After Monday’s market crash, issues concerning the stability of Bitcoin’s bull run have emerged. But, Ki Younger Ju, founder and CEO of CryptoQuant, a number one blockchain analytics agency, maintains a constructive outlook. He means that, regardless of the current crash, on-chain knowledge continues to help the notion that the bull marketplace for Bitcoin stays intact.

Bitcoin On-Chain Evaluation: Bullish Arguments

#1 Bitcoin Hashrate

The Bitcoin hashrate, which gauges the computational energy utilized in mining and processing transactions, is nearing an all-time excessive (ATH). Ju notes, “Miner capitulation is sort of over, with hashrate nearing ATH. US mining prices are ~$43K per BTC, so hashrate probably secure except costs dip beneath this.”

#2 Whale Conduct

Vital Bitcoin inflows into custody wallets are one other argument to be bullish, indicating robust accumulation by large-scale traders, also known as ‘whales’. Ju highlights, “Vital BTC inflows into custody wallets. Everlasting Holder addresses elevated by 404K BTC, together with 40K BTC in US spot ETFs over the past 30 days. New whales are accumulating.”

Associated Studying

#3 Retail Investor Participation

The present subdued participation of retail traders is just like patterns noticed in mid-2020. Ju remarks, “Retail traders are largely absent, just like mid-2020.” This absence may contribute to much less volatility, as retail buying and selling usually results in speedy worth swings.

#4 Previous Whales Nonetheless HODL

Between March and June, long-term holders (those that have held for over three years) transferred their Bitcoin holdings to newer traders. Presently, there isn’t a vital promoting strain from these veteran holders.

Bearish On-Chain Knowledge

#1 Macro Dangers

On the draw back, Ju factors out macroeconomic dangers and up to date market actions that might affect Bitcoin’s worth stability: “Macro dangers might result in compelled sell-offs. There have been giant crypto deposits by Leap Buying and selling not too long ago, and Binance hit YTD excessive in each day deposits.”

Associated Studying

#2 Borderline On-Chain Indicators

Whereas some on-chain indicators have not too long ago turned bearish, these are borderline, in line with Ju. He asserts, “Some on-chain indicators turned bearish however are borderline. If bearish tendencies persist for over two weeks, market restoration might be difficult.”

#3 Bull-Bear Cycle Indicator Flags Bear Section

Notably, the Bull-Bear Market Cycle Indicator has additionally flagged a bear part for the primary time since January 2023 (excessive blue space within the chart), warranting shut commentary. CryptoQuant Head of Analysis Julio Moreno added that this indicator has beforehand recognized restricted bear phases throughout vital market occasions just like the COVID sell-off in March 2020 and the Chinese language mining ban in Could 2021. Furthermore, it additionally accurately anticipated the beginning of the bear market in November 2021.

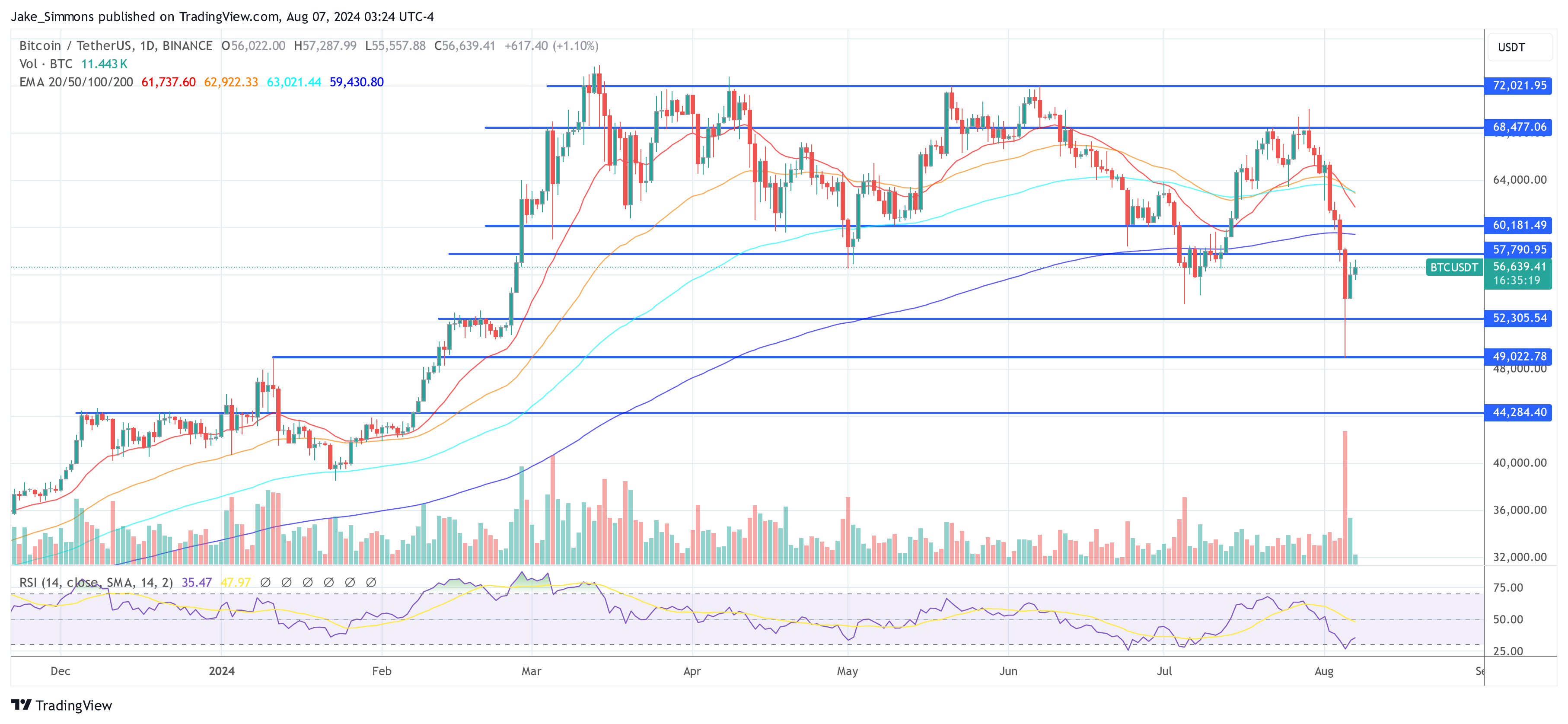

Regardless of these bearish undercurrents, Ju stays cautiously optimistic concerning the potential of Bitcoin to achieve a brand new all-time excessive till the top of the 12 months. “So long as the Bitcoin worth stays above $45K, it might break its all-time excessive once more inside a 12 months, imo. Some indicators are displaying bearish indicators. Nevertheless, they might nonetheless get better with a rebound, so we have to watch if it stays at this stage for per week or two. If it lingers longer, the chance of a bear market grows, and restoration could also be tough if it lasts over a month,” Ju concludes.

At press time, BTC traded at $56,639.

Featured picture created with DALL.E, chart from TradingView.com