A Nigerian courtroom has ordered the freezing of almost $40 million in crypto funds believed to have been used to help nationwide protests towards the federal government. The ruling, amid heightened tensions over the rising price of residing in Africa’s most populous nation, has sparked issues over the authorities’ response to civic unrest.

Anti-Graft Company Freezes $38 Million

Based on native media studies, the Financial and Monetary Crimes Fee (EFCC), Nigeria’s prime anti-corruption company, alleged that the frozen property symbolize the “proceeds of cash laundering and terrorism financing.” Nevertheless, particulars on the precise people or teams whose wallets have been focused haven’t been disclosed.

Insiders conversant in the case instructed reporters that the federal government believes the funds may be traced to suspected organizers of the #EndBadGovernance protests – a collection of demonstrations that swept throughout Nigeria in early August.

From August 1-10, the protests noticed Nigerians take to the streets to voice their frustrations over the nation’s worsening financial disaster, together with skyrocketing inflation, unemployment, and widespread poverty.

Safety forces have been accused of utilizing extreme drive, with studies of over 20 protesters killed in the course of the demonstrations. Authorities have since taken a tough line, arresting suspected protest organizers and people believed to have dedicated crimes underneath the guise of the rallies.

Nigeria’s Crypto Clampdown

This isn’t the primary time the Nigerian authorities has moved to limit the monetary assets of anti-government activists. In 2020, in the course of the widespread #EndSARS protests towards police brutality, authorities efficiently obtained a courtroom order to freeze the accounts of key protest organizers, alleging hyperlinks to terrorist financing.

Whereas the federal government maintains that the present cryptocurrency freeze is a part of professional investigations into cash laundering and terrorism, critics have condemned the transfer as a blatant try and stifle dissent and undermine the general public’s proper to assemble peacefully.

The most recent crackdown on crypto-based help for the protests highlights the Nigerian authorities’s rising unease with utilizing digital property to bypass conventional monetary controls.

Specialists warn that such heavy-handed techniques may additional undermine public belief and push extra Nigerians to hunt different, decentralized technique of organizing and fundraising.

This elevated scrutiny of the business has caught up with the world’s largest trade by buying and selling quantity, Binance, the place a prime govt, Tigran Gambaryan, is in essential situation in a Nigerian jail. His well being has reportedly been in a downward spiral since his arrest earlier this yr.

Gambaryan is dealing with critical cash laundering fees together with the trade. The Nigerian authorities accuses him and one other govt, Nadeem Anjarwalla, of laundering greater than $35 million.

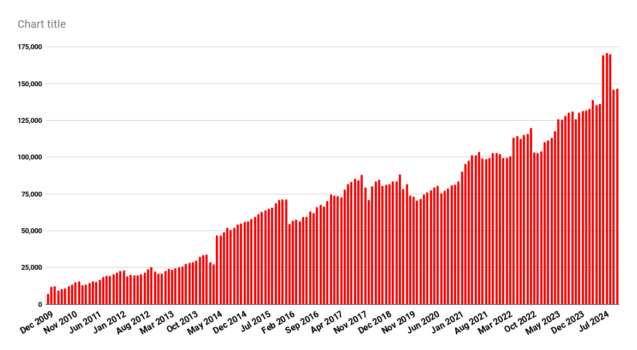

Amid a broader consolidation part for the most important digital asset after a deep correction of over 20% in early August, the overall crypto market capitalization stands at $2.005 trillion. Bitcoin (BTC), alternatively, is buying and selling at $58,000 after a number of failed makes an attempt to consolidate above the important thing $60,000 degree.

Featured picture from DALL-E, chart from TradingView.com