This text is featured in Bitcoin Journal’s “The Major Difficulty”. Click on right here to get your Annual Bitcoin Journal Subscription.

Click on right here to obtain a PDF of this text.

“Economics I believe is type of like accounting — , it doesn’t instantly have any morals. You may go into welfare economics, you strive to think about some human values otherwise you go into variations.” – John F. Nash Jr., The College of Scranton, November, 2011.

This citation from John Forbes Nash Jr. is taken from a lecture Nash gave on “Splendid Cash and the Motivations of Financial savings and Thrift”, some 61 years after the publication of his first sport principle paper merely named “The Bargaining Downside” (1950).

“The Bargaining Downside” is critical as a result of it’s believed to be one of many first examples the place an axiomatic strategy is launched into the social sciences. Nash introduces “The Bargaining Downside” as a brand new therapy of a classical financial drawback — concerning it as a nonzero-sum, two-person sport, the place a couple of normal assumptions and “sure idealizations” are made in order that values are discovered for the sport.

The family tree from “The Bargaining Downside” to Nash’s later works on Splendid Cash is established, the place in “The Bargaining Downside” Nash remarks upon the utility of cash:

“When the bargainers have a typical medium of change the issue might tackle an particularly easy type. In lots of instances the cash equal of a great will function a passable approximate utility operate.” John F. Nash Jr., The Bargaining Downside (1950).

Nash’s bargaining proposal is basically asking in regards to the fairest strategy to cut up $1 between members in a monetary transaction or contract, the place all sides has a spread of pursuits and preferences and the place there have to be settlement, or else each side will get nothing. The axioms that are launched for a Nash cut price go on to outline a singular resolution.

Nash Equilibrium versus Nash Bargaining

In The Important John Nash (2007), Harold Kuhn describes Nash’s subsequent “Non-Cooperative Video games” (1950) paper, and what later turned referred to as Nash equilibria, as a “clumsy, if completely unique, software of the Brouwer fastened level theorem”. But it was Nash’s equilibrium concept which bestowed him a public profile by way of a Nobel prize within the financial sciences. Nash’s life was later dramatized within the Hollywood movie A Lovely Thoughts.

In “Non-Cooperative Video games”, Nash’s principle relies on the “absence of coalitions, in that it’s assumed every participant acts independently, with out collaboration or communication with any of the others”. In Adam Curtis’s tv documentary The Entice (2007), Nash describes his equilibria as social adjustment:

“…this equilibrium which is used, is that what I do is completely adjusted in relation to what you’re doing, and what you’re doing or what some other particular person is doing is completely adjusted to what I’m doing or what all different individuals are doing. They’re looking for separate optimisations, similar to poker gamers.” John F. Nash Jr., The Entice (2007, Adam Curtis), F*ck You, Buddy.

The distinction between Nash equilibrium and Nash bargaining is that axiomatic bargaining (or reaching a Nash cut price) assumes no equilibrium. As an alternative, it states the specified properties of an answer. Nash bargaining is considered cooperative sport principle due to its nonzero-sum attribute and the existence of contracts. Nash prolonged the axiomatic therapy of The Bargaining Downside in “Two-Individual Cooperative Video games” (1953), introducing a menace strategy in which there’s an umpire to implement contracts — within the course of discounting “methods” as not containing particular qualities and quite specializing in formal illustration of a decided sport.

Splendid Cash and Asymptotically Splendid Cash

Simply earlier than the flip of the century, John Nash begins writing and lecturing on an evolving thesis known as Splendid Cash. It assumed completely different iterations through the years, however Nash outlined it as cash intrinsically freed from inflation or inflationary decadence. Nash isn’t a lot vital of Keynes the economist or particular person, however of the psychology of what’s turn into referred to as Keynesianism; Nash regarded it a Machiavellian scheme of continuous inflation and foreign money devaluation. Nash believed if central banks are to focus on inflation, they need to goal a zero charge for “what is known as inflation”:

“It’s only actually respectable that there shouldn’t be an arbitrary or capricious sample of inflation, however how ought to a correct and fascinating type of cash worth stability be outlined?” John F. Nash Jr., “Splendid Cash and Asymptotically Splendid Cash”, 2010.

In “Splendid Cash”, Nash returns to the axiomatic strategy he first establishes in his inchoate sport principle. Splendid Cash due to this fact turns into vital of Keynesian macroeconomics:

“So I really feel that the macroeconomics of the Keynesians is corresponding to a scientific examine of a mathematical space which is carried out with an inadequate set of axioms.” John F. Nash Jr., “Splendid Cash and Asymptotically Splendid Cash”, 2008.

Nash defines the lacking axiom:

“The lacking axiom is just an accepted axiom that the cash being put into circulation by the central authorities must be so dealt with as to keep up, over lengthy phrases of time, a steady worth.” John F. Nash Jr., “Splendid Cash and Asymptotically Splendid Cash”, 2008.

In 2002, within the Southern Journal model of Splendid Cash, Nash realizes an excellent cash can’t be fully freed from inflation (or too “good”), as it’ll have issues circulating and may very well be exploited by events who want to safely deposit a retailer of wealth. Nash then introduces a gentle and fixed charge of inflation (or asymptote) which may very well be added to lending and borrowing contracts.

Certainly, Nash describes the aim of Splendid Cash in a cooperative sport and microeconomic context:

“An idea that we considered later than on the time of creating our first concepts about Splendid Cash is that of the significance of the comparative high quality of the cash utilized in an financial society to the potential precision, as an indicator of high quality, of the contracts for performances of future contractual obligations.” John F. Nash Jr., “Splendid Cash and Asymptotically Splendid Cash”, 2008.

Bitcoin as an Axiomatic Design

If Nash’s view of economics was that it lacks any fast morals — and that values, assumptions, axioms, variations, or idealizations will be launched to find out a nonzero-sum or decided sport which offers welfare for all members — then it’s price contemplating if these axioms are current within the Bitcoin system, on condition that Nash, along with Satoshi, have been each vital of the arbitrary (or undetermined) nature of centrally managed currencies.

Pareto Effectivity

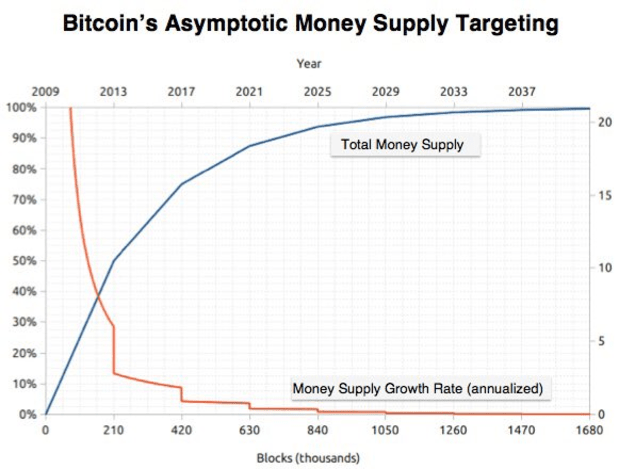

The presence of Pareto effectivity is probably probably the most demonstrative Nash bargaining axiom (see illustration) in Bitcoin with respect to the cumulative provide density and distribution: Nearly all of cash are mined comparatively early within the Bitcoin lifespan (loosely following the Pareto 80/20 energy regulation).

Scale Invariance

The size invariance is current by way of the issue adjustment mechanism which retains bitcoin provide “regular and fixed” (a phrase each Nash and Satoshi use). Irrespective of how widespread or unpopular bitcoin turns into to mine, the dimensions invariance ought to imply gamers can type life like expectations on the worth of bitcoin, and that their underlying preferences shouldn’t change concerning this. The inner divisibility of bitcoin additionally means the worth a coin is expressed in (whether or not the U.S. greenback or different foreign money) shouldn’t matter over shorter or fast time frames — simply as room temperature will be expressed as Celsius or Fahrenheit with out affecting the precise temperature. These variations ought to turn into clear solely over the long run or in intertemporal transactions.

The adjustment mechanism additionally retains whole bitcoin provide at just below 21 million, resulting from a facet impact of the system knowledge construction, and due to this fact introduces the asymptote.

Symmetry

Nash’s symmetry axiom is current within the pseudonymity and decentralization of the Bitcoin community, which offers for equality of bargaining talent (a phrase Nash introduces in “The Bargaining Downside”) by way of not having to show first-person id in taking part within the core or main community. It means there isn’t a centralized or trusted principal liable for minting the cash, a “grand pardoner” in Nash’s phrases. In relation to Nash bargaining, two gamers ought to get the identical quantity if they’ve the identical utility operate, and are due to this fact indistinguishable. Alvin Roth (1977) summarizes this because the label of gamers not mattering: “If switching the labels of gamers leaves the bargaining drawback unchanged, then it ought to depart the answer unchanged.”

Independence of Irrelevant Alternate options (IIA)

Lastly, there may be Nash’s most controversial bargaining axiom: the Independence of Irrelevant Alternate options. In easy phrases, this implies including a 3rd (or non-winning candidate) to an election between two gamers shouldn’t alter the result to the election (third events turn into irrelevant). If peer-to-peer is referring to a two-player sport, with the Bitcoin software program performing as a third-party arbitrator or umpire to “the sport” with the software program designed to a set of values or axioms, then it’s potential that IIA is current in Bitcoin’s proof-of-work. This speaks to a social group choice context: The proof-of-work says it solves the issue of the willpower of illustration in majority decision-making, and that Nash’s axiomatic bargaining (in each “The Bargaining Downside” and “Two-Individual Cooperative Video games”) explicitly addresses formal illustration in determinative video games.

Traits and Advantages of Cooperation

Usually talking, there are believed to be three situations required for a cooperative sport:

Lowered members, as there may be much less room for verbal problems, i.e., two gamers.Contracts, the place members are capable of agree on a rational joint plan of motion, enforceable by an exterior authority resembling a courtroom.Members are capable of talk and collaborate on the idea of trusted data and have full entry to the construction of the sport (such because the Bitcoin blockchain).

In respect of a nonzero sum sport and the cash choice, John Nash displays on how cash can facilitate transferable utility by means of “lubrication”, and makes this remark:

“In Recreation Idea there may be usually the idea of ‘pay-offs’, if the sport shouldn’t be merely a sport of win or lose (or win, lose, or draw). The sport could also be involved with actions all to be taken like on the similar time in order that the utility measure for outlining the payoffs may very well be taken to be any sensible foreign money with good divisibility and measurability properties on the related immediate of time.” John F. Nash Jr., “Splendid Cash and the Motivation of Financial savings and Thrift”, 2011.

The advantages of cooperation cut back the necessity for mediation or dispute decision as contracts and agreements turn into extra reliable; much less border friction in buying and selling; a nonzero-sum final result (win-win bargaining or welfare economics); extra intuitive, casual decision-making; and the chance for coalition formation which John Nash finally defines as a world empire context. The latter makes resolutions to tough issues like internet zero (or some other drawback requiring multilateral coordination) extra life like. Nash likens his Splendid Cash proposal to old school sovereigns:

“Any model of splendid cash (cash intrinsically not topic to inflation) can be essentially corresponding to classical “Sovereigns” or “Seigneurs” who’ve offered sensible media to be used in merchants’ exchanges.” John F. Nash Jr., “Splendid Cash and the Motivation of Financial savings and Thrift”, 2011.

Nash additionally displays in 2011 on a “sport” of contract signatures, as if Splendid Cash is the contract:

“It’s as if there may be one other participant within the sport of the contract signers and this participant is the Sovereign who offers the medium of foreign money when it comes to which the contract is to be expressed.” John F. Nash Jr., “Splendid Cash and the Motivation of Financial savings and Thrift”, 2011

Concluding Remarks

It’s believable to explain the Bitcoin system as a cooperative sport in a non-cooperative setting, and whereas it could be that the axioms current in Bitcoin are usually not restricted to simply these required for a Nash cut price, it might seem there are substances within the system design that give Bitcoin a deterministic attribute. On the very least, they comprise sure morals as Nash remarked as fascinating in his Scranton lecture.

Lastly, John Nash first conceived his bargaining resolution in 1950. It’s maybe becoming due to this fact he offers a less complicated context to framing the query of cash as that of “honesty” in one among his last lectures on the topic delivered to the Oxford Union shortly earlier than his loss of life in 2015.

References

A Lovely Thoughts – S Nasar

“The Bargaining Downside” – J Nash

“Non-Cooperative Video games” – J Nash

“Two-Individual Cooperative Video games” – J Nash

The Important John Nash – H Kuhn & S Nasar

Nash Bargaining Resolution – Recreation Idea Tuesdays – P Talwalkar

This text is featured in Bitcoin Journal’s “The Major Difficulty”. Click on right here to get your Annual Bitcoin Journal Subscription.

Click on right here to obtain a PDF of this text.