Ethereum spot exchange-traded funds (ETFs) that debuted within the US final week have taken the cryptocurrency market at massive by storm with appreciable inflows into these merchandise.

Based on a current report by CoinShares, the appearance of those spot ETFs has attracted $2.2 billion, marking a pivotal second for Ethereum and its buyers.

Surge in Ethereum ETFs, What about Bitcoin?

Coinshares revealed that with the launch of Ethereum ETFs, a large capital surge has not solely been seen but in addition a 542% enhance in Ethereum exchange-traded merchandise (ETPs).

Though the demand surge displays the rising curiosity from buyers searching for publicity to Ethereum by means of regulated monetary merchandise, James Butterfill, head of analysis at Coinshares, highlighted that the determine stays “considerably controversial.” Butterfill defined:

This determine is considerably controversial as Grayscale seeded its new Mini Belief ETF (the week prior) with capital from its incumbent closed-end belief (~US$1bn), which can assist clarify the regular stream of outflows in recent times.

Regardless, introducing these ETFs represents a big milestone, because it aligns with broader market developments the place buyers more and more search various and safe funding channels inside the crypto house.

Nonetheless, it’s not all constructive information, as the general digital asset market has skilled combined fortunes. As an example, the Ethereum belief from Grayscale noticed $285 million in internet outflows regardless of the general market buoyancy.

The broader crypto market has additionally felt the affect of those developments. Based on Coinshares, Bitcoin has continued to draw important capital alongside Ethereum’s inflows, with $3.6 billion flowing in over the previous month.

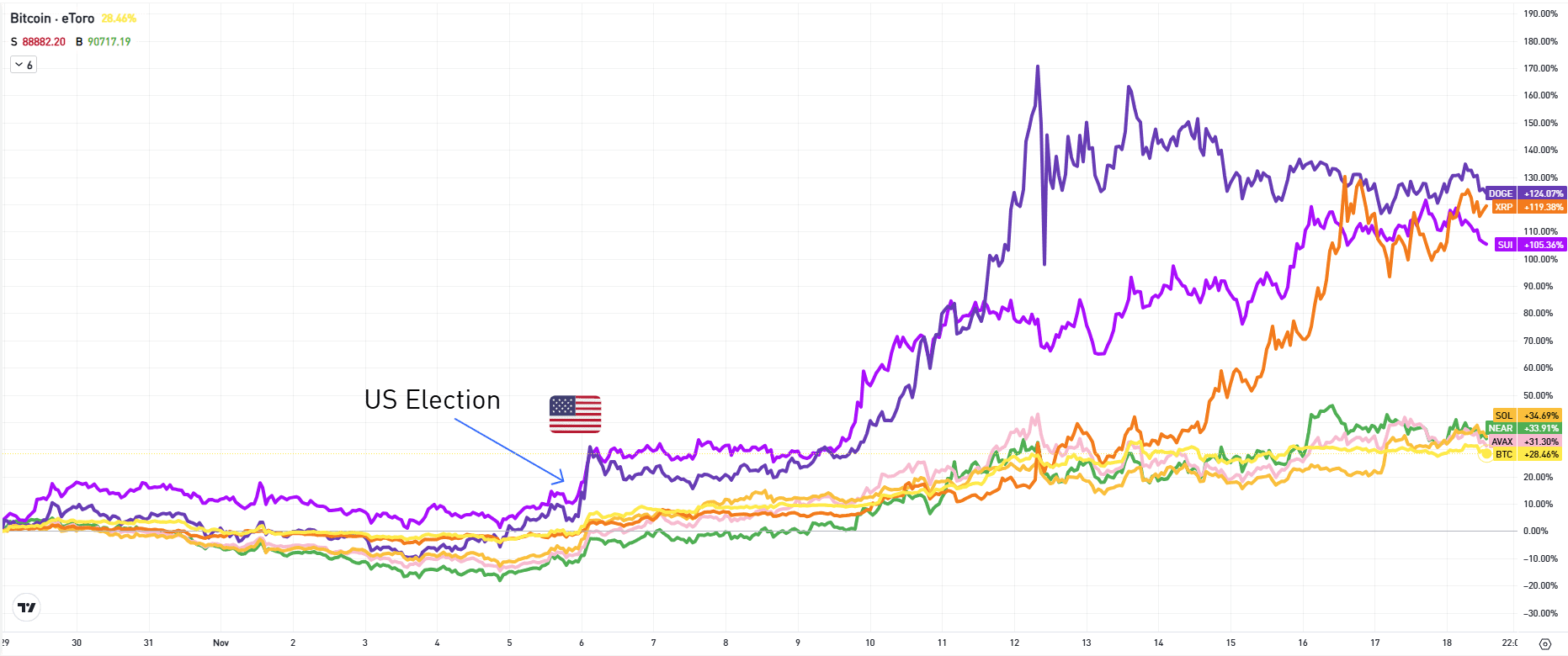

This brings its year-to-date inflows to a historic excessive of $19 billion, underpinned by hypothesis across the US elections and potential modifications in Federal Reserve insurance policies. James Butterfill notably famous:

We consider the US electioneering feedback round Bitcoin as a possible strategic reserve asset, and the elevated possibilities for a September 2024 FED fee minimize are the probably cause for renewed investor confidence.

Moreover, the CoinShares report delves into the aftermath of those flows, highlighting a “record-breaking complete influx of $20.5 billion” throughout all digital property for 2024. Buying and selling volumes have surged to their highest ranges since Could, boosted additional by the Ethereum spot ETFs’ launch within the US.

BTC And ETH Market Efficiency

Following the recorded inflows into Bitcoin and Ethereum spot ETF merchandise, their worth efficiency has struggled to maintain up the tempo.

Ethereum, for example, regardless of launching its spot ETF product final week, the asset demonstrated a “promote the information” worth motion, with ETH dropping as little as $3,098 days following the information.

Though the asset is now buying and selling above $3,300, it has but to match the optimism in its spot ETF merchandise. Bitcoin, then again, regardless of additionally seeing a decline to as little as $64,000 days following the ETH spot ETF launch, the asset was fast to get well.

Presently, Bitcoin trades at $68,850, a slight retracement from its earlier worth of $69,907 seen earlier as we speak. Notably, one notable issue attributed to Bitcoin’s present bullish worth efficiency is the current constructive assertion by former president Donald Trump on the 2024 Bitcoin Convention.

These statements embody firing Gary Gensler if elected president and making a US Authorities strategic nationwide Bitcoin reserve.

Featured picture created with DALL-E, Chart from TradingView