Este artículo también está disponible en español.

After briefly retreating to $90,000 earlier within the week, Bitcoin has rebounded strongly, climbing above the $95,000 value.

At present buying and selling at $95,224, Bitcoin has recorded a 7% achieve over the previous two weeks, signaling renewed bullish momentum.

Associated Studying

Key Indicators Spotlight Finest Shopping for Alternatives

As Bitcoin continues its rally, CryptoQuant, a outstanding on-chain analytics platform, has shared insights into key metrics that might assist potential traders decide optimum entry factors.

Drawing on historic knowledge and market behaviour, CryptoQuant highlights the patterns of value corrections, short-term holder methods, speculative bets, and buying and selling quantity indicators to information traders in navigating Bitcoin’s ongoing bull run.

Based on CryptoQuant, historic bull markets have proven that value drawdowns are inevitable, even during times of sustained progress.

As an example, the 2017 bull market skilled corrections of as much as 22%, whereas the 2021 rally noticed 10% and 30% declines. The 2024 bull run has already seen 15% and 20% value pullbacks, suggesting that periodic corrections could provide strategic shopping for alternatives.

The platform additionally emphasizes the importance of the Quick-Time period Holder Realized Value metric, which displays the typical value foundation of current traders. This metric typically serves as a vital assist degree throughout bull markets, as short-term holders usually tend to purchase at their break-even value, reinforcing value stability.

Purchase on the Common Value Foundation of Quick-Time period Holders

The Quick-Time period Holder Realized Value will be seen because the buy-the-dip degree throughout bull markets.

Traders have a tendency to purchase at their break-even value, making this indicator a visualization of value assist. pic.twitter.com/mTDpuhaK8Y

— CryptoQuant.com (@cryptoquant_com) November 27, 2024

Moreover, CryptoQuant factors to the “Flush of Open Curiosity,” a phenomenon the place speculative positions are cleared out during times of heightened value motion. This course of can create favorable entry factors for traders trying to capitalize on non permanent market resets.

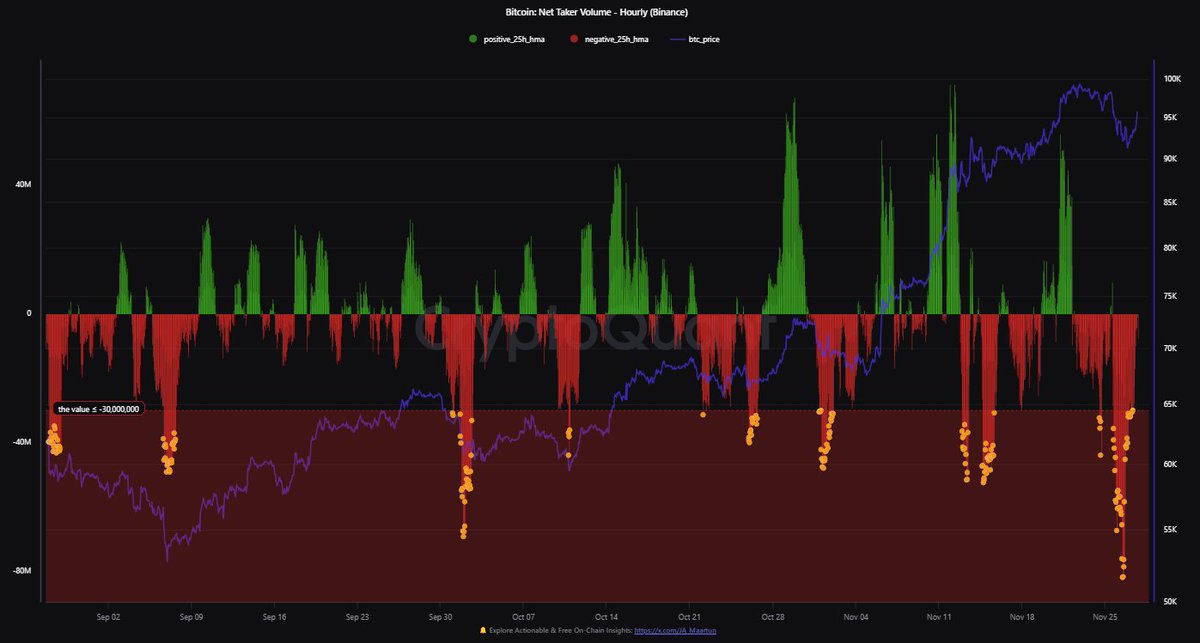

Lastly, the Internet Taker Quantity indicator, which measures the steadiness between shopping for and promoting stress, means that peak promoting exercise can sign alternatives for future value progress.

A studying beneath -$30,000,000 in line with CryptoQuant, as seen lately, could point out that sellers are nearing exhaustion, paving the best way for potential upside.

Key Help Ranges For Bitcoin

Whereas Bitcoin’s present momentum hints at one other potential rally, analysts warning the significance of sustaining vital assist ranges. Crypto analyst Ali lately recognized the $93,580 value zone as a key demand degree, the place roughly 667,000 addresses collectively acquired practically 504,000 BTC.

Associated Studying

Based on the analyst, remaining above this degree is essential to keep away from a possible sell-off from holders at this value level.

One key demand zone for #Bitcoin to observe is $93,580, the place 667,000 addresses purchased practically 504,000 $BTC. Staying above this assist degree is a should to stop these holders from promoting! pic.twitter.com/UdXTZOYzGH

— Ali (@ali_charts) November 28, 2024

Featured picture created with DALL-E, Chart from TradingView