The approval course of for the Spot Ethereum ETF is progressing easily, in response to the US Securities and Alternate Fee Chair, Gary Gensler. Talking on the Bloomberg Make investments Summit, Gensler expressed optimism for the brand new funding product, which is anticipated to launch as early as July. This improvement marks a major milestone for the cryptocurrency market, as Ethereum prepares to comply with within the footsteps of its Bitcoin counterpart.

Ethereum ETF: Clean Crusing In direction of Approval?

Gensler emphasised the constructive trajectory of the Spot Ethereum ETF approval course of in his remarks. “The registration course of is working easily,” he stated, echoing statements made earlier this month earlier than the US Senate Appropriations Subcommittee on Monetary Providers.

The SEC is actively working with issuers on their S-1 filings, a prerequisite for the ETFs to start buying and selling. “I envision someday over the course of this summer season,” Gensler added, hinting at a possible launch date throughout the subsequent few months.

The SEC’s focus stays on making certain full compliance and transparency. Gensler highlighted the significance of “disclosure and registration,” signaling that these steps are essential for the ETFs’ last approval.

This cautious but assured method goals to safeguard traders whereas facilitating the introduction of progressive monetary merchandise into the market.

Issuers Put together For Launch

A number of Ethereum ETF issuers are racing to fulfill the SEC’s necessities. Companies like VanEck have submitted amended S-1 filings, detailing vital facets reminiscent of seed capital and costs. Notably, VanEck disclosed that it will cost a 0.20% payment, which will likely be suspended till 2025, successfully making the ETF free at launch. This strategic transfer goals to draw traders and set up a powerful foothold available in the market from the outset.

Different issuers are following swimsuit, finalizing their filings and making ready for a possible July launch. The momentum amongst these corporations displays broader business anticipation of the SEC’s approval, which may open the doorways to a brand new wave of funding in Ethereum.

Broader Market Implications

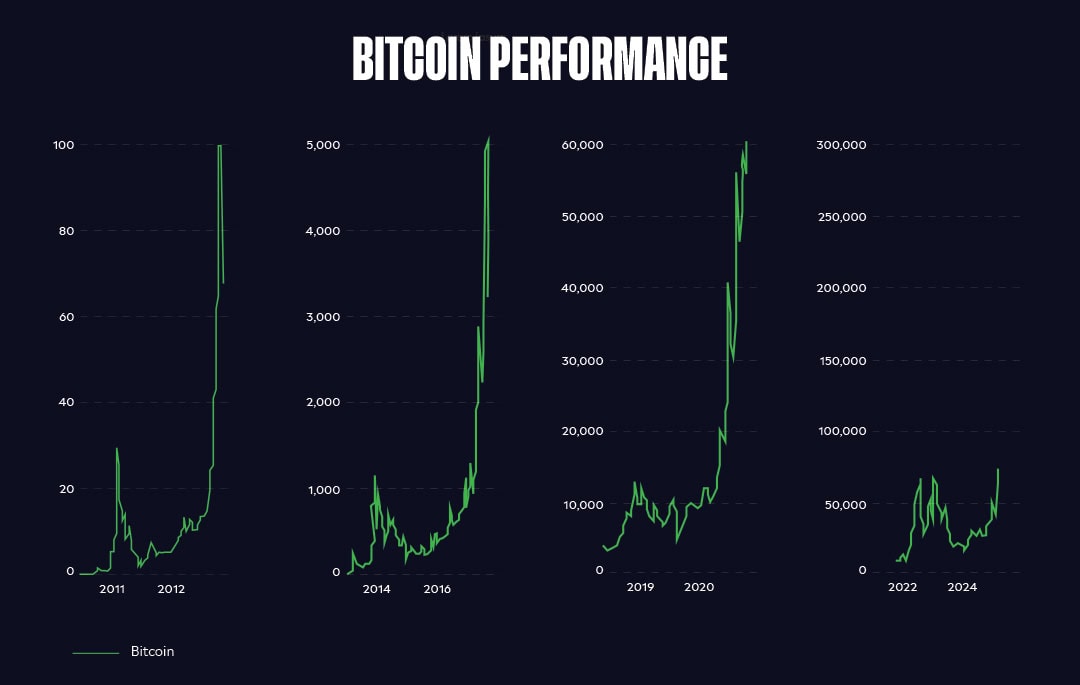

The approval of Spot Ethereum ETFs carries vital implications for the cryptocurrency market. The success of Bitcoin ETFs earlier this yr set a precedent, with Bitcoin costs hovering to an all-time excessive of $73,000 simply three months after the ETF launch. Whereas consultants consider that Ethereum ETFs might not entice the identical degree of inflows as Bitcoin, the potential for elevated funding is substantial.

Gensler didn’t draw back from addressing the broader digital asset market’s challenges. He criticized the business for occasionally utilizing non-compliant strategies and missing essential disclosures. Referring to many cryptocurrencies as securities, Gensler highlighted the necessity for higher regulatory oversight to guard traders.

Featured picture from Pixabay, chart from TradingView