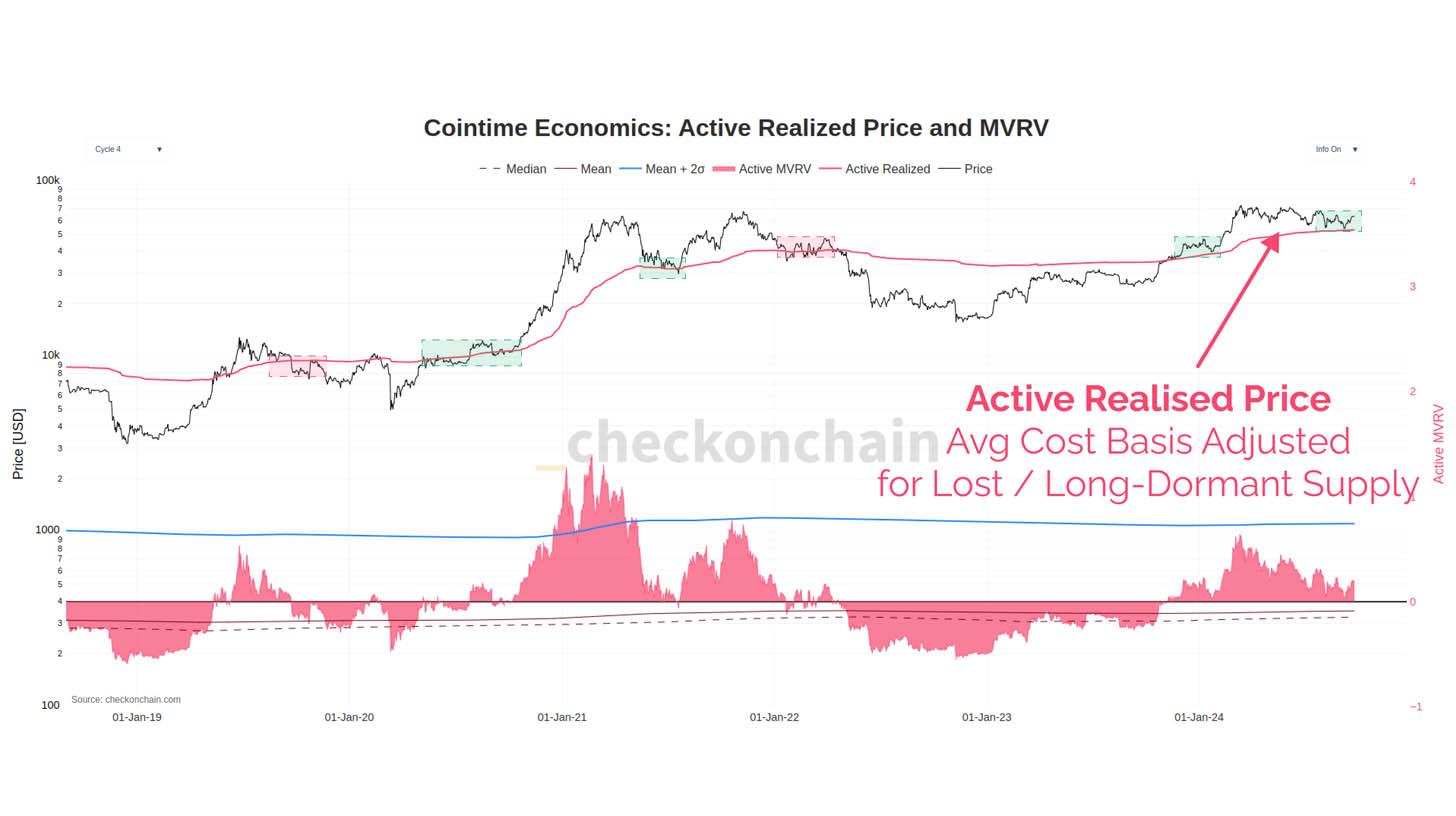

Analysis by _checkonchain analyst, Checkmate, and dpuellARK highlights a refined method to evaluating Bitcoin’s energetic realized value, providing a extra exact perspective on the fee foundation of energetic market contributors. The method appears to be like at Bitcoin’s realized value metrics, adjusted for misplaced and long-dormant provide, are shedding new mild on market valuation tendencies.

The novel metric reveals a clearer image of Bitcoin’s valuation cycles, capturing market sentiment by specializing in cash which have not too long ago moved, thus excluding inactive provide.

The energetic realized value serves as a major indicator of market efficiency. Over the previous 5 years, it has functioned as a vital help or resistance stage, with Bitcoin’s value regularly oscillating round this metric. Key observations from 2019 to 2024 embody durations of overvaluation throughout market peaks, comparable to in 2021, when Bitcoin’s value surged above the energetic realized value, reflecting heightened investor vitality.

Conversely, phases of undervaluation will be seen throughout correction durations, notably in 2022, when Bitcoin’s value fell in the direction of the energetic realized value, aligning with market normalization. The current accumulation section in 2023-2024 suggests cautious optimism, with the energetic MVRV ratio indicating a extra steady market atmosphere. Bitcoin has now bounced off the energetic realized value twice, mirroring the sooner phases of the 2021 bull run.

The energetic MVRV ratio, evaluating market worth to realized worth adjusted for energetic provide, identifies potential market tops and bottoms. Excessive MVRV values have traditionally signaled overvaluation, whereas decrease values counsel accumulation alternatives, providing nuanced insights into market cycles and investor sentiment.