On-chain knowledge reveals {that a} Chainlink indicator is at present forming a sample that has led to a median 50% enhance for LINK previously.

Chainlink 30-Day MVRV Ratio Has Plunged

In a brand new put up on X, analyst Ali mentioned the newest pattern in Chainlink’s 30-day MVRV ratio. The “Market Worth to Realized Worth (MVRV) ratio” is a well-liked on-chain indicator that tracks the ratio between LINK’s market cap and realized cap.

The market cap naturally refers back to the whole valuation of the asset’s circulating provide on the present spot worth. In distinction, the realized cap is a unique sort of capitalization mannequin that calculates the full worth of the cryptocurrency by as an alternative taking the worth at which every coin in circulation final moved on the community as its “true” worth.

Because the final transaction of any coin was most likely the final time it modified fingers, the worth at its time would signify its present price foundation. As such, the realized cap sums up the fee foundation of each coin in circulation.

On this view, the realized cap can be nothing however a measure of the full capital the traders have used to buy the asset. In distinction, the market cap represents the worth that they’re holding proper now.

The MVRV ratio compares these two fashions, and its worth can present hints about whether or not the general market holds roughly than it places into Chainlink.

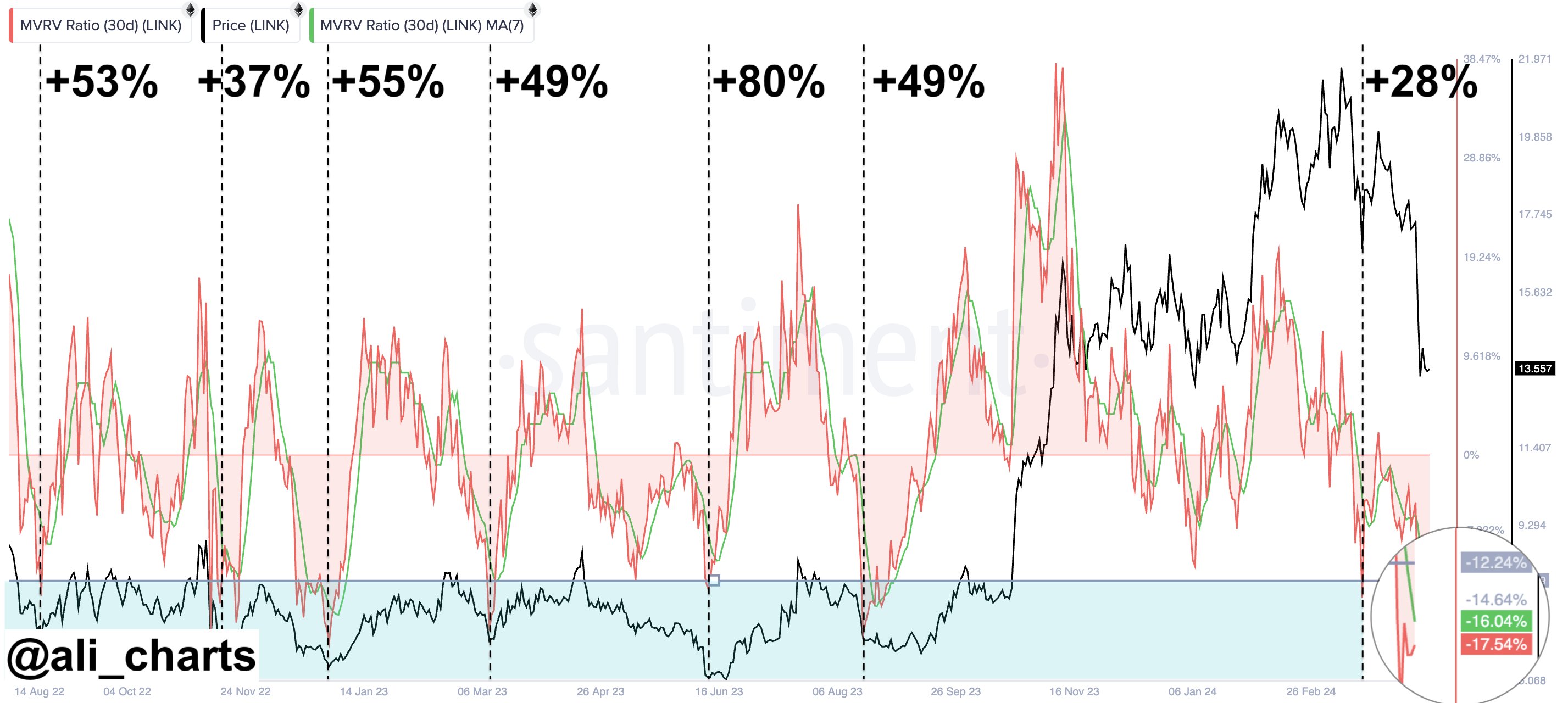

Within the context of the present subject, the 30-day model of this indicator is of focus, which restricts itself to solely the traders who purchased throughout the previous month. Right here is the chart shared by the analyst that reveals the pattern on this LINK indicator over the previous couple of years:

The worth of the metric appears to have registered a steep decline in current days | Supply: @ali_charts on X

As displayed within the above graph, the Chainlink 30-day MVRV ratio has just lately taken a pointy plunge and dipped below the 0% mark. The 0% mark is the place the market cap and realized cap are precisely equal, so beneath it, the latter can be better than the previous.

When that is the case, the traders are carrying losses. This current plunge into the destructive has naturally come for the metric because the cryptocurrency’s worth has plummeted, placing the 30-day consumers underwater.

Within the chart, Ali has highlighted a selected sample that Chainlink seems to have adopted relating to this indicator, plunging deep into the destructive territory. “Every time Chainlink MVRV 30-Day Ratio has dropped beneath -12.24% since August 2022, it’s signaled a first-rate shopping for alternative, averaging 50% returns!” notes the analyst.

Just lately, the indicator has declined in the direction of 17.54%, which means it’s beneath this stage, which has traditionally led to worthwhile shopping for home windows for the coin. It stays to be seen whether or not the sample adopted within the final two years will maintain this time as properly.

LINK Value

The previous week has been horrible for Chainlink traders. The asset’s worth has plunged by greater than 23%, coming down to only $13.3 now.

Seems like the worth of the coin has plunged just lately | Supply: LINKUSD on TradingView

Featured picture from Shutterstock.com, Santiment.internet, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal threat.