Staking platform Lido’s share of staked ether (ETH) has continued to fall, which ought to cut back issues about focus within the Ethereum community, elevating the prospect that ETH will not be designated as a safety sooner or later, JPMorgan (JPM) mentioned in a analysis report on Wednesday.

“The share of Lido in staked ETH has decreased farther from round one third a 12 months in the past to round 1 / 4 in the mean time,” analysts led by Nikolaos Panigirtzoglou wrote.

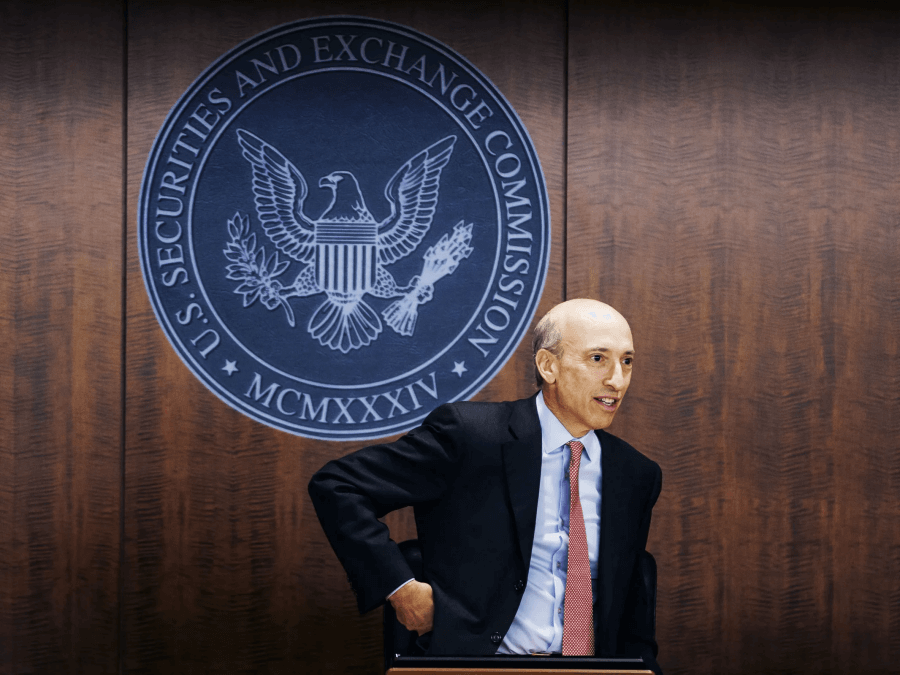

The Hinman paperwork, which have been launched final June, “revealed the position of community decentralization within the SEC’s considering on whether or not a digital token ought to be categorised as a safety or not,” the analysts wrote.

JPMorgan notes that officers from the Securities and Alternate Fee (SEC) had acknowledged prior to now that “tokens on a sufficiently decentralized community are now not securities as there isn’t any controlling group within the Howey sense.”

The Howey Take a look at pertains to the U.S. Supreme Courtroom case to find out whether or not a transaction qualifies as an funding contract. If a transaction is taken into account to be an funding contract, it’s categorised as a safety.

The latest Dencun improve ought to “assist Ethereum to extend its dominance towards various layer 1 blockchains and to recapture the misplaced market share because of earlier scalability points,” the report added.

Learn extra: Ethereum May Face ‘Hidden Dangers’ From Ballooning Restaking Market: Coinbase