The connection between the U.S. Securities and Alternate Fee (SEC) and the cryptocurrency trade has been turbulent. There’s this environment of hostility and uncertainty that continues to place the U.S. at odds with the worldwide crypto market.

The regulator has repeatedly taken motion towards crypto corporations and issued warnings to traders in regards to the dangers of ICOs and different cryptocurrency investments. These actions and warnings are sometimes substantiated with issues over points equivalent to volatility, fraud, and the dearth of regulation as important issues for potential traders.

In 2023 alone, the regulator took 26 enforcement actions associated to cryptocurrencies. Notable actions embody authorized proceedings towards preliminary coin choices (ICOs) for alleged securities violations, scrutiny of main crypto exchanges like Binance, Coinbase, and Kraken concerning the therapy of cryptocurrencies as securities, and an ongoing authorized dispute with Ripple over the standing of XRP.

Whereas the SEC’s actions are pushed by its mandate to guard traders and fight illicit actions, its present hardline stance fails to adequately accommodate cryptocurrencies’ basically distinctive nature.

The U.S. SEC’s Turbulent Relationship with Crypto

SEC’s adversarial stance stems from making use of present securities rules to an trade constructed on decentralized blockchain know-how working outdoors conventional monetary frameworks. Consequently, the SEC has clashed with varied corporations in makes an attempt to implement compliance.

These confrontations, typically labelled as “regulation by enforcement,” underscore the SEC’s dedication to upholding conventional securities rules. Nonetheless, in addition they spotlight the challenges of making use of outdated frameworks to an trade constructed on new ideas and applied sciences.

In 2019, the SEC issued the “Framework for ‘Funding Contract’ Evaluation of Digital Belongings,” and outlined the components that might be thought of for figuring out whether or not a digital asset is a safety. This framework, primarily based on the Howey Check, stipulates that an asset falls underneath SEC jurisdiction if it includes investing cash in a typical enterprise with an expectation of earnings derived primarily from the efforts of others.

Thoughts you, this normal is derived from a 1946 Supreme Courtroom case regarding orange groves and has since been used to distinguish the sale of securities from different purchases. Its utility to crypto is nevertheless attention-grabbing.

The SEC’s broad definition of securities, classifying most cryptocurrencies (excluding Bitcoin) as funding contracts the place earnings derived solely from others’ efforts, disregards cryptocurrencies’ distinctive traits and makes use of circumstances past simply funding automobiles.

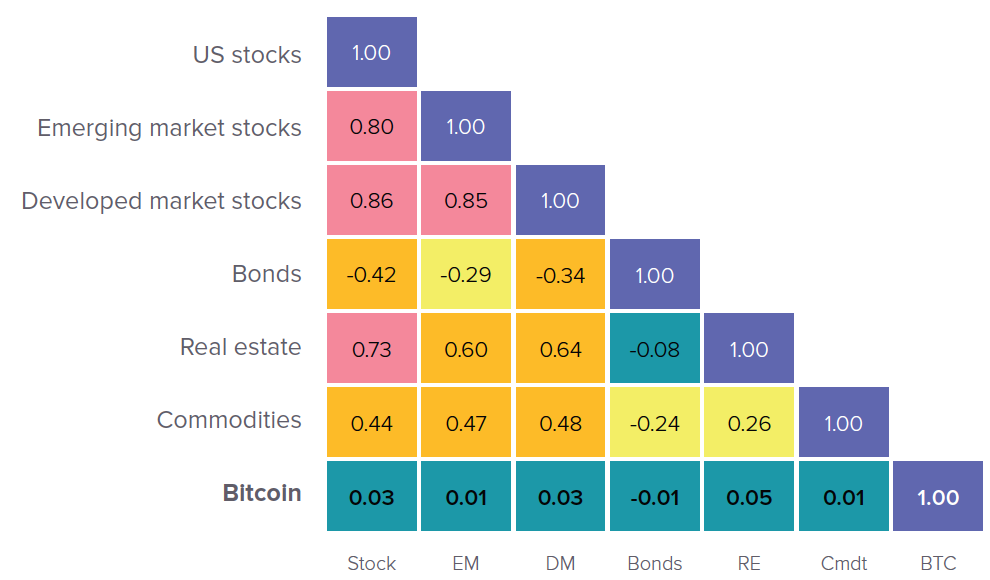

Bitcoin and crypto are basically completely different asset lessons.

Bitcoin and cryptocurrencies symbolize a paradigm shift, introducing novel ideas like trustless peer-to-peer transactions, decentralized networks, and cryptocurrency mining for transaction validation and coin issuance. This basically differs from conventional property like shares and bonds, which means cryptocurrencies could not match neatly into rules designed for outdated monetary markets.

Cryptocurrencies like Bitcoin possess inherent traits that basically differentiate them from typical asset lessons, together with:

Decentralization: Cryptocurrencies operate on decentralized blockchain know-how, negating the need for intermediaries equivalent to banks or central authorities. This decentralized construction enhances transparency, safety, and resistance to censorship.

24/7 Market Entry: In distinction to conventional monetary markets adhering to particular working hours, the cryptocurrency market operates 24/7. This steady accessibility facilitates world buying and selling at any time, providing flexibility to market members.

World Accessibility: Cryptocurrencies can be found to anybody with an web connection, fostering world monetary inclusion. This accessibility is especially impactful for people in areas with restricted entry to standard banking companies.

Restricted Provide and Shortage: Many cryptocurrencies, Bitcoin included, have a capped provide, instilling a way of shortage. For instance, Bitcoin’s most provide is ready at 21 million cash, making a notion of digital shortage that will affect its worth proposition.

Programmability and Sensible Contracts: Sure cryptocurrencies, like Ethereum, allow the creation of programmable contracts generally known as good contracts. These self-executing contracts facilitate automated and trustless execution of predefined agreements, including a layer of performance past easy worth switch.

Neighborhood-Pushed Innovation: The cryptocurrency house thrives on open-source growth and innovation pushed by the neighborhood. This collaborative strategy has given rise to numerous initiatives addressing particular challenges or introducing novel options, fostering a dynamic and evolving ecosystem.

Possession and Management: Cryptocurrency possession is managed by way of personal keys, offering people with direct management over their property. This stands in distinction to conventional monetary programs the place intermediaries typically deal with custody and management over property.

Stating the SEC’s Case

These variations that set cryptocurrencies aside additionally imply that with out sufficient and enough rules catering to this new market, many dangerous actors will (and have) exploited the loopholes within the novel merchandise to defraud traders and steal billions of {dollars}.

The unabated prevalence of scams and hacks additional offers the regulator leeway within the sector. For example, the FTX scandal, which unravelled in November 2023, uncovered the hideous facet of every thing that would go improper in a badly managed crypto entity.

The BitConnect rip-off and the OneCoin Rip-off additionally come to thoughts. (BitConnect, working as a lending platform, turned out to be a Ponzi scheme, inflicting monetary losses estimated at $2.4 billion and the platform’s closure.) OneCoin, based in 2014 by Ruja Ignatova in Bulgaria, is estimated to have defrauded traders of round $25 billion. Ignatova disappeared in 2017, and OneCoin’s different co-founder was discovered responsible of fraud and sentenced to twenty years in federal jail.

Whereas the SEC’s actions have confronted criticism for doubtlessly stifling innovation, it’s essential to acknowledge the company’s efforts in upholding its mandate to fight fraud and safeguard traders. By serving as a deterrent towards illicit actions, the SEC contributes to fostering a sturdy market surroundings for digital property.

The Path Ahead: SEC’s Stance Wants Revision to Accommodate Crypto’s Distinctive Challenges

To strike a steadiness, collaborative efforts between the crypto trade and regulators just like the SEC are important to create a nuanced regulatory framework that acknowledges cryptocurrencies’ distinctive nature whereas nonetheless defending traders.

Till rules adapt to crypto’s distinctive attributes and challenges, reasonably than shoehorning it into present frameworks, the U.S. crypto trade will stay embattled and in a repair. The intriguing half is that the SEC’s stance can not change; the U.S. legal guidelines should be modified, or new ones should be created. To quote the present SEC Chairman Gary Gensler, “When a brand new know-how comes alongside, our present legal guidelines don’t simply go away.”

It’s as much as the U.S. legislators to do that. Nonetheless, the delay in crafting legal guidelines for this evolving trade has raised issues, particularly as different nations typically look to the U.S. for steering on financial legal guidelines and innovation. These delays have additionally pressured the SEC’s hand, making the company attempt its finest to stem the huge wave of illicit actions and crimes within the sector.

Whereas the regulatory hurdles confronting the cryptocurrency trade differ throughout jurisdictions. For example, whereas El Salvador has formally acknowledged Bitcoin as authorized tender, nations like China have outrightly prohibited Bitcoin and crypto transactions. This divergence in regulatory approaches means that the crypto house can doubtlessly evolve independently from the affect of the SEC and its oversight of digital property. This appears to be the inevitable finish.

Ought to You Be Involved In regards to the U.S. SEC’s Stance on Cryptocurrency?

So, ought to we fear in regards to the SEC’s unclear–muddled up–stance about crypto? Sure, in case you are a U.S. resident, as a result of it has a powerful bearing on how you’d entry crypto companies.

Latest authorized victories for corporations like Ripple and Grayscale, in addition to rising curiosity from conventional finance establishments in crypto-based funding automobiles like Bitcoin ETFs, underscore the urgent want for a balanced strategy that fosters innovation whereas defending traders.

Nonetheless, on this present ambiguous regulatory local weather, as traders, you have to train warning and conduct thorough analysis earlier than you make any determination whereas additionally carefully monitoring developments. It’s also possible to be proactive and advocate for smart crypto rules by participating with lawmakers, taking part in public remark durations, and supporting trade organizations working in the direction of smart crypto guidelines within the U.S.

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you wish to learn extra information articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.