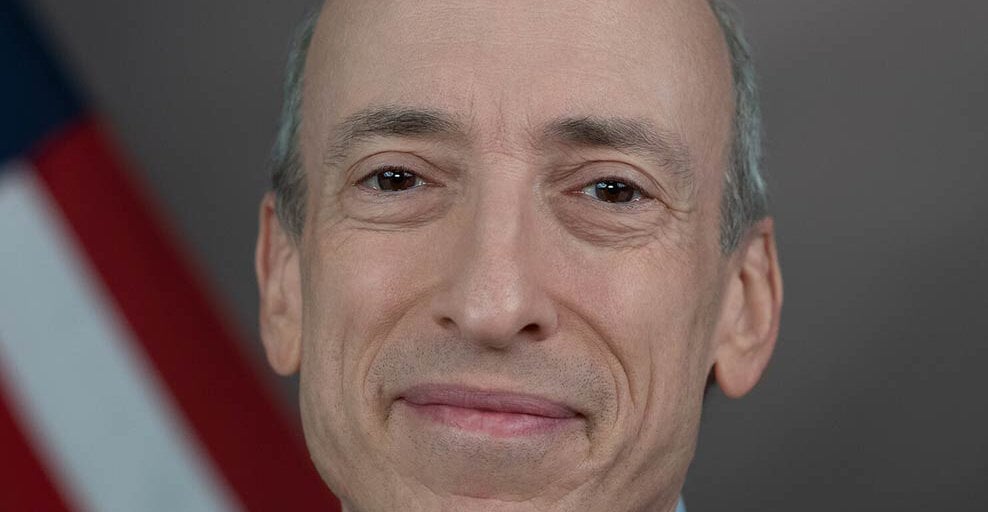

The continuing authorized battle between Coinbase and the Securities and Trade Fee (SEC) centered squarely on the rights of Chairman Gary Gensler in federal court docket on Thursday.

Coinbase’s legal professionals served Gensler with a subpoena final month, searching for in depth data that touches on digital property and the registration of cryptocurrency exchanges. The corporate’s transfer got here after a choose let the SEC’s case in opposition to Coinbase proceed on most costs.

In response, the SEC referred to as upon U.S. District Decide Katherine Polk Failla to carry a casual convention and “quash [the] improper subpoena.” Arguing the subpoena seeks nothing of relevance, SEC counsel additionally wrote that it will create an “undue burden” on the company.

“I used to be kind of shocked and never in a great way,” Failla stated of Coinbase’s written justifications for the subpoena. “I used to be not moved by mainly any of the arguments.”

Though Failla stated she wouldn’t decide on the SEC’s parallel request for a protecting order Thursday, she famous that the “reservoir of credibility that [Coinbase] had constructed up with me all through this litigation” had been drained.

Coinbase lawyer Kevin Schwartz argued that Gensler is “uniquely located as a outstanding voice on crypto’s regulatory standing.” He accused the SEC of stonewalling a subpoena for “related communications on [Gensler’s] private machine.”

“The SEC is broadly refusing to seek for or produce and log communications from Mr. Gensler inside its possession because the SEC,” Schwartz stated.

All through the listening to, nevertheless, Failla appeared extra sympathetic to the SEC, showing considerably annoyed with Schwartz at instances. At one level she prompt Schwartz transfer on from arguments defending the subpoena that she had already discovered have been unpersuasive.

“The [requests], learn collectively, search primarily all SEC paperwork, from 2017 to the current, that in any manner, form, or type contact upon the crypto asset markets,” the SEC wrote in a submitting earlier than Thursday’s listening to, including that Coinbase’s desired scope of paperwork wrongfully runs fours years previous to Gensler becoming a member of the company.

Coinbase’s subpoena additionally sought related data from Gensler on the SEC’s DAO Report and a 2018 speech from William Hinman, a former SEC official, who stated that Bitcoin and Ethereum shouldn’t be thought-about securities as a result of they’re sufficiently decentralized.

The SEC argued in court docket that Gensler’s actions as an company official are separate from these as a person, and that a lot of the paperwork Coinbase seeks aren’t topic to discovery.

“It’s an improper intrusion right into a public official’s personal life, primarily based on his determination to serve,” the SEC wrote, explaining that the subpoena must be directed on the company, not Gensler.

In response to the SEC’s submitting, Coinbase had argued that the subpoenas are related, and that notion is definitely supported by the corporate’s so-called honest discover protection.

The SEC claimed in a lawsuit final yr that Coinbase didn’t register as an change, clearing home, and dealer—all whereas offering these providers to traders. The SEC has additionally alleged that Coinbase supplied and bought unregistered securities via its staking service.

Moreover, the SEC claims that a number of tokens on Coinbase’s platform represent securities, together with main altcoins like Solana, Cardano, and Polygon. Coinbase has denied the claims and argues that “none of those property are securities” on America’s main change.

Schwartz indicated that Coinbase plans to press ahead with the subpoena, planning to submit the mandatory filings to Failla’s court docket by Monday.

Edited by Ryan Ozawa.

Day by day Debrief Publication

Begin each day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.