect.Web. Privateness is massively essential to KG. Not that way back, he says, South Africans lived below a dictatorial state of surveillance and management. He identified that Steve Biko printed his well-known “I Write What I Like” essays below a pseudonym: as soon as the authorities discovered he was the writer, they put him on trial and killed him.

Everybody is usually a hero, KG says, but when they really feel prefer it’s too dangerous, they gained’t take the most important steps. So making a privacy-boosting VPN accessible to Africans was a worthy aim.

KG’s subsequent undertaking was a software program answer to what he noticed as one of many greatest boundaries to Bitcoin adoption in Africa: the shortage of web entry. 10 years in the past, he was a part of an MIT World Startup Labs effort engaged on cell cash in South Africa. The issue was that the cell cash system was fragmented, they usually wished to attempt to bridge the several types of credit that individuals used throughout the nation. That is the place he began tinkering with USSD: a protocol for communication over textual content messaging, no web required. In Could of 2022, a Namibian Bitcoiner wrote “There has acquired to be a approach to get a Bitcoin pockets onto a non-smartphone cell phone. Somebody out there’s undoubtedly good sufficient to determine this out. I imagine in you.” KG shortly responded: “Give me 2 weeks.” He was prepared. He had taken a pay minimize (often called a “soul dividend”) when he left Amazon to work on his VPN, however was extra energized than ever to work on Bitcoin.

A couple of days after his well-known tweet, with the expertise from the MIT problem a decade in the past in thoughts, he launched Machankura, referring to the South African slang time period for cash. The brand new service would enable function telephone customers — or smartphone customers with no knowledge — to ship, obtain, and save Bitcoin. A number of the greatest challenges that Machankura overcomes are within the UX space: historically, to make use of Bitcoin, individuals want to repeat and paste an deal with, or learn a QR code. However function telephones normally don’t have these capabilities. KG’s device would additionally want to make use of Lightning, to beat the more and more excessive on-chain charges, however USSD has a 182 character restrict, so prolonged Lightning invoices weren’t going to suit. The answer was to undertake the Lightning Handle, a mechanism invented by the Brazilian software program engineers Andre Neves and Fiatjaf, which provides Machankura customers an email-based, human-readable id. For instance: [your phone number]@8333.mobi.

As we speak, Machankura customers can ship Bitcoin to one another utilizing telephone numbers or Lightning Handle “usernames.” They’ll additionally use on-chain addresses or Lightning invoices, assuming their telephones have copy-paste performance, however the former two choices are dominant. To fireplace up the service, a consumer dials a quantity from their telephone, producing a textual content response with numerous choices, a decision-tree of kinds. To ship, press 1, and so forth. From right here a consumer can do a wide range of issues with Bitcoin with no web.

One highly effective performance is the overlap with Azteco, a voucher service. So for instance, KG would possibly go right into a comfort retailer in South Africa, and with money purchase a voucher referred to as OneVoucher. In Kenya somebody would possibly purchase the same voucher utilizing MPESA. It’s a 16-digit code with a certain quantity of worth on it, and this code could be entered into the Machankura menu. On the again finish, what KG and group are doing is shopping for an Azteco voucher with the 16-digit code, and crediting the account of the Machankura consumer. This enables Machankura customers to simply “high up” their Bitcoin account utilizing money or MPESA credit.

Machankura additionally has an API to Bitrefill, so any product out there on Bitrefill could be offered on the app’s consumer interface. Availability ranges by nation however once they go to choice 4 contained in the app, they’ll barter for items and companies: for instance, airtime or grocery vouchers. What this implies is right this moment, as we start the yr 2024, Machankura’s consumer base of 12,000 Africans are in a position to ship and obtain worth globally, purchase cell minutes, purchase vouchers for gasoline or petrol, buy electrical energy (by way of pre-paid vouchers), or commerce into money, all utilizing Bitcoin, with no web. KG’s dream is beginning to be realized.

In fact, massive challenges stay. One is scaling throughout the whole African continent. Proper now, KG works with companies like Africas Speaking to entry totally different telecom networks. In that mannequin, Machankura pays a month-to-month charge to Africas Speaking for airtime, as an alternative of the customers paying the telecom straight. The scaling is a sluggish however regular course of, however is occurring, even in locations like Malawi. A second problem is custody. In the meanwhile, Machankura is a custodial service. Which means: they maintain your Bitcoin. Not your keys, not your cash. So although it’s a really useful gizmo, it’s not really giving property rights to its customers. However, within the coming month, Machankura is planning to launch a proof-of-concept that enables customers to self-custody. If it really works easily, it will likely be one of many greatest improvements in Bitcoin’s historical past, permitting individuals with out the web to really be their very own financial institution.

The trick, KG says, is {that a} SIM card is a computational platform that may retailer issues. It may possibly, for instance, signal Bitcoin transactions, or interface with the Lightning Community. He’s incentivized to push Machankura on this route for the mission of human freedom, but in addition, for enterprise causes: they don’t need to develop as massive as MPesa, and be responsible for all consumer funds, and to hold a lot counterparty danger. This manner, when KG goes to Vodaphone to pitch a partnership for tens of thousands and thousands of recent customers, he can say: how would you prefer to introduce your customers to Bitcoin, with no counterparty danger? It’s a a lot simpler “sure” than if he have been to say: let’s introduce your customers to Bitcoin, however you need to maintain all of the funds, and cope with these rules and legal guidelines and obligations.

Within the West, Bitcoin adoption would possibly imply the centralizing forces of enormous on-grid mining operations and ETFs. However the wonderful irony is that in Africa, Bitcoin’s know-how arc is making the forex increasingly more decentralized. Because the community eats increasingly more off-grid low-cost electrical energy, at dozens of fully separated websites, it turns into more durable and more durable to close down. And because the community provides increasingly more self-custodial customers on doubtlessly thousands and thousands and thousands and thousands of SIM playing cards, it turns into increasingly more unstoppable. As Lyn Alden describes in her guide, Damaged Cash, up up to now trendy financial know-how was inexorably centralizing because it turned extra digital and extra superior. Bitcoin breaks this pattern, and Africa helps Bitcoin break it.

And as Africa helps Bitcoin, Bitcoin helps Africans. KG says that some Machankura customers began with function telephones, after which, after getting concerned within the Bitcoin financial system, purchased themselves a smartphone. They’re pulling themselves into the web utilizing Bitcoin. And others by way of Gridless are pulling themselves into electrical energy utilizing Bitcoin. Collectively, they’re transferring into the longer term.

V. Bridging the Gender Hole

There are 700 million African ladies. All of them, based on Marcel Lorraine, may at some point be Bitcoin customers. Marcel, a Kenyan entrepreneur and social activist, has made it her life mission to onboard the ladies of Africa into a brand new forex system that they (not their husbands) can management, and that may meaningfully enhance their very own freedom.

Her journey started in 2018, when she was doing a gig in Nairobi and struggling along with her funds. She was operating Loryce, her firm that consults for company and social occasions. She would save her earnings, she says, however then on the finish of the yr have much less and fewer to point out for it. The federal government, she says, stored elevating taxes. And her solely choice was to avoid wasting in a shilling checking account, which stored depreciating quickly. For context, whereas not as weak because the kwacha, the Kenyan shilling depreciated 21% in opposition to the greenback in 2023, which itself additionally depreciated in opposition to items and companies. Ultimately, Kenyans are getting a minimum of 25% much less stuff for his or her wages than one yr in the past.

On the gig, Marcel heard about cryptocurrency and decentralized finance. “Can I be paid in that,” she requested herself, “to avoid wasting me from the trouble of charges and inflation?” At the moment, she mentioned, there was a ridiculous quantity of hype round blockchain in Kenya. There have been tons of scams, and tons of promoted occasions round totally different tokens. Throughout that point there have been no instructional hubs or teams: you’d present up at an occasion and hope it wasn’t pitching a rip-off. “I invested in a wide range of tokens,” she says, “together with Bitcoin. I made cash. I misplaced cash. It was irritating.”

In the course of the COVID pandemic, she couldn’t do occasion manufacturing, so she was day buying and selling shillings and {dollars}. She determined to give attention to Bitcoin, as a result of she didn’t have time to check a couple of sort of funding, and moreover, as she says, it’s the mom of digital currencies.

In 2022, Marcel helped set up the primary post-pandemic Bitcoin occasion in Kenya in April at a Nairobi resort at a convention room stuffed with Bitcoiners. Attendees included native educators Rufas Kamau and Grasp Guantai, and even Paco de la India, who was passing by way of on his journey to journey the world solely utilizing Bitcoin. At that occasion Marcel seen an issue: there have been a variety of males however solely two ladies, and he or she was one of many two. She had seen that crypto and blockchain occasions had a gender hole, maybe solely 30% ladies. However 98-2 for Bitcoin? “We may do higher,” she mentioned. So she reached out to a couple feminine buddies, who advised her that they have been afraid to go to Bitcoin occasions, as a result of the surroundings felt male dominated. OK high-quality, she thought: “There’s an issue and I could make an answer.”

Marcel created Bitcoin DADA in 2022 as a secure house for women and girls to study monetary freedom. The primary cohort was held in Could, with 20 individuals, simply her circle of buddies. Ever since, she has run on-line courses each Tuesday and Thursday at 9:00pm. At first, it was simply Kenyan females. Within the second cohort, that they had 40 college students. Every cohort is 6 weeks lengthy. Now, she says, they’ve held 5 cohorts, and greater than 300 ladies have gone by way of the course, with a complete of 130 graduates. All of them now have a strong understanding of Bitcoin. They know methods to self-custody and purchase Bitcoin with no KYC through money trades.

On our manner by way of Nairobi, I watch as Marcel effortlessly makes use of Bitnob and Machankura to purchase Bitcoin with MPESA, after which ship Bitcoin with out utilizing any knowledge. I consider how individuals on Wall Road or Silicon Valley could be blown away by this feat, which she makes look so easy. Marcel usually suggests a variety of wallets in her course, together with the self-custodial Muun and Phoenix, and the custodial Pockets of Satoshi for small transactions.

For on ramps, Marcel usually recommends the Nigerian-founded Bitnob app. College students, like everybody in Kenya, have MPESA, and use Bitnob to swap that for Bitcoin after which withdraw to, for instance, a Muun pockets. Kenya is far more developed than Malawi, however many smartphone customers nonetheless don’t have constant knowledge, rendering Machankura additionally a key device. For the principle curriculum, Marcel makes use of the Mi Primer Bitcoin guide (initially created in El Salvador) after which she walks college students by way of sensible examples of why it’s essential for African females to grow to be Bitcoiners.

Again in 2022, Marcel first heard concerning the Africa Bitcoin Convention. The Austrian educator Anita Posch approached Marcel and requested if she was going: no, Marcel mentioned, it was too costly. However Anita insisted and helped set up a fundraiser, and contributed half whereas the group lined the remainder. On her go to to Accra in December 2022, Marcel was impressed by what the convention organizer and Togolese human rights activist Farida Nabourema had created. In 2023, Marcel got here again to the second version of the convention with 4 girls, and Bitcoin DADA helped two female-led groups enter the occasion’s hackathon. Marcel now provides a mentorship program which helps the women converse in their very own capacities, whether or not on social media or at occasions like ABC, to assist them inform their very own tales.

On the bottom, Marcel visits universities and runs trainings for ladies and men collectively. College students are weak as a result of they’re typically focused by scams. She describes the obscene lengths that WorldCoin went to try to sucker college students into shopping for and buying and selling their token in Kenya. Bitcoin, she factors out, has no related advertising price range. Instructing and coaching the youth, she says, is underfunded and vitally essential. Each single individual that attended certainly one of her occasions at a college not too long ago had been focused by WorldCoin: a brutal actuality.

Marcel’s objectives are to streamline DADA’s mentorship program in order that they’ll match expertise and talent for Bitcoin firms, to assist get ladies employed within the house, and likewise to broaden to totally different nations. A number of of her mentees have already earned jobs or fellowships within the Bitcoin ecosystem, at organizations like Btrust or ABC. She says they now have 30 lively alumni in Uganda now, and extra in Nigeria, South Africa, and Tanzania.

“For me,” Marcel says, “Bitcoin offers us again our voices. It’s laborious being African, and more durable being an African feminine. This provides us monetary independence and a chance to work on ourselves.”

Marcel has lengthy supported one explicit college in Nairobi’s Kibera, the most important city slum in Africa. She has personally seen Bitcoin assist individuals escape. She is aware of it will probably assist get many many extra, however the laborious work must be performed.

Her mission appears a tall order: going from what’s now in all probability just some thousand African feminine Bitcoiners to tens of 1000’s, tons of of 1000’s, thousands and thousands, and ultimately, tons of of thousands and thousands. “If I don’t do that,” Marcel says, “then I might have failed my sisters. Finance is considered a person’s factor, so ladies get financially abused. I don’t need to go away the ladies behind.”

Bitcoin, she says, offers a manner out of macro issues like forex devaluation, and micro issues like repression inside the house. A whole lot of overseas support, she says, doesn’t make it to the slums. Bitcoin helps as a result of it makes certain the cash will get straight the place it must be: “We remove the waste and corruption.”

On my final evening in Nairobi, I meet Felix, an area Bitcoin entrepreneur. Like many others I met, he’s now operating a Bitcoin enterprise, in his case promoting merchandise, and is incomes in satoshis. He explains how the Lightning integration at Binance has been enormous for Kenyans, as now they’ll interface with Pockets of Satoshi, Phoenix, Machankura, and different apps immediately with very low charges. He says how Binance p2p can also be getting used extensively to commerce from MPESA to Bitcoin. I ask him about Marcel, and he raves about her work. He says that it’s important to get ladies concerned in Bitcoin adoption, and that Marcel is doing god’s work on this space. “She is,” he mentioned, “bridging the hole.”

VI. African Producers, not Customers

Bitcoin mining would possibly assist present electrical energy to thousands and thousands of Africans, but when the proceeds aren’t spendable in an area financial system, and usable by all residents, then it’s only a partial revolution. If one problem for widespread Bitcoin adoption in Africa is the shortage of web, and one other is low use amongst ladies, then one other, based on Femi Longe, is breaking the cycle of dependence on the West.

Femi is a Nigerian social entrepreneur with 20 years of expertise mentoring African technologists and start-up founders, and performed a key function in creating and operating the 2 most essential tech hubs in Nigeria and Kenya. In 2022 he was employed to steer the Qala Fellows, an initiative from Tim Akinbo, Carla Kirk-Cohen, Bernard Parah, and Abubakar Nur Khalil to speed up the method of transferring African pc engineers into contributing to the Bitcoin ecosystem.

Final yr, Qala was acquired by Btrust — the charity based by Jack Dorsey and Jay-Z to help Bitcoin infrastructure in Africa and the World South — and renamed Btrust Builders, the place Femi now sits as director. He’s targeted on serving to Africans transfer up the worth chain in Bitcoin. Fairly than simply being shoppers, like Africans are in so some ways within the present world monetary system, he desires them to be producers within the new Bitcoin financial system.

Femi says there are two legs to this journey: first, getting Africans extra concerned in protocol and infrastructure discussions. As Jack Dorsey says, if Bitcoin goes to be cash for the world, it needs to be made all over the world. Femi says that African views will probably be wanted to assist evolve Bitcoin to its true potential. We are able to already see proof of that in Machankura’s product highway map, which may assist decentralize and strengthen Bitcoin by creating doubtlessly thousands and thousands of extra self-custodial customers, and Gridless’s work, which makes mining extra censorship-resistant and strong. The second leg to the journey, Femi says, is creating Bitcoin instruments and functions that assist Africans enhance their high quality of life, within the context of their very own group, metropolis, and nation.

Femi says that these are early days: in 2022, when Qala participated in a hackathon across the first Africa Bitcoin Convention, they struggled to draw members. Folks have been “simply dipping their ft in,” mentioned Femi. However in 2023, he mentioned the inflow of expertise was spectacular. One winner was BitPension, a start-up aiming to permit anybody in Africa to arrange a BTC-denominated pension, the place anybody can purchase satoshis in small quantities day-after-day, which go right into a time-locked self-custody, so that you could’t betray your self. As we speak’s pensions, Femi says, may simply rug you, or they might be investing in oil or weapons firms. BitPension, or the same concept, might be game-changing. The corporate gained $5,000 of BTC, and is at the moment constructing a minimal viable product. Femi additionally identified Splice, one other hackathon entrant, which is leveraging native communities of cell cash brokers to facilitate dollar-stabilized trades over Lightning utilizing Taproot Property.

Femi says that the Western mentality round Bitcoin is simply too targeted on the financial savings side, and never sufficient on the medium of change half. In his view, this overemphasis on financial savings slows down the adoption, and cements fiat forex because the on-ramp to Bitcoin. A whole lot of the work that must be performed isn’t just instructing individuals methods to save, but in addition sitting down with native rideshare apps, for instance, and exhibiting them how they’ll add native Bitcoin funds. The one manner we will get out of the damaged forex system is to construct a brand new one, he says, to depart the previous one completely behind.

Contemplate the common particular person’s day, says Femi, and ask: what are all of the contact factors the place they will work together with cash? Now: how will we put Bitcoin at any certainly one of them? How will we assist create choices for them to spend the Bitcoin that they earn? In the event that they don’t have these choices, Femi says, they continue to be a part of the exploitative fiat system. The extra service provider companies we’ve got, he believes, the extra items we will purchase, and the much less curiosity there will probably be within the conversion to USD side. “If we don’t get service provider traction,” he says, “we’re caught up to now.”

One other perception Femi has is that wallets will probably be sooner or later options, not core merchandise. “The place you retain your cash is essential. Extra essential is what you are able to do with them,” he says. There will probably be, he says, pension options, worldwide commerce settlement options, payroll options: at the moment, a variety of these companies are disconnected from wallets, ultimately these will probably be inbuilt.

One thing else Femi is targeted on helps Africans construct sturdy narratives. He factors to the truth that there aren’t any Bitcoin books written by Africans. “We have to inform our tales and doc our experiences,” he says. “There’s a sturdy narrative about what Bitcoin is for and who it’s for,” he says. Lots of people who’re utilizing Bitcoin of their each day life past financial savings have no idea methods to, or aren’t superb at, explaining this to others. Or, they might not need to alert the authorities. For instance, he factors to Nigerian importers who don’t need the state to know they’re paying in Bitcoin. The federal government, for its half, has instructed any financial institution to freeze accounts which can be concerned with Bitcoin or cryptocurrency.

When individuals see Nigeria as a top-10 nation for Bitcoin adoption, they are saying: there are such a lot of hodlers in Nigeria. No, Femi says: “a variety of these of us don’t also have a pockets. They simply have to get funds to China tomorrow. They ship naira to some man who does the switch.” Bitcoin is starting to vary the material of worldwide commerce, however no person is aware of. Partly it’s as a result of individuals don’t need others to know concerning the particulars, however partly once more it’s as a result of there is no such thing as a funding right into a platform to assist individuals inform their story.

The Bitcoin ecosystem, he says, isn’t doing the work to counter what the IMF may be saying. There’s little or no empirical knowledge on adoption, which based on Femi may actually assist with policymakers. One contact of his within the Nigerian authorities advised him: “I would like one thing to persuade me that this is smart, that it’s not simply handing energy from one group of white guys to a different.” There isn’t sufficient work being performed both, Femi says, to assist individuals keep away from scams and token schemes. This hurts the person, and it hurts any governments trying to innovate. Have a look at the Central African Republic, he says. “They tried to observe El Salvador, however a bunch of scammers with Sango Coin acquired to them first.”

“To maneuver ahead, I feel we have to write books,” Femi says. “That’s scary for lots of us as a result of we haven’t performed it earlier than. We don’t know what the method is.” He says that 16 or 17 years in the past he wished to learn a non-fiction guide about Africa written by an African — and it was very laborious to search out one. Africa Unchained by the Ghanaian economist George Ayittey was one of many first he noticed, however there weren’t many others prefer it. This downside is now, based on Femi, spilling over into the Bitcoin house. What his fellow Btrust chief Abubakar Nur Khalil is doing together with his Forbes columns is nice, he says, “however we want books, and mentorship about methods to get there.”

Femi thinks loads may go improper. He’s cautious of the facility of Bitcoin billionaires because the forex continues to develop at scale. “As an African,” he says, “we’ve got seen that Invoice Gates might need good intentions however his basis has huge affect on healthcare coverage on the continent in the meanwhile. Zuck could also be nice – however once more, his company has enormous affect right here. So there’s part of me that’s afraid that even when the system is decentralizing, in a hyperbitcoinized world there’ll nonetheless be individuals with outsized energy. The true promise of Bitcoin is that everybody ought to have a good shot. The world we stay in is damaged: the hole between the richest and poorest, in each nation, has by no means been wider. Replicating these similar imbalances within the Bitcoin world could be a failure.”

Regardless of this concern, Femi says that Africans “can not afford to remain on the sidelines.” Bitcoin, he says, is inevitable and is already taking place round us. He thinks it may change the prevailing world financial system. “What occurs in Africa,” he says, “impacts the way in which black individuals are handled in all places on this planet. Bitcoin is a chance to redefine the facility system and energy construction.”

His hope is that when Bitcoin achieves its full potential, Africa’s place on this planet will probably be totally different. Impartial, and never dependent. “I hate being from the continent that everybody simply desires to assist,” he says.

However the one manner Africa actually advantages from the Bitcoin revolution, he says, is that if Africans paved the way. “The hope I’ve,” he says, “shouldn’t be inevitable. We now have to make it occur.”

VII. A Glitch Within the Matrix

In Kenya, I acquired the prospect to listen to the origin story of Gridless from Philip: 10 years in the past, he and Erik have been discussing the Turkana Wind Farm, an enormous 400-megawatt undertaking inbuilt Kenya that had no prospects for years. The federal government needed to pay 9 to 10 cents per KwH for nothing. This was as a result of the architects wouldn’t construct the positioning and not using a assured revenue circulation from a authorities or anchor consumer. The scenario is widespread: a “take or pay” contract. The worst half: Kenya has a variety of low-cost geothermal energy, however oftentimes it’s really stored offline as a result of the federal government is already on the hook to pay for the costly wind energy.

Erik and Philip watched this unfold and thought: what a catastrophe. In addition they thought: how may we deal with this? What’s an influence consumer that doesn’t want a variety of connectivity? That’s location agnostic? Initially, they thought of bringing an aluminum processing plant as much as Turkana, however the logistics challenges have been overwhelming. Then they thought of an information middle. Higher, however the web wouldn’t be ok, they thought.

Lastly, the Eureka second: Bitcoin may repair this. They giggle at how properly they could have performed if that they had taken that danger a decade in the past. In fact, it was early days again then, and mining at Turkana was an concept only a bit too loopy to depart their present jobs for. It wasn’t till 2022 that they lastly acquired every little thing in place to make Gridless occur.

For a lot of Africans, Bitcoin is a twin revolution: permitting communities to make the most of stranded vitality, and, on the similar time, giving them entry to a parallel world financial system, primarily based on property rights, not borrowing from overseas with strict situations.

Within the trendy monetary system, nations like Kenya, Malawi, and the DRC should acquire {dollars} or euros to purchase planes, industrial tools, fertilizer, oil, and even to pay again debt. Bombardier shouldn’t be going to simply accept kwacha for cost. And printing kwacha to purchase {dollars} shouldn’t be an choice: it crashes the native forex. So policymakers should give attention to making stuff that the US or Europe or China desires, as an alternative of what the nation wants. Solely then can they earn the {dollars} to have the ability to advance as a nation.

It doesn’t at all times need to be this manner. If Bitcoin turns into an even bigger and larger piece of the worldwide financial system, African nations will be capable of remodel their vitality into a worldwide reserve forex, with out asking permission from or doing enterprise with any empire or far-away energy.

The relative quantity of Bitcoin won’t be enormous, all issues thought-about, however economics is all concerning the margins, the place it may make an enormous distinction.

As we speak, Africa has 45 currencies. Inter-continental enterprise is tormented by delays, paperwork, and rent-seeking, particularly from overseas. As of late 2022, 80% of all inter-African funds have been processed by a European or American firm. However in a Bitcoin world, Africans may commerce with one another with out paying what is actually a tribute tax to former colonial powers. There could be no world rent-seeking as somebody within the DRC trades with somebody in Kenya: it might be a very peer-to-peer transaction.

It’s laborious to say, in fact, if issues will transpire on this manner. However all revolutions begin small and develop. As we speak, people in Japanese Africa can already simply join with their friends elsewhere on the continent, in minutes or in seconds, in a manner that doesn’t unduly profit the West.

Elementary applied sciences just like the plow, metallurgy, the steam engine, airplane, and the web have superior civilization past the wildest goals of our ancestors. Folks right this moment with out query stay longer and more healthy lives than we did 1,000 or 5,000 years in the past. That’s to not say it’s at all times been constructive: development in a single place has typically come on the expense of development elsewhere.

Colonialism, tyranny, slavery, the subjugation of girls, and conflict stay scourges on the planet.

One wonders what would possibly come of a financial revolution on par with the most important innovations in human historical past. Morally talking, it’s laborious to argue for right this moment’s system, the place roughly 1 billion individuals take pleasure in a globally-accepted, freely tradeable reserve forex, and seven billion earn wages in strictly inferior financial applied sciences.

The dominant forex is rescued, at occasions, by ways like aggressive rate of interest hikes that crush greater than 150 different weaker currencies, depleting the wages of billions of individuals. Politics and markets have each performed a task in creating this forex caste system, and left alone, it appears it’d solely get increasingly more brutal, with peripheral currencies getting weaker and weaker, and dominant ones changing into increasingly more widespread.

When the West suffers a monetary collapse, paradoxically, individuals flock to the greenback.

The place you’re born mustn’t decide the standard of your wages, and but it does. Till now. Bitcoin is, with out exaggeration, one thing like a glitch in The Matrix. One thing the present system didn’t count on and can’t course of.

If it continues to develop and broaden, it’s going to ultimately take away the “forex devaluation” choice that governments in Malawi and in so many different locations train to maintain their corrupt operations afloat. They must resort to different choices: larger taxes, or lowered authorities spending, however they are going to not be capable of perpetrate mass theft on the press of a button.

Three years in the past, impressed initially by the 2020 Stone Ridge Shareholder Letter written by Ross Stevens, and confirmed by interviews with numerous Bitcoin miners, I wrote about how Bitcoin would assist convey a variety of new renewable energy on-line in Africa. However I had no concept at what scale, till I began to go to a number of the Gridless websites, and I had time to consider carefully concerning the implications, that are actually staggering.

For instance, as an alternative of a authorities attempting to construct energy infrastructure by reckless borrowing, promoting off fairness to foreigners, slicing fiscal expenditures, or elevating taxes, why not simply design a method round mining Bitcoin? Kenya may ship a group of researchers to map all of the websites like Lake Naivasha, determine the full wasted electrical energy at present energy technology websites, determine what number of ASICs they might combine, plot the revenue, after which take one final fiat mortgage from the IMF or a world creditor.

Because the years go by, the fiat funds to the IMF would get overshadowed by the appreciating capital from the Bitcoin mining operations. Ultimately, they might go debt-free.

One can also’t assist however surprise concerning the fleets of older ASICs, not very worthwhile with costly Western electrical energy charges, however completely purposeful with a budget or free energy being unlocked in Africa and the worldwide south. They may, and certain will, be a boon for off-grid miners in nations like Malawi. Right here’s one other factor: climate occasions, commerce wars, and monetary crises would possibly make vitality very costly within the West, the place miners might need to close down in America or Europe. However off-grid in Africa, this drama is irrelevant, and may even imply extra Bitcoin for the native miners.

It’s not simply what Bitcoin can do for Africa: it’s what Africa can do for Bitcoin. If firms, and, at some point quickly, nation-states and firms begin changing the continent’s 1000’s of gigawatts of wasted and untapped hydro and geothermal and biomass vitality into capital, feeding all of that electrical energy to the Bitcoin community, throughout a decentralized and disconnected grid system, then we’ve got a way more unstoppable world forex.

The form of off-grid mining that makes financial sense to scale out throughout Africa can decentralize Bitcoin and make it stronger. Equally, if the tons of of thousands and thousands of cell cash customers of right this moment by no means really get a checking account, however simply transfer from MPESA to Bitcoin utilizing their SIM playing cards by way of a service like Machankura, the community turns into far more resilient.

I requested Erik and Philip concerning the time it could take for Bitcoin to begin to actually remodel the continent. Erik mentioned that inside 30 years mining will assist enhance electrical energy entry in Malawi from 15% to shut to 100%. Philip mentioned that Africa may, with Bitcoin’s assist, attain Northern Europe’s per-capita electrical energy consumption by the tip of the century. However each agreed, Bitcoin adoption as a medium of change would possibly occur a lot, a lot sooner.

For tons of of thousands and thousands of individuals, it might not in the long run be the United Nations or Invoice and Melinda Gates or the World Financial institution that convey them into the twenty first century, however an open-source software program community, with no identified inventor, and managed by no firm or authorities.

For dozens of good African entrepreneurs, that is the imaginative and prescient. And in a time the place so many are jaded concerning the world round them, it’s a refreshing one.

“The massive downside that retains us going day-after-day,” says Erik, “is the quantity of people that lack electrical energy on this continent. It’s not possible to understand.”

“Image 1,000 individuals with out energy,” he says. “Now 10,000. Now 1 million. Now 600 million. You may’t. It’s so egregious and unfathomable. And with out energy, there is no such thing as a freedom. However now we will repair this downside, and make cash, all on the similar time.”