All of us have a journey to Bitcoin. Some began as sound cash advocates who adored Austrian economics and gold. Others fell out of the TradFi world once they knew one thing wasn’t fairly proper. Most Bitcoiners have gone via trials and tribulations of altcoin hell. Nevertheless you made it right here and to Bitcoin, welcome–and buckle the F*ck up.

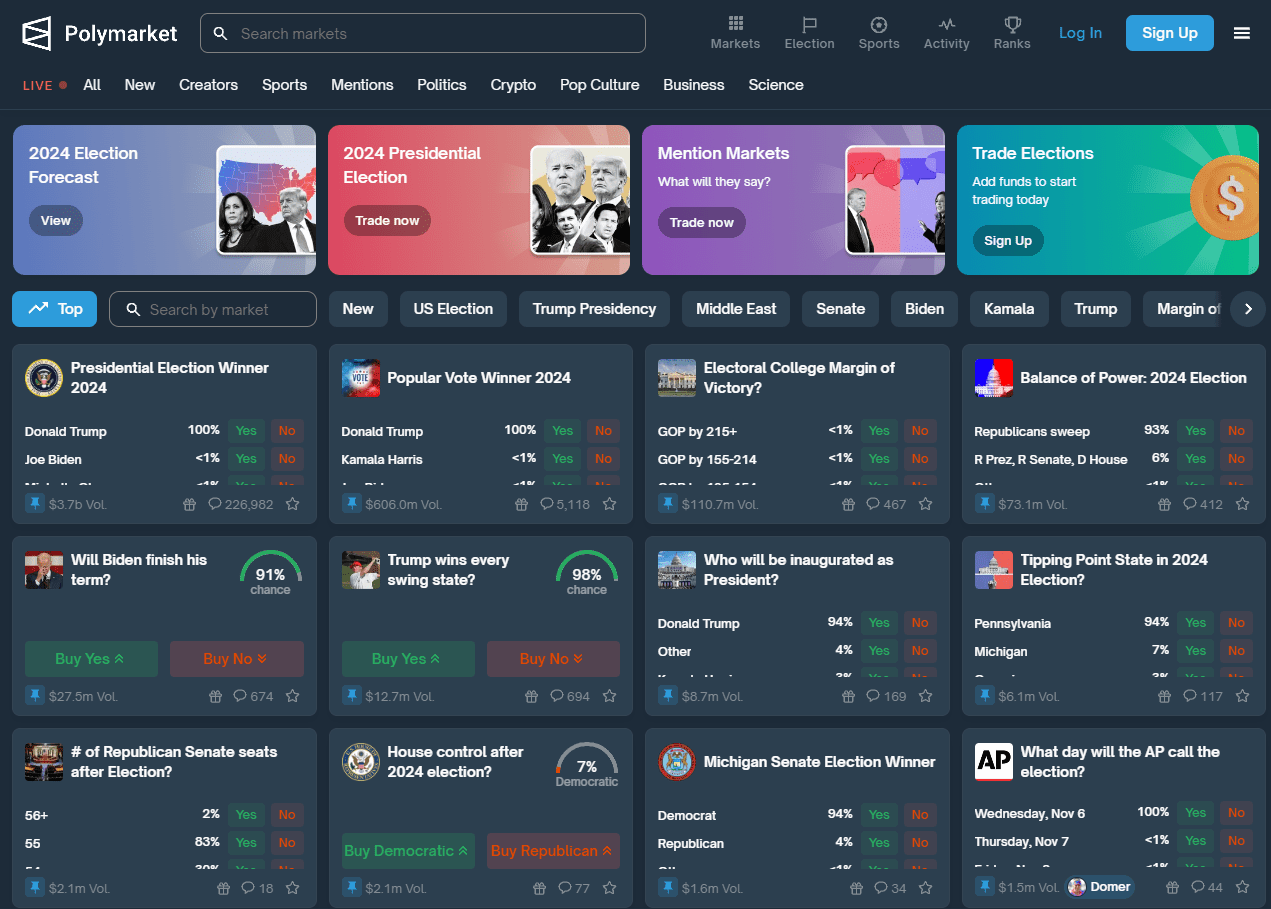

Once I first turned excited by Bitcoin, it was July of 2017, and it was already nicely into the bull market of that yr. I purchased some and watched its worth enhance. Then I purchased extra. As tends to occur throughout these parabolic bull runs, I stored watching the value rise and my curiosity go from:

to Disbelief to Infatuation to Degenerate Shopping for to Despair.

This can be a trajectory you possibly can keep away from throughout the subsequent bull run should you put together your self correctly.

If you’re studying this hoping to search out all of the solutions, I’ve some unlucky information. There are not any proper solutions in Bitcoin or life. We’re all on a journey to determine what to do and strategy. I hope to information you, however finally, your private targets and disposition will dictate the way you deal with volatility. Bitcoin will check your resolve.

Through the later part of the 2017 bull run, I talked about Bitcoin to everybody in my life—fully obsessed. My neighbor on the time was older than me and had skilled the dot-com increase. I’ll always remember the recommendation he gave me; this recommendation was born of gaining (and shedding) some huge cash throughout the dot-com bubble. He listened to my fervent curiosity in Bitcoin, and he took a really measured strategy to my evident LOVE for this asset. He informed me that throughout the dot-com increase, he made extra money than he ever believed he would have, and in the long run, he was proper again the place he started—as a result of he rode the bull market excessive and didn’t promote something. His recommendation was, “I’m glad you might be doing nicely, however don’t overlook to take some revenue.” He suggested me to promote 50% and hold 50%—a easy hedging technique. I did heed his recommendation shortly after Bitcoin hit its all-time excessive and bought a few of my holdings close to that native high.

Now, I do know that that is sacrilege to many hodlers. We don’t promote our bitcoin, proper?? Effectively, that could be a private determination, and relying in your threat tolerance and place in life, you could wish to take some threat off the desk. That’s a part of investing, and because the previous saying goes, nobody ever loses cash promoting for a revenue. This text goals to present the recommendation I want I had gotten after I first found Bitcoin. I hope this helps newcomers to the area perceive navigate the bombastic setting that bitcoin produces throughout its bull runs.

I’ve seen two bull runs, one in 2017 and one in 2021. These bull runs have been VERY completely different, and I think that should you spoke to these concerned in bull runs previous to 2017, you’ll discover that these additionally had a really completely different really feel.

The very first thing I wish to get off my chest is that this—Nobody is aware of what will occur:

Balaji talks about 1 million in 3 months Nobel laureates are saying it’ll go to zero Buffett and Munger(RIP) name it rat poison

Whoever you might be listening to, regardless of how lengthy they’ve been within the area or how appropriate they’ve been prior to now, IT DOES NOT MATTER. They do not know what the long run holds.

In investing, there may be an thought referred to as survivorship bias. Those that have been appropriate have survived, they usually appear to be geniuses as a result of they’ve been appropriate. The VAST majority of those that have been unsuitable are forgotten. You don’t hear about them. I gained’t throw anybody below the bus right here, however there have been outstanding individuals in Bitcoin calling for MUCH greater costs after we have been sitting at 68K in 2021. I’m not saying that they’re dangerous individuals; I’m certain that they’d a very good cause to forecast these numbers, however should you had taken their recommendation at the moment, you’ll have purchased on the worst time attainable and gotten crushed for YEARS.

In my opinion, there are completely different tiers of crystal ball holders on the market, and the bottom tier is the technical analyst sort. These are the dime-a-dozen individuals you see on Twitter spouting off about momentum, value ranges, cup and handles, and so forth. These individuals have been calling for 10K bitcoin when it bottomed at 16k. I’m not saying that TA is all nonsense; essentially, it’s a system for predicting human motion via chance. It’s a consideration at finest. It ought to by no means be utilized in a vacuum to find out your allocations. If you happen to use it along side fundamentals, it may be way more useful. The purpose I’m driving at right here is there are GRAVEYARDS of TA analysts on the market who informed you to purchase at 68K and to not purchase at 16K. They’re throwing probabilistic darts. Don’t put your monetary future on somebody’s educated guess.

The second model of crystal ball aficionados on the market are macro analysts. These individuals have extra credibility for my part as a result of they’re assessing the final pattern within the economic system. They’re contemplating rates of interest, Fed actions, and financial information. These sorts are MUCH nearer to base actuality as a result of they’ve their finger on the heartbeat of the financial heartbeat. However, as with TA analysts, these individuals might be TOTALLY unsuitable. Many stated that Fed funds charges couldn’t exceed x or y, or all the economic system would collapse. Effectively, the rates of interest have been elevated to ranges nicely above their doomsday predictions, and we have now not seen a collapse.

Whether or not you comply with a TA analyst or a Macro analyst, they are often completely WRONG due to a black swan. Nicholas Taleb—famously hated by Bitcoiners—coined the phrase black swan to label occasions that occur infrequently that merely can’t be predicted in commonplace modeling as a result of they’re so unlikely. Covid was a black swan. The battle in Ukraine was a black swan. And guess what, there could possibly be one other unpredictable black swan tomorrow that might render the entire TA and macro analysts fully unsuitable. The world has a ton of randomness. By the way in which, black swans aren’t at all times dangerous. They’re simply as more likely to be constructive catalysts.

So does this imply we must always stay paralyzed with worry and never belief anybody??

Completely not. It means we must always take some time to EDUCATE OURSELVES! You have to take accountability for your self and your choices. You possibly can take the data from the TA analysts and the macro analyst and make your personal educated choices. THIS IS OF THE UTMOST IMPORTANCE.

Educate Your self

Bitcoin is an extremely easy but endlessly complicated animal. Your schooling won’t ever be full, however you possibly can incrementally develop your understanding. We did a 10-episode Bitcoin Fundamentals Sequence with Dazbea and Seb Bunney, and I don’t really feel like we even scratched the floor!

You wish to be educated for resiliency. If in case you have a stable grasp of Bitcoin and the way it works, you’ll not be simply shaken. The psychology right here is VERY IMPORTANT. If you happen to perceive what you might be investing in, and the market is hit by an alternate failure just like what occurred to FTX, you’ll perceive a couple of issues that the common particular person might not.

Bitcoin is unaffected The value drop is non permanent and with out advantage Due to this fact, it is a nice time to be accumulating Bitcoin

Now, the other of that is additionally true. While you see mainstream headlines fawning over Bitcoin, with the features by no means seeming to finish, and you’re feeling like it is best to drop each bit of cash into Bitcoin as a result of its value goes nowhere however up—BE CAUTIOUS. I’ve discovered that my psychology is typical. I’ve worry when the value is getting crushed, and I’ve irrational exuberance when the value is rising rapidly. If I do EXACTLY the other of what my monkey mind tells me, I discover I’m usually doing the suitable factor. That’s to say, once you really feel excessive worry, that is the time to purchase, and once you really feel elated, that is the time to promote.

Panic shopping for is harmful. While you really feel an uncontrollable urge to purchase Bitcoin, take a deep breath. I can guarantee you that it is possible for you to to purchase some, and in case you are feeling the urge this strongly, the market might be ripe for a pullback. That’s no assure, however in my expertise, this has been the doubtless case. I’m not advocating for buying and selling BTC, under no circumstances. I can actually say that I’ve misplaced extra BTC than I’ve gained by buying and selling, and if most individuals are sincere, they are going to admit the identical. Buying and selling is a ability and self-discipline that only a few individuals grasp.

The standard psychological roadblocks that hold individuals up are worry and greed. Mirror in your emotions and acknowledge if you find yourself experiencing these feelings. They may trigger you to make errors. The best method to mitigate all of that is merely to dollar-cost common. Swan is the PERFECT place for DCA. Greenback-cost averaging takes all of the stress out. Full cease. If you happen to degree into this asset at this second and it drops to 30% in a single day, ask your self actually: Do I’ve the abdomen for that? Do I’ve the conviction for that? Do I’ve the academic chops to know why the greenback value doesn’t matter within the brief time period? Will I panic promote? If you happen to aren’t convicted, dollar-cost averaging will prevent. You might be getting the common value over an extended time frame.

I’ve just a little DCA tactic that’s easy and works for me:

When the value corrects I enhance my DCA, when the value will get frothy, I feather again and common in with much less. Over months and years, this supercharges your common purchase.

Don’t Really feel Like A Sellout For Promoting BTC

Have a plan and be able to execute. My neighbor’s plan is a stable place to start out. After you have doubled your cash, take the preliminary funding out. There’s a vital asterisk concerned on this—What are you going to purchase as a substitute of Bitcoin? Inflating money? The alternatives for the place else you place your cash nowadays are very restricted. This may be controversial to many within the area, however I believe it’s completely cheap to promote some Bitcoin. If in case you have been holding for YEARS, and your stack may meaningfully make your life higher, by all means, promote a portion.

Time is the one asset that’s extra worthwhile than BTC; we have now a very finite period of time on this earth. If you happen to hodl your BTC after which take a mud nap, what was the purpose? If you happen to can promote a portion of your stack and repay your home, or get out of crushing debt, I believe that could be a sound determination. It is probably not the BEST monetary determination, particularly if your home is on a low-interest fee mortgage, but it surely’s an comprehensible determination due to the peace of thoughts this might carry. Nevertheless, you have to additionally do not forget that promoting Bitcoin will very doubtless be a painful determination in the long run.

Promoting Bitcoin for toys however will not be an important transfer. While you purchase that 250k moon Lamborghini, which loses 50% of its worth in 3 years whereas Bitcoin has gained greater than that proportion to the upside, the remorse might be insufferable. Robert Kiyosaki involves thoughts. His ebook Wealthy Dad Poor Dad has been very influential on me, and his description of property vs. liabilities hit dwelling:

An asset generates money circulation A legal responsibility subtracts money circulation

If you happen to purchase property, your web price will enhance considerably on an exponential curve. If you’re shopping for liabilities, you might be merely getting poorer. If you happen to promote Bitcoin, you’ll doubtless remorse it in the long run.

Time Desire

Time choice is a subject usually visited in Bitcoin. Having a low time choice means you might be keen to forgo niceties at the moment for a greater future. Each worthwhile cathedral, each basic piece of artwork, all the pieces lovely on this world has been constructed as a result of individuals labored with a watch to the long run, not the current. If DaVinci taped bananas to the wall we’d have by no means remembered him. If the nice pyramids had been constructed of clay, they might be gone. If Civilization spent all of its wealth on the right here and now with out investing sooner or later it will not final.

Bitcoin itself is a digital artifact that has been crafted to perfection by a mysterious architect. It’s designed to final eons; if civilization lasts, it’ll have good constancy into the long run. As a result of nobody can change it or management it, Bitcoin is anti-entropic. That is the epitome of low-time choice craftsmanship. Bitcoin is a Da Vinci in a world of bananas taped to partitions. It is so obvious as soon as the work is put in that it’s embarrassing extra individuals don’t perceive the worth proposition.

In stark distinction to this Bitcoin masterpiece, we have now the sand hills we name alt-coins or shitcoins. These have been constructed utilizing Bitcoin’s know-how however introducing entropy. Constancy is misplaced in altcoins as a result of every has a founder or group who controls them. When people can management one thing, they inevitably manipulate it to their profit. And whether or not consciously or subconsciously, it’ll degrade. Most of those shitcoins have been designed from the outset to rip-off you. A few of these alt-coins have management that could be well-intentioned, however they’re human and able to being influenced and coerced. The issue is LEADERSHIP. Bitcoin and its time chain have been designed to take away the human factor as a main attribute. Introducing people into the combination causes entropy to destroy worth via seigniorage.

Bitcoin’s invention was that of NON-INTERVENTION by people.

These are insights that take years for many individuals to know fully. If you need the TL;DR on altcoins, it’s easy. Simply don’t trouble. You might be higher off taking your cash to a on line casino and enjoying craps. The deck is stacked closely in opposition to you within the crypto world; you might be merely getting fortunate should you earn a living. Take the low-time choice route and stack Bitcoin whereas studying as your funding grows. I can confidently say that you’ll be a lot additional forward in 5 years dollar-cost averaging into Bitcoin than you’ll be playing on shitcoins.

5-Yr Outlook Minimal

Most individuals get excited by Bitcoin throughout one among its parabolic bull runs. I used to be one among them. We’re all excited by getting forward financially, particularly with the specter of inflation hanging over our heads.

If you’re new to Bitcoin and that is your first foray, be sure you are ready to carry this asset for no less than 5 years. You might be doubtless right here throughout a bull run, and except you bought fortunate, it’s most likely on the trailing finish of the bull run. As of the date of writing in December 2023, I consider we’re at first of the subsequent bull market. With the ETF approval, the halving in April 2024, and the Fed poised to show dovish, many catalysts are aligned. This does NOT make it inevitable. Black swans are at all times a risk. With that black swan caveat apart, we appear poised for large value appreciation within the subsequent few years.

Self Custody

The primary time you purchase Bitcoin on the alternate of your alternative, it’ll really feel like shopping for every other asset at a brokerage. You purchase Bitcoin, and the quantity on the display screen displays the quantity of bitcoin you now “personal.”

It’s critically vital that you simply take custody of your Bitcoin. We’ve got seen alternate failure and downright fraud go on very lately. When these frauds are uncovered and prosecuted and the value of Bitcoin will get hammered as a result of many individuals affiliate the asset Bitcoin with the exchanges that promote it, this turns into a HUGE shopping for alternative. When FTX failed 1 yr in the past, the value of Bitcoin was negatively affected, and those that understood that Bitcoin had no elementary downside loaded up. They understood that worry was coursing its method via the market (again to why being educated is SO IMPORTANT on this area). If you happen to purchased Bitcoin at the moment (round 16k), you secured nicely over a 100% achieve in a yr!

Consider seed keys because the password to your Bitcoin, which should be protected as a result of if anybody else will get it, they’ll take possession of your Bitcoin—no bueno. Bitcoin Seed keys are usually protected by a {hardware} pockets or signing machine. This machine protects your seed keys from hackers or dangerous actors. I’ve been utilizing Coldcards for years, and they’re among the finest gadgets for shielding seed keys. It really works very merely. You create your secret keys utilizing the machine; it saves them and retains them offline, by no means linked to the web. That final level is IMPORTANT. You don’t EVER wish to save these phrases on an internet-connected pc. The one place to soundly retailer your Seed Keys is on a tool designed for them. If the pc is compromised (and consider me, it’s VERY LIKELY COMPROMISED) the signing machine will defend your Bitcoin.

This may increasingly all sound very tough and complicated if in case you have by no means performed it earlier than, however belief me, it’s simple. I might suggest that you simply watch BTC Classes movies about utilizing the signing machine you select. He has unbelievable walk-through movies on YouTube that specify do all the pieces intimately.

Collaborative custody with an organization like Swan Bitcoin or Unchained Capital can be a good suggestion for these new to the area. They may maintain your hand and defend you from making easy errors that may trigger points. Collaborative custody is price the fee in case you are frightened about shedding your Bitcoin. Unchained gives a collaborative custody product that may maintain a number of keys and may help your family members retrieve your Bitcoin within the case of your demise.

DO NOT BRAG ABOUT YOUR BITCOIN. There’s a temptation to brag about success. If you happen to keep the course for 5 years, you’ll doubtless have it. You might be proud that you’ve got had the self-discipline and self-control to grasp your self and efficiently purchase what you view as a major quantity of Bitcoin. Don’t share how a lot you’ve got with others. This needs to be apparent, however there are people who is probably not so excited for you. They might inform their associates, and ultimately somebody who you don’t know, who might have the capability for violence, might determine you might be an appetizing goal. That is but one more reason to make use of a multi-sig setup. Even when somebody obtained 1 of three keys, they can not steal your Bitcoin.

Don’t Purchase Bitcoin That You Don’t Management

Don’t buy the shiny new ETF Wall Avenue is providing. Purchase Bitcoin solely at locations that let you take precise custody of your Bitcoin. Don’t put your Bitcoin on any type of service that provides a yield, particularly if that yield appears unrealistically excessive. As a basic rule of thumb, simply don’t do it.

The primary and most vital cause it is best to take custody of your Bitcoin is that you’ve got absolute and full management of it. There’s a saying in Bitcoin, “not your keys, not your cash.” If you happen to shouldn’t have custody of your Bitcoin, you merely have an IOU. That is all the cause for Bitcoin’s existence. To take away middlemen and permit individuals to manage their monetary future.

When you’ve got custody, you don’t incur a payment such as you would with an ETF. These charges can appear low, however over time they are often SIGNIFICANT. GBTC is a belief that’s the most just like a Bitcoin ETF. GBTC fees a 2% payment PER YEAR (now 1.5% with the ETF). Over time this may be vital. Moreover, the ETF merchandise that Wall Avenue is promoting don’t let you EVER custody the bitcoin. An ETF may make sense for some individuals in some situations, however for anybody who can confidently construct a Lego set, taking custody of Bitcoin is of comparable complexity. Simply do it your self.

As Bitcoin turns into extra mainstream, it is going to be attainable to make use of it as collateral. Sure, I perceive that utilizing your Bitcoin as collateral takes it out of your possession and requires belief in a third social gathering. That is one other case the place it is best to educate your self and be SURE that you’ve got chosen a lender that’s reliable and won’t go bust. At all times defer to self-custody if in any doubt.

Borrowing in opposition to your Bitcoin is unimaginable should you don’t have custody of it your self. You can not lend the Bitcoin that Blackrock is holding in your behalf. That is vital. There are tax advantages from borrowing in opposition to Bitcoin as a substitute of promoting it. If you happen to don’t management your Bitcoin, you might be boxing your self out of some predictable use instances within the close to future and plenty of unpredictable makes use of which have but to be invented. Programmable cash will not be helpful should you don’t have custody of it.

The ultimate cause it is best to maintain your Bitcoin is a bit darker. Bitcoin was designed to be uncensorable and unconfiscatable. When it turns into obvious to the state that it’s shedding management of the cash, it’ll doubtless come for yours. This has precedent in U.S. historical past. In 1933, Govt Order 6102 made it unlawful to personal gold for U.S. residents. They compelled individuals to show in gold and obtain $20 per ounce. The federal government then repriced gold at $35 per ounce. You could possibly get jailed for proudly owning gold cash within the U.S. from 1933 till the mid-Nineteen Seventies. This might occur once more, and you’ve got optionality should you maintain Bitcoin your self. Custodians WILL be compelled to present the federal government your Bitcoin on this state of affairs. What you do along with your Bitcoin on this scenario needs to be YOUR name, not a custodian’s.

Duty

If you happen to take the steps to self-custody your bitcoin, you might be accountable. This can be a sort of radical accountability that may fear individuals. If you happen to lose your seed keys, your Bitcoin is misplaced eternally. There isn’t any quantity to name, and nobody who may help you. IT. IS. GONE.

In 2017, one among my associates on the firehouse misplaced what was then $1300 price of bitcoin as a result of he put the Bitcoin on a paper pockets. These aren’t used anymore as a result of they’re so insecure, however you possibly can print out a QR code that can maintain your bitcoin. He left the piece of paper in his automobile. He then cleaned out his automobile and vacuumed up the paper pockets. That Bitcoin is gone eternally. It’s now price someplace within the vary of 4-5 thousand {dollars}, and it is simply gone. Effectively, it is technically not gone, it is nonetheless there; simply not accessible to anybody. With out the password, nobody can transfer the bitcoin, so it’s successfully bitcoin that’s frozen eternally.

One other good pal of mine misplaced a major quantity of Bitcoin at an organization referred to as BlockFi. This was an alternate that provided yield on Bitcoin stored at their alternate. That Bitcoin will not be frozen, however it’s now locked up in litigation for the foreseeable future. So as to add insult to damage—as a result of the Bitcoin when held by BlockFi was not technically his, it’s theirs primarily based on the “settlement” he signed when opening the account, he’ll at some future date get the greenback worth of that bitcoin on the value when BlockFi went bust—which is 16 thousand {dollars}—we have now rounded squarely again to why it is best to take self-custody critically!

The previous saying in bitcoin is “Not your keys, not your Cash.”

Bitcoin is an limitless studying journey. If you need a rabbit gap to discover, you might be in luck! The quantity of stable content material provided within the area is light-years higher than in 2017. You possibly can go from zero to proficient in a fraction of the time it will have taken again then. As was alluded to above a pair instances, we have now curated a Fundamentals Sequence at Blue Collar Bitcoin that you should utilize to get began. The checklist of nice content material creators and sources is so lengthy that we are able to’t identify all of them. Simply go exploring and watch out to confirm, not belief.

Proceed studying, and above all—assume for your self!

Keep in mind the knowledge of Matt Odell: “Keep humble and stack Sats.”

This can be a visitor publish by Josh. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.