The UK monetary regulatory company sticks to its choice to proceed implementing stringent guidelines within the registration course of of companies concerned in cryptocurrencies.

The Monetary Conduct Authority (FCA) asserted that UK’s robust laws on crypto companies function a deterrence to forestall these corporations from changing into conduits for any cash laundering actions.

Strict Guidelines Obligatory

The FCA upheld the strict registration course of beneath the Cash Laundering Rules (MLRs), stressing that the laws are important to safeguard the integrity of the UK’s monetary system.

In an announcement, Val Smith, head of funds and digital property in FCA’s authorizations division, stated that the requirements will set the stage for a thriving, aggressive cryptocurrency sector that protects the individuals and the monetary markets’ integrity.

Smith defended the MLRs from critics who argue that the rigorous laws could stunt the expansion of the UK’s cryptocurrency sector.

Dealing With Cash Laundering Significantly

Smith stated that the regulatory workplace goals to maintain crypto companies from being conduits of cash laundering actions even when the consequence is a decrease variety of crypto companies getting registered.

“We by no means flip functions down out of hand. However we deal with the chance of companies getting used for cash laundering extraordinarily critically. Permitting illicit cash to stream freely can destroy lives,” Smith stated.

He added that the MLR necessities assist sort out “real-world points” equivalent to organized crime, terrorism, and human trafficking.

Sustaining Common Customary

Smith defined that enjoyable the federal government’s requirements in crypto agency registration that creates “a race to the underside” is not going to make sure the safety of the individuals and the markets, saying that “improvements constructed rapidly on unsafe, unregulated and untrusted foundations” are like homes constructed on sand which can finally collapse.

She stated the regulator needs to intently collaborate with companions throughout authorities, trade, and different jurisdictions to develop a crypto sector that’s constructed on dependable, sturdy foundations.

“By doing this we may help allow security, safety, and sustainable progress for years to come back.”

Picture: British Guild of Vacationer Guides

She famous that a necessary a part of a aggressive crypto sector is to set and preserve requirements that individuals can belief.

“That’s why we maintain all companies looking for registration, not simply crypto companies, to robust and common requirements.”

The monetary watchdog has been implementing MLRs since January 2020 which require corporations concerned in crypto-related actions to register their enterprise with the FCA.

MLRs required these corporations to conduct danger assessments. In addition they must implement due diligence on their clients and assign a Cash Laundering Reporting Officer.

UK Is Not Alone

Regulating cryptocurrency-related actions isn’t endemic to the UK. Different nations are additionally taking needed measures on their crypto sectors.

A very good instance is the European Union. The regional bloc has crafted the Markets in Crypto-Property Regulation (MiCAR), aiming to ascertain a single cryptocurrency market which ensures the safety of its customers and market integrity.

Singapore and Switzerland, however, have develop into crypto-friendly hubs as properly, after implementing insurance policies that promote and nurture cryptocurrency startups.

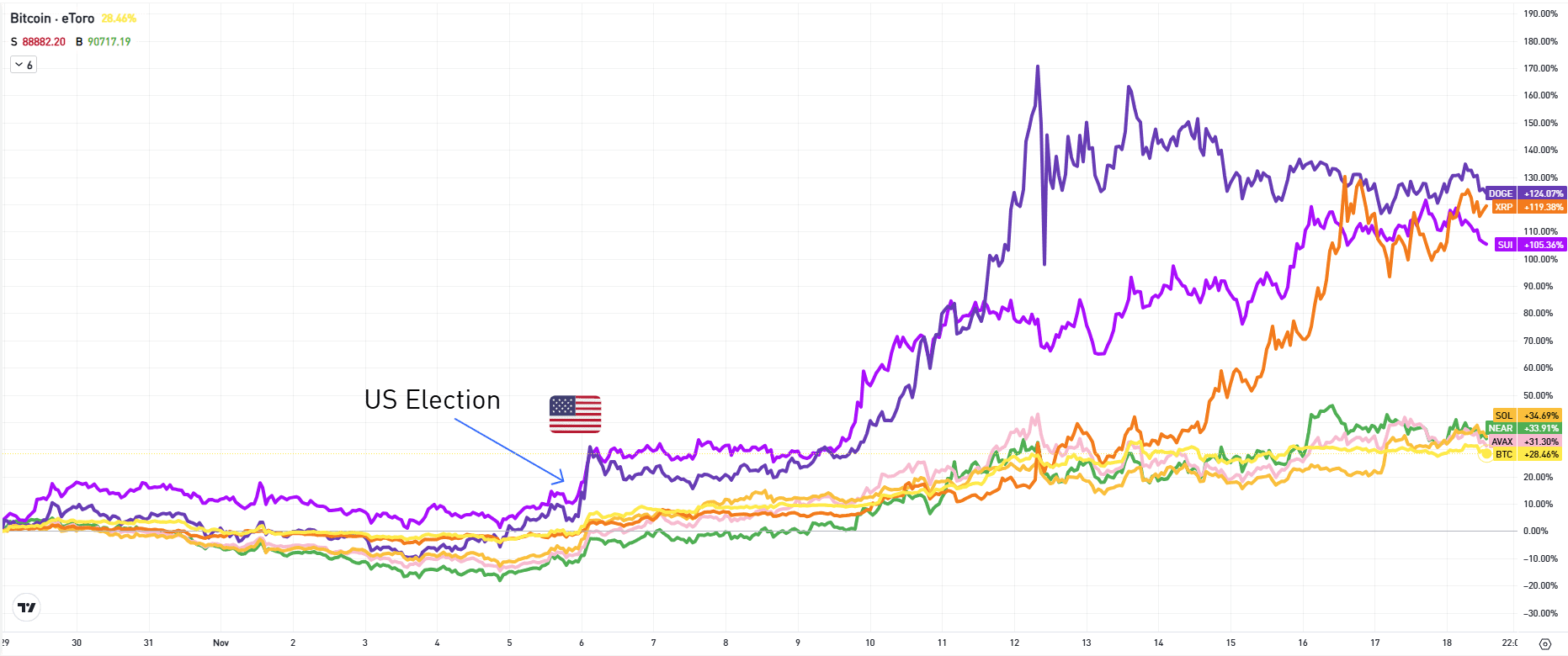

Featured picture from LAB51, chart from TradingView