Peak Bitcoin, hardly.

https://x&interval;com/pete_rizzo_/

As I wrote in Forbes in 2021, the world is waking as much as a brand new actuality with regard to Bitcoin – the unlikely reality that Bitcoin’s programming has cyclical results on its financial system.

This has led to at the very least 4 distinct market cycles the place Bitcoin has been branded a bubble, skeptics have rung their arms, and every time, Bitcoin recovers kind of 4 years later to set new all-time highs above its beforehand “sky-high” valuation.

I personally watched Bitcoin go from $50 to $1,300 in 2013. Then, from $1,000 to $20,000 in 2017, and I watched it go from $20,000 to $70,000 in 2021.

So, I’m simply right here to narrate that, from my previous expertise, this market cycle is simply heating up.

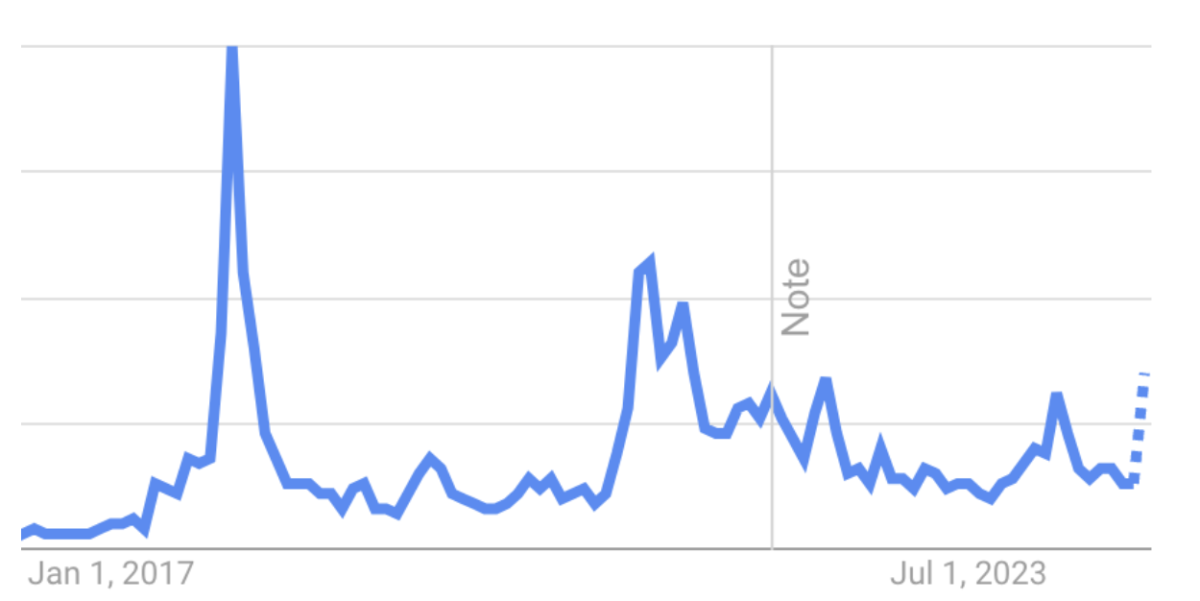

For many who have been in Bitcoin, there’s one tried-and-true and that’s Google Search. So long as I’ve been in Bitcoin, this has been the perfect indicator of the energy of the market.

Search is low, you’re in all probability in a bear market. Search heading again to all-time highs? This implies new entrants are getting engaged, studying about Bitcoin, and changing into lively patrons.

Keep in mind, it is a behavior change. Bitcoin HODLers are slowing shifting their property to a completely new financial system. So, Google Tendencies search then, represents a snapshot of Bitcoin’s immigration. It exhibits what number of new sovereign residents are transferring their cash right here.

And it’s one thing that every one who’re anxious about whether or not bitcoin’s value topping out in 2024 ought to take note of.

Final 12 months was the Bitcoin halving, and traditionally, the 12 months following earlier halvings has led to cost appreciation. Perhaps you’re tempted to suppose, “this time is completely different” – not me. I have a look at search and I see a chart that continues to speed up into value discovery. Belief me once I say nobody I do know is promoting bitcoin.

As proven above, purchaser curiosity is accelerating, and these new patrons have to purchase that Bitcoin from someplace. Add nation states, US states, and a coming Trump administration set to ease the burden on the trade? Properly, I feel the chart above says all of it actually.

This text is a Take. Opinions expressed are solely the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.