Fast Take

In response to a report from New World Wealth and Henley & Companions printed by CNBC, the inhabitants of crypto millionaires has surged by 95% over the previous yr. This fast development in wealth is especially evident amongst Bitcoin holders, the place the variety of millionaires has greater than doubled, reaching 85,400.

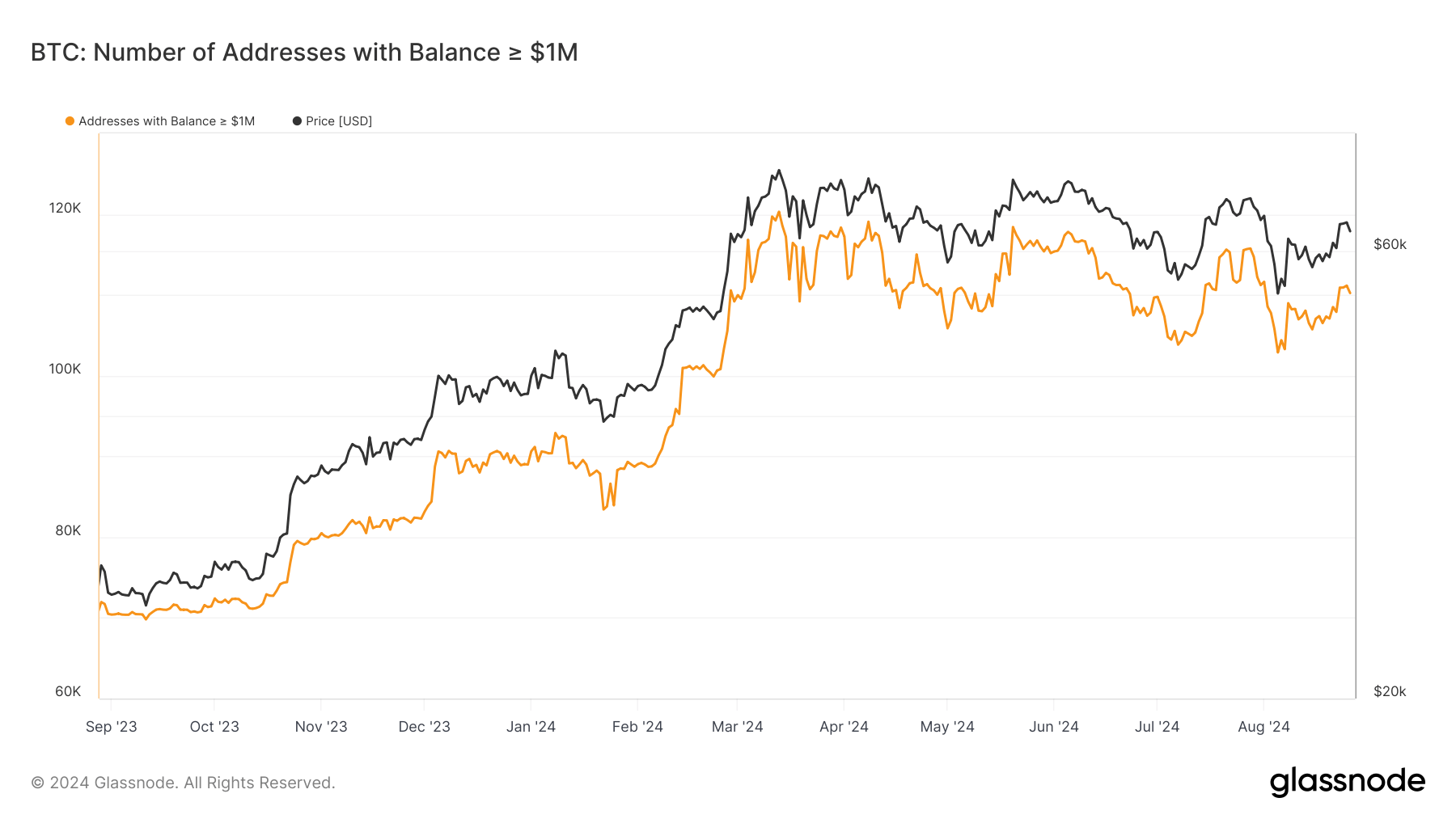

Nonetheless, it’s vital to notice that monitoring particular person crypto millionaires is difficult, as solely pockets addresses may be monitored. Since a number of addresses can belong to a single particular person, exact monitoring of people is just not potential.

Information from Glassnode reveals that there are at present 110,000 Bitcoin addresses with balances exceeding $1 million.

The report additionally highlights the emergence of 325 crypto centi-millionaires (these with $100 million or extra in crypto holdings) and 28 crypto billionaires. This improve in high-net-worth people within the crypto area has been considerably pushed by the success of Bitcoin ETFs and a outstanding 140% year-over-year rise in Bitcoin’s worth.

The report notes among the many wealthiest within the crypto world, Changpeng Zhao, founder and former CEO of Binance, tops the checklist with an estimated value of $33 billion. He’s adopted by Brian Armstrong, CEO of Coinbase; Giancarlo Devasini, CFO of Tether; and Michael Saylor, co-founder of MicroStrategy, all key figures contributing to the rising crypto wealth panorama.

An intriguing facet of the report is the continued rise within the variety of crypto millionaires and billionaires and the shifting developments of the place these people select to work and reside. The report highlights how tax-friendly and crypto-friendly jurisdictions, like Singapore, have gotten more and more enticing.

Henley & Companions launched a “Crypto Adoption Index,” the place Singapore ranks first, adopted by america in fourth place. In response to the report, 15% of america inhabitants owns cryptocurrencies. The report notes:

“That is supported by robust infrastructure, with a excessive density of crypto ATMs, crypto-friendly banks, and an rising variety of companies accepting cryptocurrency”.