Charitable monetary planning is a way that hyperlinks monetary knowledge with altruism, with the twin intention of rewarding the donor and serving the general public good. This complete information simplifies the idea and presents insights into making your charitable efforts as efficient and fulfilling as doable.

What Is Charitable Monetary Planning?

Charitable monetary planning is a brilliant method for folks to assist causes they care about by planning their donations. This isn’t nearly giving cash away. It’s about ensuring your charitable giving matches into your monetary plan so you may assist others whereas additionally taking care of your self. This strategy makes it doable to assist nonprofit organizations or causes in a method that may additionally present monetary advantages to you, like probably qualifying for tax advantages.

How Charitable Monetary Planning Works

At its core, charitable monetary planning is about deciding the way to give your cash or property to charity as a part of your general monetary planning. This implies fascinated with how a lot you wish to give, when to provide it, and the way to do it in a method that’s greatest for you and the causes you assist.

For instance, you would possibly wish to give in a method that lowers your taxes or matches into your property planning. This requires a little bit of homework and probably speaking to a monetary advisor who is aware of about charitable donations. The aim is to make giving a part of your monetary technique so you may hold supporting your favourite causes with out hurting your monetary well being.

Totally different Strategies of Giving

Relating to charitable monetary planning, there are a number of strategies you should use to make your donations. Every has its personal set of advantages and might match totally different monetary and private targets.

Direct Donations

Probably the most easy methodology is direct donations. With direct donations, you give cash, shares, or different property on to a charity.

One of many greatest benefits of direct donations is their simplicity: you resolve how a lot to provide and to whom, and then you definately make a donation. This methodology may supply tax advantages—if you happen to itemize your taxes, you may deduct the worth of your donation out of your taxable revenue, which could decrease your tax invoice. For instance, if you happen to donate $1,000 to a homeless shelter, you immediately assist these in want and can also scale back your taxable revenue by $1,000.

Charitable Trusts

Charitable trusts are a extra subtle strategy to make charitable donations. They allow you to put property right into a belief that may finally go to a charity or charities of your selection.

There are two important varieties of CTs: a charitable lead belief (CLT) and a charitable the rest belief (CRT). With a CLT, the charity will get revenue from the belief for a set variety of years, and what’s left goes to your heirs. With a CRT, you or your heirs get revenue for a interval, after which the charity receives the rest. Each these trusts will be nice for monetary planning—they could assist scale back property taxes, be a supply of revenue throughout your lifetime, and nonetheless assist your favourite causes.

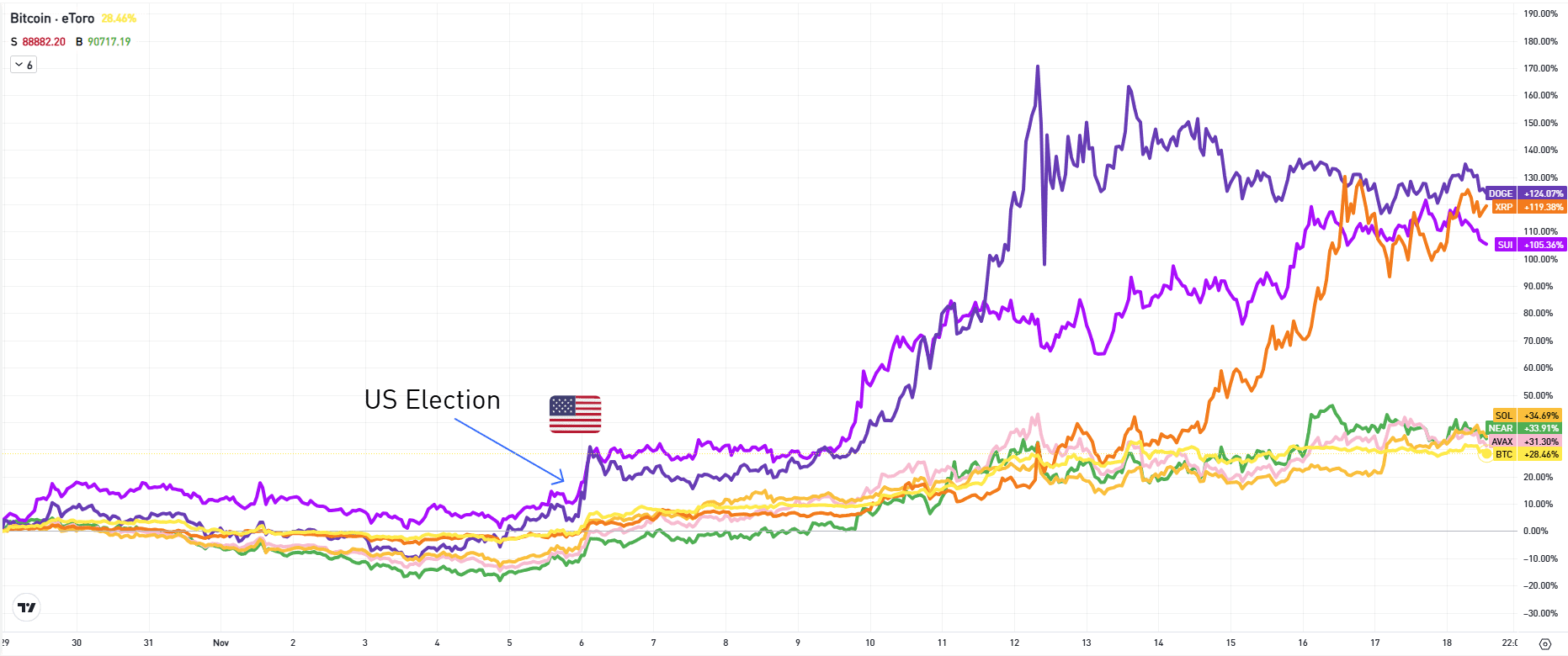

When planning for the longer term, think about the chances of cryptocurrency. Study concerning the potential affect of a $100 funding in Bitcoin at this time in our detailed article right here.

Donor-Suggested Funds (DAFs)

Donor-advised funds are one other common possibility for charitable giving. Right here, you set cash or property right into a fund, get a tax deduction that 12 months, after which advocate grants to charities over time. It’s a versatile strategy to give as a result of you may resolve when and the way a lot to donate to totally different organizations. Plus, since you get the tax deduction up entrance, it could assist scale back your taxable revenue in a 12 months when you might have extra revenue than common.

In abstract, charitable monetary planning means that you can assist the causes you’re enthusiastic about in a method that matches your monetary targets and probably presents tax advantages.

Tax Financial savings By means of Charitable Monetary Planning

Charitable monetary planning combines the will to assist significant causes with the chance to take pleasure in tax benefits. This structured strategy consists of choices like direct donations, that are immediately deductible from revenue tax, trusts that may decrease property taxes, donor-advised funds that provide rapid tax deductions whereas allowing future suggestions for grants, and endowments that guarantee ongoing assist for charitable initiatives with the additional advantage of potential tax deductions for the donor.

Understanding the tax implications of charitable giving is essential for maximizing financial savings. Sustaining detailed information of all donations is vital to claiming rightful deductions. The timing of donations additionally performs a pivotal position; to profit within the present tax 12 months, contributions have to be accomplished by year-end. This necessitates proactive measures to make sure donations, whatever the methodology—be it examine, bank card, or different means—are processed well timed.

Furthermore, itemizing deductions—a course of the place taxpayers record out particular deductible bills comparable to charitable donations reasonably than choosing the usual deduction—can considerably affect tax advantages. Many overlook the extra tax financial savings that itemizing presents, probably lacking out on the prospect to spice up their charitable affect with out incurring further prices. Strategic planning and timing of donations can’t solely profit the donor financially but additionally amplify the assist supplied to cherished causes.

Why Crypto Donations Are a Factor?

Cryptocurrency donations have gained recognition for a number of causes, each from the donor’s and the recipient’s views. They provide a novel mix of monetary technique, philanthropy, and technological innovation. Right here’s an in depth exploration:

1. Tax Advantages for Donors: When donating cryptocurrency on to a charity, donors can probably bypass capital features taxes on the appreciated property. This provides to the monetary attraction of crypto donations as a result of one other route—promoting the cryptocurrency first after which donating the money proceeds—is burdened by capital features tax.

2. Rising Adoption of Cryptocurrency: Because the adoption and acceptance of cryptocurrencies like Bitcoin and Ethereum develop worldwide, donors search for methods to make use of their digital property philanthropically. Charities and nonprofits adapting to just accept donations in cryptocurrency can faucet into a brand new donor base enthusiastic about digital foreign money and its potential.

3. Anonymity and Transparency: Some cryptocurrencies can supply donors anonymity, interesting to those that choose to maintain their philanthropy personal. Then again, blockchain know-how can present transparency, permitting donors to see precisely how their donation is being utilized by the charity.

4. Effectivity and Decrease Transaction Prices: Crypto transactions will be extra environment friendly and have decrease charges than conventional banking programs, particularly for worldwide donations. This effectivity ensures {that a} bigger portion of the donation goes on to the trigger.

Contemplating a donation in cryptocurrency? The preliminary step is buying some. Changelly presents aggressive charges and fast transaction occasions, making it a wonderful selection. Click on right here to hitch our neighborhood of over 7 million customers and expertise the comfort at this time!

Are crypto donations tax-deductible?

Sure, you may deduct taxes if you happen to donate in crypto. The IRS has confirmed that charitable donations in cryptocurrency usually are not topic to capital features taxes and will be deducted from one’s gross revenue in some instances. Nevertheless, it’s necessary to maintain thorough information, particularly for donations price $250 or extra, and if you happen to’re donating greater than $5,000 in crypto, you have to have a certified appraisal to use for a deduction.

Setting Up a Charitable Plan

Relating to organising a charitable plan, success hinges on a considerate charitable technique that aligns philanthropic targets with the appropriate charitable organizations. Step one in profitable charitable monetary planning is defining these targets. Whether or not pushed by a ardour for training, healthcare, or environmental conservation, figuring out particular areas of curiosity helps focus efforts and sources successfully. This readability ensures donations go away a mark on fields the donor is genuinely enthusiastic about.

The following step includes meticulous analysis to pick out charities that not solely match the donor’s targets but additionally function effectively and successfully. The panorama of charitable organizations is huge, and never all are created equal by way of affect and operational transparency. Therefore, it’s very important to decide on these with a strong monitor file of success within the areas that matter most to the donor.

Collaborating with monetary planners can additional refine this charitable technique, making it doable to navigate the complexities of charitable giving with ease. This partnership can guarantee donations are structured to maximise tax efficiencies, thereby enhancing the donor’s capability to assist their chosen causes extra robustly. By means of structured charitable monetary planning, donors can craft a plan that not solely aligns with their values but additionally leverages monetary methods to make a extra substantial distinction.

Charitable Monetary Planning: Execs and Cons

Charitable monetary planning permits people to weave charitable contributions into their broader monetary and property planning, leveraging numerous giving strategies for enhanced affect and private satisfaction. Nevertheless, like all advanced technique, it comes with each benefits and potential drawbacks.

Advantages of Charitable Monetary Planning

Leaving a Legacy

By means of structured giving choices like endowments or scholarships, donors have the chance to ascertain an enduring affect that transcends their lifetime. This strategy not solely helps significant causes indefinitely but additionally secures a donor’s legacy, making certain their values and commitments proceed to make a distinction.

Monetary Development By means of Charitable Belief

Charitable trusts supply a novel strategy to mix philanthropic targets with monetary progress alternatives. By offering revenue to the donor or their beneficiaries and finally transferring property to charity, these trusts create a win-win situation that may improve the donor’s monetary technique whereas supporting cherished causes.

Fulfilling Philanthropic Objectives

Structured charitable monetary planning permits donors to focus on their contributions extra successfully, making certain that each greenback makes essentially the most important doable affect. This strategic strategy amplifies the advantages of every donation, satisfying donors’ needs to contribute to significant change.

Challenges of Charitable Monetary Planning

Unsure Future Tax Adjustments

The panorama of tax laws is at all times evolving, making it difficult to foretell how future adjustments would possibly have an effect on the tax effectivity of charitable contributions. This uncertainty can complicate planning and will deter some potential donors.

Potential for Misuse

With out thorough analysis and due diligence, there’s a danger that donations might not be used as supposed. The effectivity and transparency of charitable organizations fluctuate, underscoring the significance of choosing respected companions in your philanthropic efforts.

Prices of Setting Up Trusts or Funds

Establishing and managing charitable trusts or donor-advised funds includes numerous charges, which may diminish the funds obtainable for charitable functions. Authorized, administrative, and administration prices have to be fastidiously thought of to make sure that nearly all of your contribution goes on to the supposed trigger.

Concluding Ideas

In essence, whereas charitable monetary planning presents a strong mechanism for making an enduring distinction, it requires contemplation and strategic planning. By understanding each the advantages and challenges, donors could make knowledgeable selections that fulfill their philanthropic targets, guarantee their legacy, and foster a sustainable affect on the world.

To navigate these waters efficiently, donors ought to keep knowledgeable about potential tax legislation adjustments, conduct thorough analysis on charitable organizations, and look at the prices related to totally different giving strategies. Consulting with monetary and authorized professionals can present beneficial insights, serving to donors craft a charitable monetary plan that aligns with their values, maximizes affect, and optimizes tax advantages.

Disclaimer: Please be aware that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.