On Oct. 4, Bitcoin ETFs recorded modest web inflows of $25.6 million. Constancy’s FBTC ETF noticed an influx of $13.6 million, whereas Bitwise’s BITB ETF added $15.3 million. Ark’s ARKB ETF introduced in $5.3 million, as did VanEck’s HODL ETF. Nevertheless, these positive aspects had been partially offset by Grayscale’s GBTC, which noticed outflows of $13.9 million. Different ETFs remained flat, together with these from BlackRock, Invesco, Franklin, Valkyrie, and WisdomTree.

By Oct.7, Bitcoin ETFs skilled a considerable inflow of $235.2 million, marking a pointy rise in institutional exercise. Constancy’s FBTC ETF posted $103.7 million in inflows, whereas BlackRock’s IBIT ETF adopted with $97.9 million. Bitwise’s BITB ETF and Ark’s ARKB ETF recorded inflows of $13.1 million and $12.6 million, respectively. Invesco’s BTCO ETF added $2.5 million, and VanEck’s HODL noticed an extra $5.4 million. No outflows had been reported throughout any of the main ETFs on this date.

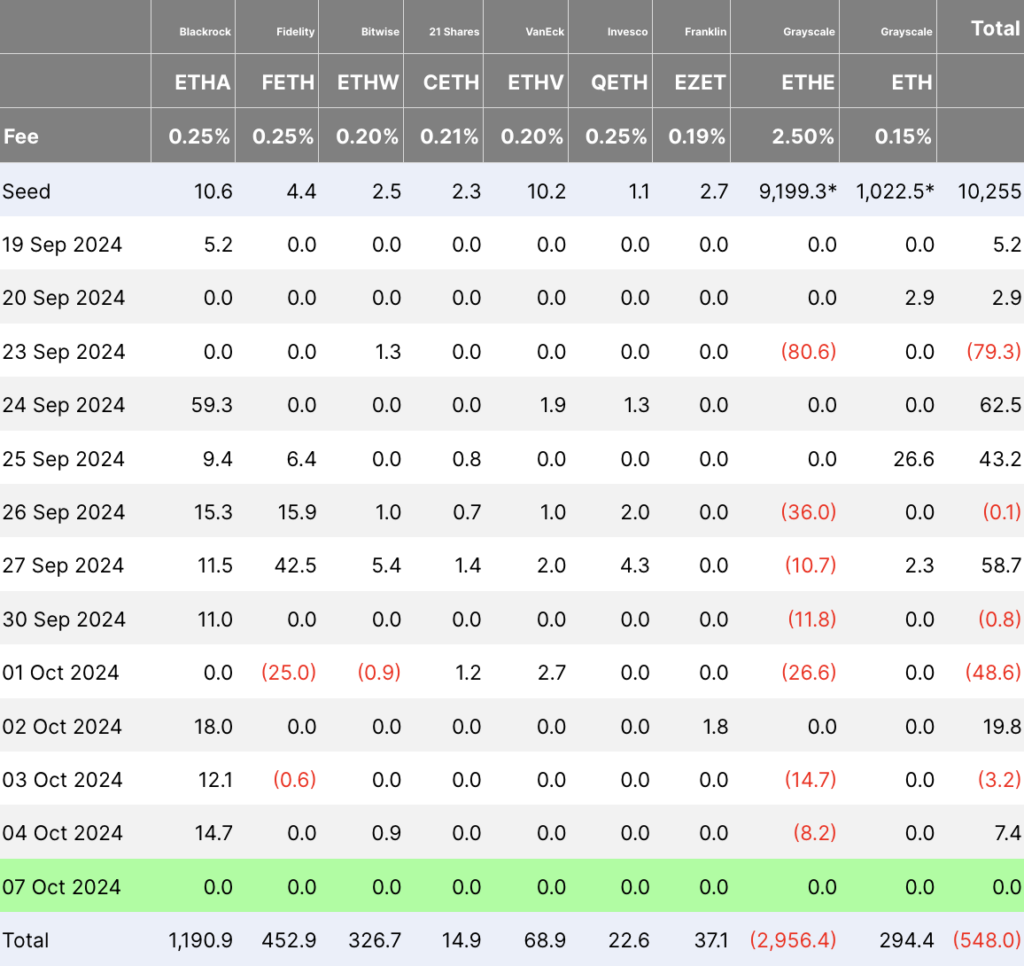

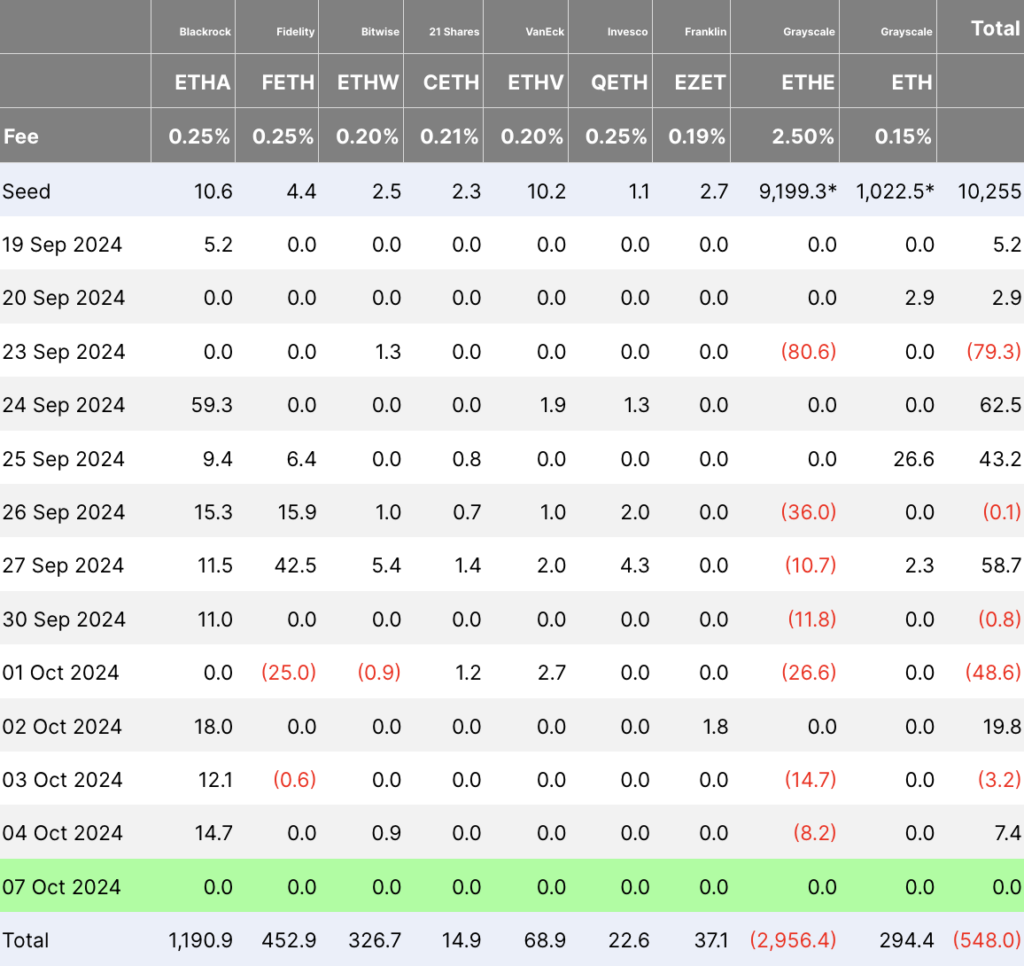

For Ethereum ETFs, Oct. 4 noticed a complete web influx of $7.4 million. BlackRock’s ETHA ETF led with $14.7 million, whereas Grayscale’s ETHE skilled outflows of $8.2 million. Minor inflows of $0.9 million had been recorded for Bitwise’s ETHW ETF, whereas different ETFs noticed no vital exercise.

On Oct. 7, Ethereum ETFs noticed no main inflows or outflows, and all merchandise reported flat flows.

Substantial inflows into Bitcoin ETFs on Oct. 7 point out renewed confidence out there, particularly following a quieter session on Oct. 4. Ethereum ETFs, whereas constructive on Oct. 4 on account of BlackRock’s inflows, noticed no additional motion on Oct. 7, signaling a short lived pause in institutional curiosity in Ethereum.