The crypto market is buzzing with the latest approvals of Ethereum ETFs, stirring discussions and speculations amongst buyers and analysts alike.

For the reason that approval of the spot Ethereum ETF final week, Ethereum has solely recorded a surge to as excessive as $3,959 up to now, prior to now retracting to a present buying and selling value of $3,757.

Though reaching the $3,900 mark represents a big improve, it falls in need of the dramatic surge anticipated by many following the US SEC’s approval of the spot ETFs.

Is Spot Ethereum ETF Approval Priced In?

In keeping with a latest report, consultants are divided on whether or not the affect of those approvals has been totally priced available in the market.

Arthur Cheong from DeFiance Capital mentioned this, declaring that the market hasn’t but adjusted to this important shift and that such a significant change in market dynamics can’t be immediately mirrored within the value.

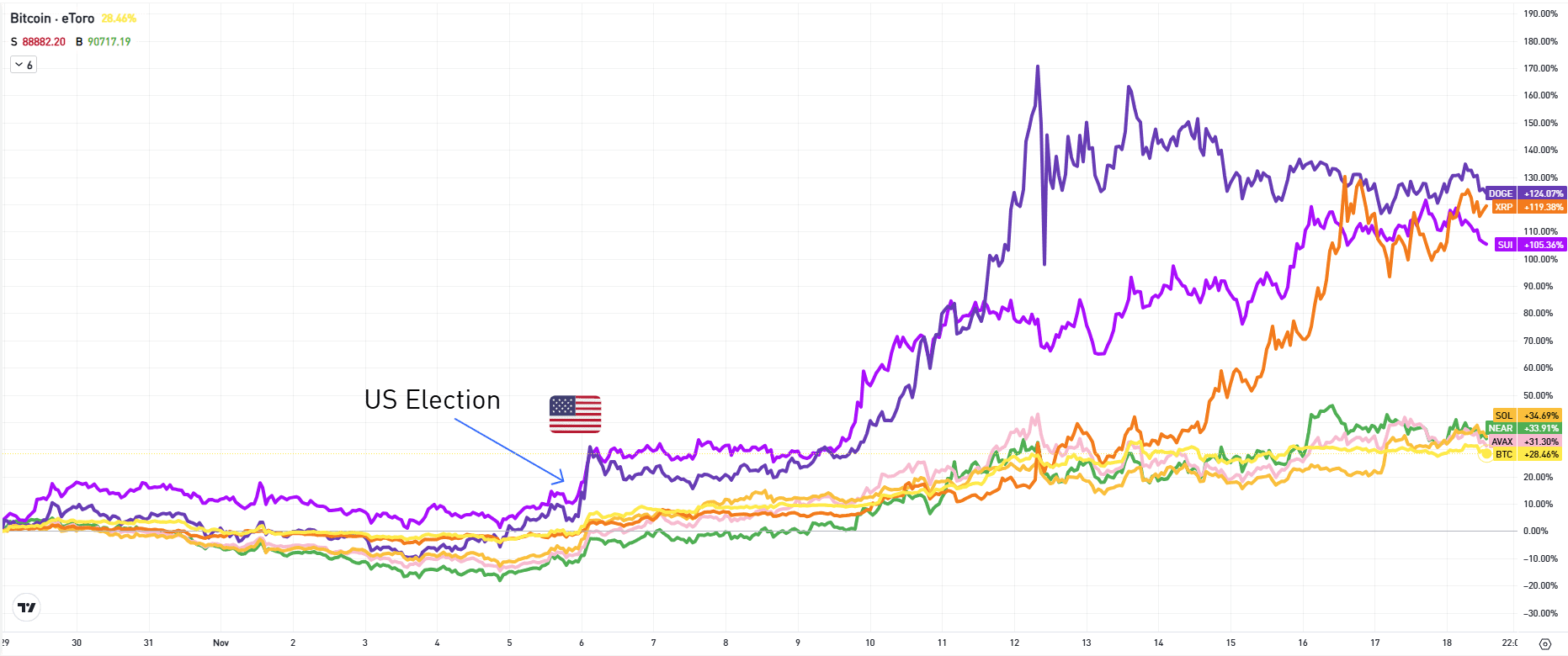

Brian Rudick from GSR concurs, noting that the sample noticed with spot Bitcoin ETFs would possibly repeat with ETH, the place important value actions adopted each the anticipation of and the precise spot ETF launches.

Regardless of Ethereum’s latest good points, the consensus amongst these market consultants means that the complete potential of the ETF approvals may not but be priced in.

Rudick additional disclosed ETH’s future value will doubtless hinge on the inflows into the newly launched spot Ethereum ETFs, much like the traits noticed with Bitcoin. He predicts a potential “50-100% improve” in Ethereum’s value from earlier within the month, pushed by sturdy inflows into these ETFs.

In the meantime, Danny Chong from Tranchess views the approval as solely partially “priced in.” He expects appreciable volatility and potential “sideways buying and selling” within the quick time period because the market adjusts to the “fluctuating demand and provide dynamics.”

Chong emphasizes that the spot ETH ETFs would possibly foster elevated institutional adoption and stabilize Ethereum’s long-term costs.

Skilled Forecasts $1.8 Trillion Market Cap Put up-ETF Approval

In the meantime, Michael Nadeau, the founding father of The DeFi Report, has just lately analyzed the potential results of Ethereum’s spot ETF approval on its market trajectory.

Nadeau has outlined a valuation framework suggesting the complete crypto market might obtain a $10 trillion market cap. He believes that ETH is poised to exceed Bloomberg’s estimated 10-20% of Bitcoin’s internet inflows.

In keeping with his projections, ETH might obtain a market cap of $1.8 trillion on the peak of this cycle, which, assuming the provision stays fixed, might push the value of ETH to roughly $14,984.

For comparability, he notes that if Bitcoin have been to realize a $4 trillion market cap, its value might soar to $202,000.

Featured picture created with DALL-E, Chart from TradingView