DeFi – brief for ”decentralized finance” – is an umbrella time period for monetary providers operating on blockchain networks. For instance, this could embrace lending, borrowing, spot buying and selling, and insurance-related providers. Immediately, DeFi represents one of the crucial vital sectors inside the Web3 area, and the DeFi {industry} continues to develop each day. As such, changing into a DeFi developer is a superb profession alternative. Nevertheless, what precisely is decentralized app growth? And the way does it work? Should you’re in search of the solutions to those queries, be part of us on this article as we discover the ins and outs of DeFi dapp growth!

Overview

We’ll kickstart in the present day’s article by returning to fundamentals to reply the query, “What’s DeFi?”. From there, we’re additionally going to dive a bit deeper into decentralized functions or dapps to clarify what they’re and the way they work. Subsequent, we’ll leap into DeFi dapp growth to briefly cowl the method of making DeFi platforms. We’ll then discover just a few advantages of DeFi dapps and dive into some outstanding examples of current initiatives. From there, we’ll briefly clarify what it takes to start out with decentralized app growth. Lastly, we’ll introduce you to Moralis’ industry-leading suite of Web3 APIs, as that is the best technique to construct DeFi platforms!

In Moralis’ premier Web3 API suite, you’ll discover a number of interfaces for various use instances. Some outstanding examples embrace the Pockets API, NFT API, and so on. With these instruments, you’ll be able to effortlessly construct all the pieces from decentralized exchanges (DEXs) to lending platforms. As such, with Moralis, it has by no means been simpler to get into DeFi dapp growth.

Additionally, do you know you could entry our premier interfaces without cost? All it’s a must to do is enroll with Moralis, and also you’ll have the ability to construct your first challenge in a heartbeat!

What’s DeFi?

DeFi is an abbreviation for ”decentralized finance”, and it’s an umbrella time period for monetary providers operating on blockchain networks like Ethereum, BNB Good Chain (BSC), Polygon, Solana, and so on. The DeFi area is sort of intensive, and there are platforms offering many of the widespread providers that typical banks and different establishments provide – together with borrowing and lending, spot buying and selling, shopping for insurance coverage, and so on.

Nevertheless, since DeFi relies on peer-to-peer (P2P) blockchain networks, the {industry} removes the necessity for third-party and middleman involvement in monetary transactions!

However how is that this attainable?

Relatively than counting on conventional establishments and their workers to validate transactions, DeFi platforms leverage sensible contracts – often known as Web3 contracts – as a substitute. Good contracts are mainly packages operating on blockchain networks that execute each time predetermined situations are met. This makes sensible contracts superb for automating processes comparable to monetary transactions.

As such, sensible contract know-how utterly shifts the elemental belief mannequin for monetary providers from reliance on intermediaries to belief in code residing on blockchain networks. What’s extra, as with crypto typically, DeFi is world, pseudonymous, decentralized, and open to everybody throughout the whole globe!

What’s a Dapp?

Purposes and software program – comparable to DeFi platforms – constructed with sensible contracts are sometimes called decentralized functions (dapps)!

However what precisely are dapps? And the way do they work?

Decentralized functions – generally generally known as dapps – characterize a brand new technology of web-based apps constructed utilizing decentralized applied sciences comparable to P2P blockchain networks and sensible contracts. Consequently, dapps – in contrast to most typical functions – are free from the management and affect of central authorities.

Nevertheless, dapps aren’t all that completely different from conventional functions in the case of the person expertise. And so they usually serve the identical goal and supply related performance. As such, if they’re well-designed, the tip person shouldn’t have the ability to inform the distinction.

Briefly, the primary distinction between dapps and conventional apps is that dapps use decentralized P2P blockchain networks for his or her backend operations and leverage sensible contracts to chop out pointless intermediaries!

However, that provides you a short overview of what dapps are. For a extra in-depth rationalization of this new technology of functions, take a look at our ”What are dapps?” article!

Within the subsequent part, we’ll discover what DeFi dapp growth entails!

What’s DeFi Dapp Growth?

Now that you’ve familiarized your self with DeFi and dapps, you is likely to be considering constructing one thing your self. As such, we’ll offer you an outline of DeFi dapp growth on this part!

So, what’s DeFi dapp growth?

Put merely, DeFi dapp growth is the method of making DeFi dapps. Nevertheless, that is fairly self-explanatory and doesn’t say all that a lot. As such, let’s briefly look into the everyday steps of the DeFi dapp growth course of to provide you an outline of what it entails:

Market Analysis: Step one in any DeFi dapp growth endeavor must be analysis to determine gaps within the current market. Challenge Specs: As soon as a spot has been recognized, the following step is to form the concept right into a technical plan. Frontend Design: With a plan at hand, it may be useful to start out with the design of the person interface (UI) and person expertise (UX), as a broad overview of the frontend generally is a important element in how the challenge’s backend is structured. DeFi Dapp Growth: The following step is to undertake all of the technical work, together with infrastructure growth and blockchain engineering. What’s extra, this, for example, entails important steps comparable to sensible contract growth. Testing: As soon as a minimal viable product (MVP) is prepared, it’s time to check the challenge to determine bugs and errors. Deploy the Challenge: As soon as the DeFi dapp is prepared, the following step is to deploy the challenge to the blockchain. Upkeep and Assist: With the DeFi dapp up and operating, the ultimate a part of the event course of is upkeep and help.

However, that provides you an outline of the everyday DeFi dapp growth course of. Nevertheless, that is an instance, and a few of the steps above can change relying on the event workforce’s preferences and different elements.

Why Construct DeFi Dapps?

Now, with an outline of what DeFi dapp growth entails, you would possibly nonetheless be asking your self, ”Why ought to I construct DeFi dapps?”. Effectively, to reply this query, let’s take a look at just a few advantages of dapps:

No Single Level of Failure: Since DeFi dapps are decentralized, there’s no single level of failure. This, for example, makes dapps extra dependable, more difficult to hack, and censorship-resistant. Openness: Dapps are usually utterly open and permissionless. Which means that anybody can use them and infrequently doesn’t even want an account, making onboarding tremendous simple. As a substitute, customers solely require a Web3 pockets to work together with all dapps on a blockchain community. Pseudonymous: With dapps, customers typically don’t want to offer names, e-mail addresses, or any private data in any respect. Clear: Public blockchain networks are usually completely clear. As such, when utilizing dapps and different Web3 platforms, everybody concerned can see the total set of transactions. Value-Efficient: Since dapps leverage sensible contract know-how, there’s no want for third-party involvement. Because of this, there are not any intermediaries that cost for his or her providers, which may make the utilization of dapps cheaper in comparison with typical functions.

However, that covers just a few outstanding advantages of why it is best to construct DeFi dapps. Within the subsequent part, we’ll discover DeFi dapps additional by some outstanding examples of already current platforms!

DeFi Dapp Examples

There are lots of various kinds of DeFi dapps starting from decentralized exchanges (DEXs) to lending platforms. On this part, we’ll discover three outstanding examples:

Uniswap: Uniswap was launched in 2018, and it’s an industry-leading DEX for swapping cryptocurrency tokens on Ethereum and different outstanding blockchain networks. Because the platform’s launch, Uniswap has processed over 160 million transactions, with the entire buying and selling quantity exceeding $1.5 trillion.

Furthermore, since Uniswap is decentralized, there isn’t a single entity in charge of the platform. As a substitute, Uniswap is ruled by a worldwide neighborhood of UNI token holders and delegates, with UNI serving because the protocol’s governance token.

Aave: Aave is a decentralized, non-custodial, open-source liquidity market protocol the place customers can take part as suppliers or debtors. Suppliers are accountable for offering liquidity to the market to earn passive revenue, whereas debtors can lend undercollateralized or overcollateralized.

Very like Uniswap, Aave additionally contains a governance token referred to as AAVE. AAVE has two central capabilities. To begin with, it’s used to manipulate the protocol. As such, AAVE token holders can vote on enchancment proposals and resolve how the Aave protocol will progress transferring ahead. Second, AAVE will also be staked, the place stakes earn rewards and charges from the protocol.

Compound Finance: Compound Finance is an Ethereum-based decentralized borrowing and lending platform launched in September 2018. With Compound, lenders can deposit belongings into liquidity swimming pools and earn curiosity in return. Debtors can then take out loans in alternate for paying curiosity. And this complete course of is dealt with by sensible contracts, eliminating the necessity for intermediaries.

Moreover, Compound Finance supplies a token referred to as Compound (COMP). That is an ERC-20 token, and holders debate, suggest, and vote on modifications to the protocol.

To discover extra DeFi protocols, take a look at the DeFi dapps web page inside Moralis’ dapp retailer!

Learn how to Get Began with DeFi Dapp Growth

DeFi dapps typically comprise three central elements: a frontend, sensible contracts, and a backend. Consequently, to start out with DeFi dapp growth, you want the fundamentals of constructing these three elements. And let’s briefly begin with DeFi dapp frontend growth:

Frontend: DeFi dapp growth doesn’t differ all that a lot from typical Web2 practices in the case of the frontend. Consequently, when constructing DeFi dapps, you’ll be able to leverage lots of the similar instruments and languages, together with JavaScript, HTML, CSS, and so forth. Good Contracts: In terms of sensible contract growth, you usually want to understand the fundamentals of Solidity. Solidity is a so-called contract-oriented programming language, and it’s specifically designed for creating EVM-compatible sensible contracts.

What’s extra, there are various instruments value utilizing that may make sensible contract growth considerably extra accessible. Try the Web3 Wiki web page for Solidity instruments to study extra about this!

Backend: Backend growth has, no less than from a traditional perspective, been essentially the most cumbersome job of decentralized app growth. It has usually required builders to arrange infrastructure for speaking with the assorted blockchain networks and sensible contracts to, for example, fetch important on-chain knowledge. Thankfully, there at the moment are instruments you should utilize to leverage already-built backend infrastructure to keep away from reinventing the wheel. And the perfect instrument for that is Moralis!

As such, if you’d like an easy and highly effective instrument for speaking with numerous blockchains, we extremely suggest trying out Moralis. And to study extra about this, be part of us within the subsequent part as we discover this industry-leading DeFi dapp growth instrument!

Additionally, if you wish to study extra about what it takes to start out with decentralized app growth, take a look at our extra complete information on Web3 growth and tips on how to study it!

Moralis – The #1 Device for DeFi Growth

Moralis is an industry-leading Web3 API supplier, and with our premier interfaces, you get all the information you want in a single place. As such, with Moralis’ cross-chain appropriate Web3 API suite, it has by no means been simpler to construct DeFi dapps comparable to DEXs, lending platforms, and decentralized autonomous organizations (DAOs)!

So, why must you leverage Moralis in your decentralized app growth endeavors?

To reply this query, let’s take a look at three outstanding advantages of Moralis!

High Efficiency: Moralis’ Web3 APIs guarantee high efficiency. It doesn’t matter if you wish to decide by pace, reliability, or pricing; our interfaces repeatedly blow the competitors out of the water. A number of Interfaces: In our suite of premier Web3 APIs, you’ll discover an interface for each use case. As an example, if you wish to construct your individual DeFi dapp, then you may get a variety of the performance you want from the DeFi API. Or, if you happen to’d wish to construct an on-chain pockets tracker, you’ll be able to seamlessly arrange real-time alerts with the Streams API.

To study extra about all out there instruments, take a look at our Web3 API web page!

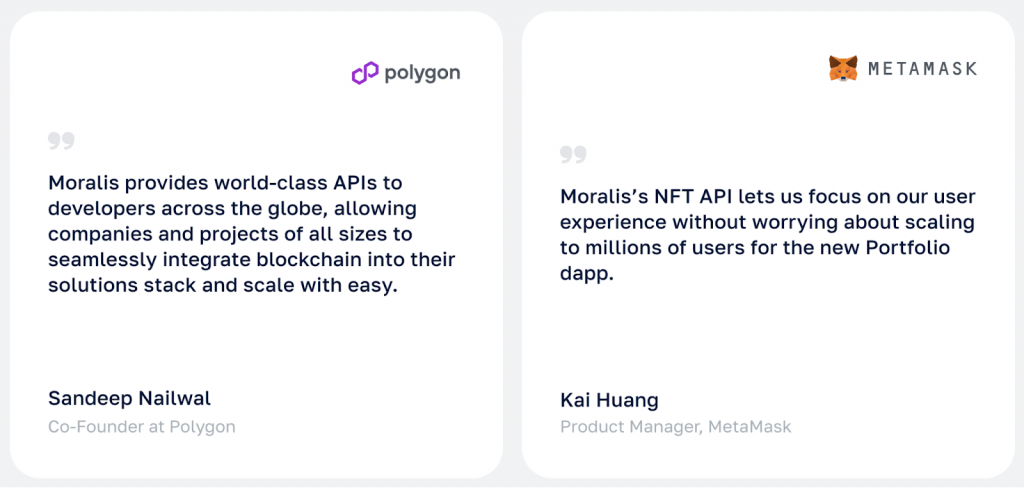

Trusted by Trade Leaders: Moralis’ Web3 APIs are trusted by {industry} leaders, together with MetaMask, Polygon, Tryhards, NFTrade, and lots of others. Simply take a look at a few testimonials beneath:

So, regardless of which of the most important and hottest blockchains you wish to construct on, ensure that to take a look at Moralis. You may enroll with us without cost, and also you’ll get rapid entry to all our industry-leading interfaces!

Abstract: What’s DeFi Dapp Growth?

In in the present day’s article, we kicked issues off by exploring the ins and outs of DeFi. In doing so, we bought to study that it’s an umbrella time period for monetary providers on blockchain networks like Ethereum.

Furthermore, we additionally explored the ins and outs of decentralized app growth, the place we found that it usually entails all the pieces from market analysis, frontend/backend growth, and so on., to sustaining the dapp as soon as it’s launched.

From there, we additionally dove into the advantages of constructing dapps in comparison with typical functions and explored three outstanding examples of current platforms: Uniswap, Aave, and Compound.

Lastly, we coated just a few issues you want to get began with decentralized app growth. And in doing so, we launched you to Moralis – the final word instrument for constructing DeFi platforms!

Should you appreciated this DeFi dapp growth article, contemplate trying out extra content material on the Web3 weblog. As an example, discover the perfect free NFT instruments or get some inspiration from our checklist of sensible contract concepts.

Additionally, if you happen to’re critical about moving into decentralized dapp growth, don’t neglect to enroll with Moralis. You may arrange your account freed from cost, and also you’ll acquire rapid entry to all our premier Web3 APIs!